(Next report is on Tuesday October 9th. The Canadian equity market is closed for a holiday on Monday. U.S. equity markets are open, but the bond market is closed for Columbus Day and equity volumes are expected to be well below recent daily activity).

Pre-opening Comments for October 5th

U.S. equity index futures are higher this morning. S&P 500 futures are up 4 point in pre-opening trade.

Index futures moved higher following release of the U.S. September jobs report. Consensus for September U.S. Non-farm Payrolls was 118,000 versus 96,000 in August. Actual was 114,000. Also, the August report was revised higher to 142,000. Consensus for the September unemployment rate was unchanged from August at 8.1%. Actual was a decline to 7.8%.

The Canadian jobs report also was encouraging. Consensus for September Canadian Employment was an increase of 10,000 versus a gain of 34,000 in August. Actual was a gain of 52,000. Consensus for the September unemployment rate was unchanged from August at 7.3%. Actual was an increase to 7.4%.

Hewlett Packard eased $0.14 to $14.80 after Argus reduced its rating from Buy to Hold and Sterne Agee downgraded the stock from Buy to Neutral.

Marriott International fell $1.39 to $37.55 after Lezard Capital, ISI Group and UBS downgraded the stock from Buy to Neutral.

Family Dollar Stores is expected to open higher after Credit Suisse upgraded the stock from Neutral to Outperform.

Automatic Data Processors added $0.35 to $59.25 after Goldman Sachs upgraded the stock from Neutral to Buy. Target was raised from $53 to $68.

Zynga plunged $0.58 to $2.24 after the company lowered its third quarter guidance.

Technical Watch

Zynga Inc. (NASDAQ:ZNGA) – $2.24 plunged 20.4% after the company lowered its third quarter guidance. The stock has a negative technical profile. Intermediate trend is down. The stock will open below support at $2.67 to reach an all-time high. The stock trades below its 20, 50 and 200 day moving averages. Short term momentum indicators are trending lower. Strength relative to the S&P 500 Index has been negative since March. Better opportunities exist elsewhere.

Leibovit Volume Reversal Signals

Positive Leibovit volume reversal signals were flashed by XRT and GOOG. Following is a link to the report:

Interesting Charts

The U.S. Dollar was surprisingly weak yesterday.

Weakness in the U.S. Dollar prompted strength in commodity prices and related equities.

Coal stocks led the advance among commodity stocks partially because of comments supporting coal made by Governor Romney during the Presidential debate.

The Mexican ETF broke to an all-time high.

Tech Talk’s ETF Column

(Published yesterday at www.globeandmail.com).

Headline reads, “Time to lighten up on your energy exposure”. Following is a link:

Following is full text:

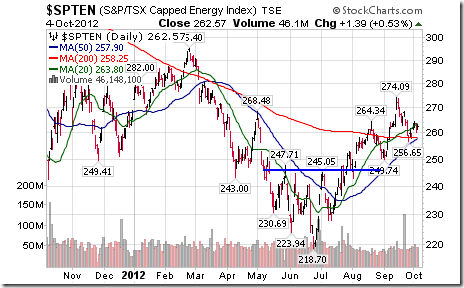

The second of two periods of seasonal strength in the energy sector is ending. Thackray’s 2012 Investor’s Guide notes that the average optimal time to own the sector is from July 24th to October 3rd. A trade in the S&P Energy Index and the S&P/TSX Energy Index has been profitable in 10 of the past 15 periods.

The energy sector has another period of seasonal strength from January 30th to April 13th. The latter time frame historically has been more reliable and more profitable than the July/October period.

Between the July/October period and the January/April period, energy prices and energy equity prices enter into a “shoulder” season between summer and winter when demand for energy and energy prices historically have weakened.

Once again, the July 24th to October 3rd period of seasonal strength has been profitable. Since recommending the sector in this column on July 23rd, the S&P/TSX Energy Index has gained 8.7 per cent and the S&P Energy Index has advanced 7.0 per cent.

On the charts, the S&P/TSX Energy Index had a positive technical profile until recently. In late July the Index broke above a classic reverse head and shoulders pattern on a break above 245. The Index slightly exceeded is target price of 272 based on the pattern. However, signs of technical weakness have surfaced recently. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index and the TSX Composite Index turned negative last week. Preferred strategy is to take seasonal profits at current or higher prices.

A word of caution! Anticipation of third quarter earnings reports by companies in the sector to be released in late October are not expected to help equity prices. On average, earnings by major companies in the sector are expected to decline by more than 20 percent on a year-over-year basis.

