by Richard Shaw, QVM Group

Europe will not stay down forever. The US will not be the clear market of choice forever. Depressed markets have substantial price recovery potential when their trend reverses from down to up. Here is a look at some of the potentially more interesting European ETFs and a couple of European mutualf funds.

The fund is not totally inclusive. Mutual funds are for the most part excluded, in favor of ETFs. However, active management of a mutual fund may be advantageous.

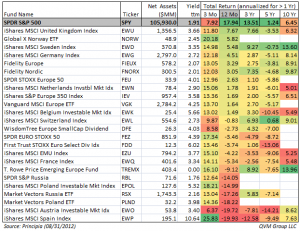

To make the list a fund must outperform the S&P 500 proxy SPY in at least one of these periods: 10 years, 5 years, 3 years, 1 year or YTD 2012 or 3 months; and the fund must have at least $10 million in assets.

Many funds outperformed over 10 years. No funds outperformed over 5 years and 3 years. Some funds outperformed YTD, and more funds outperformed over 3 months.

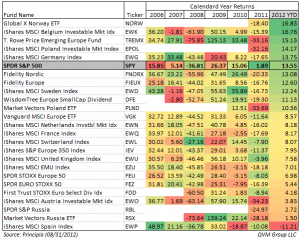

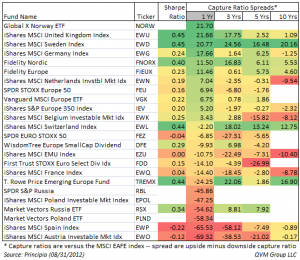

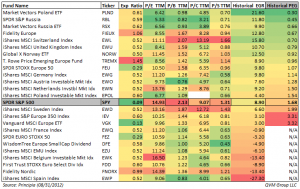

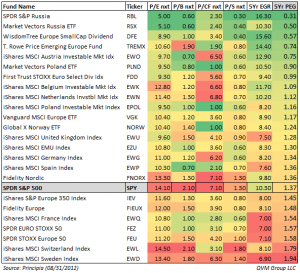

Here’s the data — except for capture ratios, SPY is included in the data table for contrast.

Figure 1: Rolling Returns and Yield

Figure 2: Calendar Yields

Figure 3: Sharpe Ratio and Capture Ratio Spreads for 1, 3, 5 and 10 Years

Figure 4: Historical Valuation Multiples

Figure 5: Forward Valuation Multiples