by Douglas Peebles, AllianceBernstein

Treasury-inflation protected securities, or TIPS, have been a popular choice for investors concerned about future inflation. And TIPS’ returns have been impressive in recent years. But the main contributor to TIPS’ performance isn’t inflation. It’s an ingredient that could become as hurtful down the road as it’s been helpful in the past.

While TIPS were the best-performing sector among high-quality assets in two of the past six years—2007 and 2011—and are leading so far in 2012, it’s interest-rate sensitivity we can thank. And interest-rate sensitivity is a sizable risk that could be very painful when rates rise again.

Indeed, inflation hasn’t been a major presence in recent years. The inflation rate has been relatively benign throughout the latest performance streak by TIPS. Inflation, as measured by the Consumer Price Index, has averaged between 2.0% and 2.5%.

The truth is that what’s been driving performance is falling interest rates. Over the last several years, US rates have plunged, with the 10-year Treasury yield falling from 4.7% at year-end 2006 to 1.6% on August 31, 2012. This has created a strong tailwind for bonds—and for TIPS in particular. A steady decline in rates has benefited TIPS more than Treasuries and more than the broad US bond market.

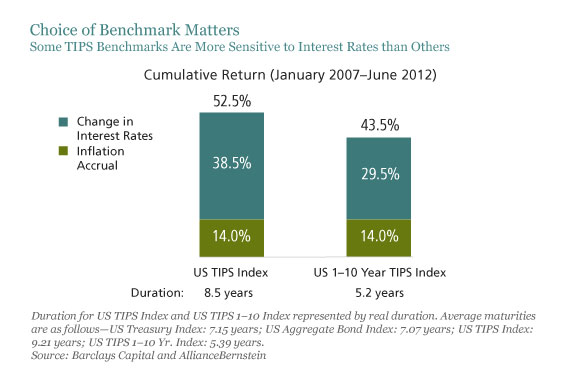

Why have TIPS benefited more? Because their higher interest-rate sensitivity—that is, their longer duration—magnified TIPS’ returns. The Barclays Capital US TIPS Index is almost 50% more sensitive to interest-rate changes than the standard Treasury bond index. This greater responsiveness put TIPS in position to receive the bigger price boost as rates tumbled. But with rates at all-time lows, having a longer duration now poses a big risk to TIPS.

So what happens when rates begin to rise again? In a rising-rate environment, longer-duration securities such as TIPS will underperform.

What about the inflation-protection component? What if inflation picks up? Importantly, it’s quite likely that if and when inflation does rise, TIPS’ yields will also be rising—and values will be declining—as the Federal Reserve tightens monetary policy. In that situation, the result of having a longer duration could more than offset the inflation protection.

So we’ve established that standard TIPS portfolios possess a lot more interest-rate risk than investors realized—or intended. Many investors looking for inflation protection have a taken on a lot more interest-rate risk too.

What do we think is the right strategy? Investors should harvest their recent gains now, but should continue to guard against the potential of rising inflation by moving into an inflation-protection strategy with a shorter-duration benchmark.

Inflation affects the longer-duration US TIPS benchmark and the shorter-duration US 1–10 Year TIPS benchmark in exactly the same way; thus, each offers an identical measure of inflation protection. The difference in return comes from how each responds to changes in interest rates, as shown in the display below.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Douglas J. Peebles is Chief Investment Officer and Head of Fixed Income at AllianceBernstein.

Copyright © AllianceBernstein