October 2, 2012

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- Highlights, key takeaways and perspective on the recent BCA Research Investment Conference.

- The eurozone crisis and China's slowdown remain risks, but are somewhat offset by optimism about US markets.

- Politics will remain a force underpinning uncertainty and volatility.

I try to attend BCA Research's annual conference in New York City, my stomping ground, whenever I'm able. On September 10 and 11, I sat in on two days of panel discussions on a variety of topics, and today's report will provide some highlights and perspectives.

One of the interesting features of the conference was electronic audience polling, and I'll share some results throughout this report. Through these polls and in conversations with other attendees, it was clear the mood was relatively optimistic, with 43% of respondents to one poll saying they were overweight risky assets. However, the mood among many of the panelists was decidedly less optimistic.

Can the euro be saved?

Panelists:

- Bernard Connolly, chief executive officer of Connolly Insight LP; his 1995 book, "The Rotten Heart of Europe," outlined the flaws in the proposed euro project and cost him his job at the European Commission

- Dhaval Joshi, BCA's Chief European Strategist

Connolly presented the negative view on the euro, stressing that budget deficits and wide yield spreads in the eurozone periphery are symptoms of the problem, not the problem itself. He views the single currency project as fundamentally flawed from the beginning and said it will be "virtually impossible to sustain."

Connolly outlined several possible resolutions to the eurozone crisis, each of which has problems:

- Relying on austerity to squeeze costs in competitive countries would bring depression, default and—most importantly—social and political upheaval. Complicating the problem is the fact that Ireland and Spain experienced housing bubbles four times larger than that of the United States. Defaults and bankruptcies could mushroom in these countries.

- Massively depreciating the euro would lead to an unacceptable (≈70%) rise in inflation in Germany.

- Moving Europe to a full transfer union would require a perpetual transfer from Germany of about 10% of German gross domestic product (GDP).

Connolly said he believes that European Central Bank bond purchases will only delay required adjustments in peripheral countries and allow debt ratios to continue to rise.

Joshi agreed that Europe's monetary union had fundamental flaws from the outset, but he focused more on worries associated with Germany and its "export bubble" and "lopsided economy," with net exports having been the virtual sole contributor to growth since the introduction of the euro. This means Germany has become highly vulnerable to swings in global demand, in addition to being the global "shock absorber."

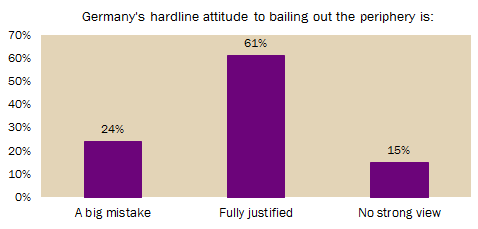

The audience was asked whether Germany's hardline attitude was justified, and voted overwhelmingly that it was:

Source: BCA Research Inc., as of September 18, 2012.

Joshi's key question is whether the imbalances are corrected in a violent V-shape through euro disintegration, or more gradually in an extended L-shape, with the monetary union kept largely in place. He believes most politicians (and voters) would prefer an L-shaped outcome versus a depression.

Our view

At Schwab, we believe the flaw of the euro—a common currency that has shared monetary policy but disparate fiscal policy and cultural differences—has been exposed by the sovereign debt crisis. However, eurozone countries will have a difficult time "checking out" due to the high costs of a currency breakup. While continued accommodations for Greece's "special case" may not continue, they demonstrate the commitment of policymakers to try to keep the euro together.

Debating China's economic future

Panelists:

- Michael Pettis, professor of finance, Peking University

- Victor Gao, director of the China National Association of International Studies; former translator for Deng Xiaoping

Pettis said he believes China faces an inevitable and painful transition, with economic growth falling to a 3-4% rate in the next decade. Its growth model involves a systematic transfer of wealth from the household sector to support growth, and three mechanisms facilitate this process:

- Undervalued currency: a direct subsidy on the net export sector, but a consumption tax on households.

- Widening gap between Chinese wage growth and productivity growth: reduces labor's share of GDP.

- Financial repression: low interest rates transfer wealth from savers to borrowers.

Pettis said he believes that as marginal returns on capital slow, it will become more difficult to find economically viable projects. China's savings rate will need to decline and its consumption-to-GDP ratio must increase, which will only occur if household income captures a larger share of GDP. Pettis outlined four policy options:

- Reverse transfer mechanism from households to other sectors, leading to a sharp increase in the value of the yuan and potential major recession (unrealistic).

- Gradually reduce distortions, which could take a decade (they've run out of time).

- Massive privatization program to transfer wealth from state sector to households (politically difficult).

- Expand government debt to absorb private-sector debt (possible, but economically inefficient).

Gao countered with a far-more-upbeat assessment, though he liberally relied on history and China's great transformation over the past three decades. He said he expects China's economy to continue to grow at close to 8% thanks to four megatrends he doesn't believe will change: industrialization, modernization, urbanization and globalization.