A wide variety of Exchange Traded Funds in the energy sector as well as crude oil, natural gas and gasoline are available in North American equity exchanges. U.S. exchanges list 30 Energy ETFs. A list is available at http://etfdb.com/etfdb-category/energy-equities. Another 24 U.S. based ETFs trade oil, gasoline and natural gas. A list is available at http://etfdb.com/etfdb-category/oil-gas. The most actively traded U.S. listed ETF, the Energy Select Sector SPDR (XLE $73.08) gained 8.6 percent since the close on July 20th. Canadian exchanges list seven energy equity ETFs and eleven oil and natural gas ETFs. The most actively traded Canadian equity ETF, iShares on the S&P/TSX Capped Energy Index (XEG $16.42Cdn.) has gained 9.0 per cent since the close on July 20th

Don Vialoux is the author of free daily reports on equity markets, sectors, commodities and Exchange Traded Funds. He is also a research analyst at Horizons Investment Management, offering research on Horizons Seasonal Rotation ETF (HAC-T). All of the views expressed herein are his personal views although they may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment. Horizons Investment is the investment manager for the Horizons family of ETFs. Daily reports are available at http://www.timingthemarket.ca/

Updates on Continuing Seasonal Trades Recommended Since July

July 6: Accumulate gold bullion

Period of seasonal strength: July 12th to October 9th

Gold price on July 6th: $1,578.90. Current price: $1,791.80

Comment: The end of the period of seasonal strength is next Tuesday on average. However, technical remain positive. Preferred strategy is to hold for now, but take profits on the first available technical sign of weakness (e.g. breaking below its 20 day moving average)

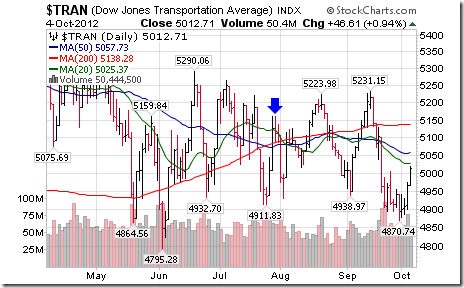

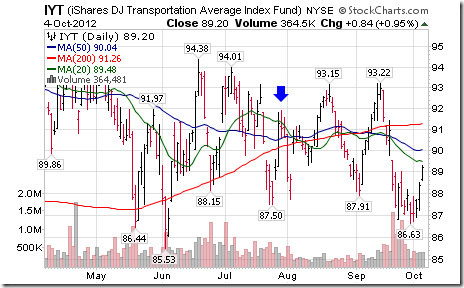

July 27: Sell the Transportation Sector

Dow Jones Transportation Average at 5,126.65. Current price: 5,012.71

ETF: IYT at $91.56. Current price: $89.20

Period of seasonal weakness: August 1st to October 9th

Comment: The period of seasonal strength is about to end. Technical have started to recover from oversold levels (Stochastics, RSI). The Index and ETF are about to move above their 20 day moving averages. Preferred strategy is to take profits on short positions at current or lower prices.

August 6th: Sell the Airline sector

ETF: FAA at $28.66

Period of seasonal weakness: August 1st to October 9th

Comment: As noted in yesterday’s Tech Talk, a stop buy order was triggered on a break above resistance at $30.20.

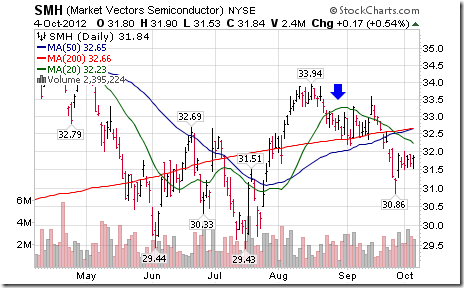

August 28: Sell the Semiconductor sector

Philadelphia Semiconductor Index: 397.04. Current level: 383.65

ETF: SMH: $32.83. Current level: $31.84

Period of seasonal weakness: End of August to October 9th

Comment: The end of the period of seasonal weakness on average is reached next week. Short term technical indicators (RSI, Stochastics, MACD) have started to recover from oversold levels. Preferred strategy is to take profits on short positions at current or lower prices.

Eric Wheatley’s Column

Hi guys,

My laptop pooped out on me this week, so I’m typing this on a very old, buggy computer. I’ll therefore avoid spending too much time on this machine, so this week’s commentary will be recycled (and translated) from last week’s French-language blog post.