Our view

At Schwab, we believe that as China's economy matures and shifts from over-reliance on government investment to increased private consumption as a percent of GDP, slower growth is likely the new normal. However, this transition won't be accomplished overnight; the government will likely need to enact market-based reforms and reduce its grip on the economy, and the transition could be accompanied by bumps in the road.

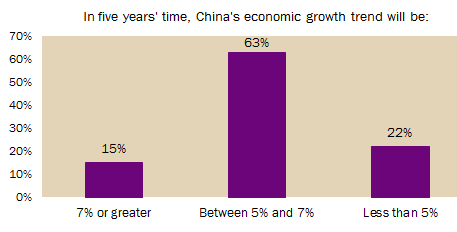

Our view on China's economic trajectory is in keeping with the results of a poll during the conference:

Source: BCA Research Inc., as of September 18, 2012.

US economy, policy and market outlook

Panelists/speakers (subset):

- Norman Ornstein, resident scholar, American Enterprise Institute

- David Stockman, former budget director for President Ronald Reagan

- David Rosenberg, chief economist, Gluskin Sheff and Associates

- Laszlo Birinyi, president and founder, Birinyi Associates

- Richard Bernstein, CEO and founder, Richard Bernstein Advisors

Ornstein spoke over lunch on day one and presented three key themes:

- The high level of political dysfunction in Washington. The key problem is a shift by both parties toward more adversarial parliamentary-style interaction within a system designed to be based on consensus-building.

- Political dysfunction and gridlock breeds disenchanted voters. A culture has evolved in which politicians are no longer held accountable for spreading lies. Biased reporting in the press amplifies differences between parties and makes it difficult for voters to identify those responsible when things go wrong.

- Politics will remain a source of volatility for markets if Barack Obama is reelected. A Mitt Romney win and Republican control of the Senate could lead to a "mother of all reconciliation" bills that repeals the Patient Protection and Affordable Care Act, makes the Bush tax cuts permanent, eliminates sequesters and turns Medicaid into block grants.

I wholeheartedly agree that more years of infighting and discord in Washington is the most likely outcome, regardless of the election results, and that politics (globally) will remain a source of uncertainty for markets.

Stockman followed Ornstein and unleashed a furious attack on Federal Reserve policy on the grounds that it's creating an addiction to cheap money and enabling the government to spend beyond its means. He said he believes that aggressive Keynesian monetary and fiscal policies have prevented a cleansing of financial imbalances and have contributed to the massive build-up of debt over the decades (I couldn't agree more).

Stockman said he believes the fiscal governance process is broken and that both Democrats and Republicans have become "free lunch" parties, telling voters fairy tales about the fiscal mess. He also indicated that he believes Congress will only be able to manage compromises that last three to six months, and that the US Treasury bubble will burst at some point, resulting in a severe recession.

Rosenberg was also characteristically gloomy, saying that he believes the United States is not decoupling from the rest of the world and that he expects a shock in trade numbers in the next several quarters.

Both Birinyi and Bernstein were more optimistic, making a strong contrarian bull case for US stocks. Bernstein's "Wall Street" sentiment indicator (tracking strategists' stock-allocation recommendations) is at its lowest point since tracking began in 1986.

Bernstein said he believes the problems in the rest of the world will ensure a continued flight to safety into dollar assets and that US stocks will continue to outperform global benchmarks. He acknowledged the risk that earnings have likely peaked, and if the dollar appreciates, small-cap domestic stocks will likely outperform larger-cap multinationals. (I agree with this assessment.)

Birinyi posited that there's no "average" or normal bull market—that group rotation exists but is random. He said he believes we're in the fourth and final leg of the bull phase that could lead to a 1,500 level in the S&P 500 index by the end of this year.

Our view/conclusions

Although the outlook among many panelists, regardless of topic, was relatively gloomy, the outlook of the audience was a bit more optimistic (including yours truly). Yes, the eurozone is still a mess, China's growth is weaker than many believe, and neither the Fed nor US politicians are distinguishing themselves. But at some point, the negative tail risks get priced in, leaving an opening for positive tail risks. I think that's what's been driving stock prices higher, and I continue to believe the US market will outperform most other global indexes.

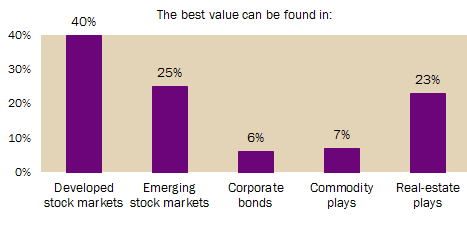

One of the final poll results is consistent with my view:

Source: BCA Research Inc., as of September 18, 2012.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Copyright © Charles Schwab & Co., Inc.