Here are my rules on life and investing. While they come from various sources – fans of Christopher Hitchens will undoubtedly recognise one of them – I’ve found them to work for me:

· There is nothing free in life. NOTHING.

· If you want to get yourself out of a hole, the first thing you have to do is to stop digging.

· Don’t ever speak ill of a former employer or significant other. It’ll only make YOU look bad.

· If you wouldn’t buy a stock you own at its current price, sell it.

· The only true human right/freedom is to leave.

· It’s always a good idea to buy a toilet plunger BEFORE you need it.

· Success is pretty much always proportionate to the effort put in.

· The markets are random over the short-term (astute charting folks notwithstanding). If you look at your retirement savings every morning and get giddy when they rise/depressed when they fall, you’ll just talk yourself into selling low and buying high.

· “That which can be asserted without evidence can be dismissed without evidence”.

· Silicone should NEVER lubricate silicone.

· Any man should get his butt kicked in a fight at least once in his life. This experience should then be recalled every time he gets angry enough to hit someone.

· If you listen to financial/medical/legal advice from your bother-in-law/neighbour/hairdresser, you’re going to regret it.

· Over the short-term, frankness and honesty can be deleterious. Over a lifetime however, the reflexive taking responsibility for one’s actions and being forthright will reward the valorous.

· Only you can solve your problems, no matter their cause. Wasting time and energy complaining about that which you can’t control isn’t going to help.

· Keep your eyes on the horizon. You probably have years yet to live; your little daily ups and downs have NO impact on your future wealth and happiness.

· If someone asks you to sniff something, say NO.

· Hope that your first-ever trade is a losing one.

· Always respect a sincere apology. Holding a grudge is easy, fessing up to a mistake isn’t.

· There is no riskless human endeavour. If you avoid all risk, the opportunity costs of events forgone will erode your wealth and happiness (in other words: get out there and do that stupid/embarrassing/kinky thing you’ve always wanted to).

· If you’re going to lift a heavy object, determine where you’re going to set it down ahead of time.

· There’s always a pigeon at the card table. If you can’t figure out who it is after two hands, it’s you.

· If you are going to work in a third-world country and get squicked out by Canadian public washrooms, you’re going to have a bad time (this one is specific and personal, but REALLY relevant if it applies).

· If you think you’ve found the secret to easy money, you’ll be poor soon.

· If you’re paying a professional, make sure that his/her interests are perfectly aligned with yours.

· The entire planet wants to siphon your savings. Stay alert and incredulous. This especially applies to everyone who is paying hidden mutual fund sales fees.

· Information is ubiquitous. Useless information is ubiquitous. Don’t blindly consume what the media excrete without critically sniffing it first (yeah, this contradicts a previous rule. This site is a medium. Sniff it).

· Most important of all: life is really frickin’ short. Stressing out only shortens it.

*****************

I haven’t really been feeding my Twitter account this week because of the computer thingy. Sorry.

In this week’s French-language blog: overconfidence and xylophones.

Cheers!

Éric Wheatley, MBA, CIM

Associate Portfolio Manager, J.C. Hood Investment Counsel Inc.

eric@jchood.com

514.604.2829; 1.855.348.2829

Twitter: @jchood_eric_en

Blogue en français : gbsfinancier.blogspot.ca

*****************

Little known fact about John Charles Hood #46

John Charles Hood has never owned a toilet plunger and has never needed one.

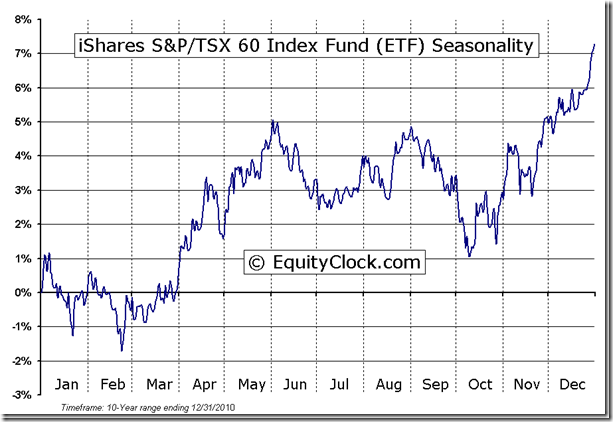

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

iShares S&P/TSX 60 Index Fund (ETF) (TSE:XIU) Seasonal Chart

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.c a are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

Horizons Seasonal Rotation ETF HAC October 4th 2012

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/d504780e00ef83bfa3de0acf5e6bf487.png)