by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday September 19th

U.S. equity index futures are higher this morning. S&P 500 futures are up 2 points in pre-opening trade. Index futures gained from news that Japan has launched a US126 billion economic stimulus program.

Index futures were virtually unchanged following release of August Housing Starts report. Consensus was an increase to 765,000 from a downward revised 733,000 in July. Actual was an increase to 750,000.

MMM eased $0.93 to $92.50 after commenting that previous third quarter sales guidance is a “stretch”. ‘Tis the season for companies to lower guidance.

Autozone fell $4.34 to $353.50 after announcing less than consensus fiscal fourth quarter sales.

General Mills added $0.42 to $39.73 after reporting higher than consensus fiscal first quarter earnings.

Needham downgraded the U.S. toy manufacturers on weaker than expected industry sales. Recommendations on Mattel and Hasbro were lowered from Buy to Hold.

Waste Management is expected to open lower after JP Morgan downgraded the stock from Neutral to Underweight.

Monsanto added $1.39 to $90.45 after Goldman Sachs upgraded the stock from Buy to Conviction Buy. Target is $110.

Shoppers Drug is expected to open lower after Morgan Stanley downgraded the stock from Equal Weight to Underweight.

Technical Watch

Shoppers Drug Mart Corp. (TSE: SC) – $41.59 Cdn. is expected to open lower after Morgan Stanley downgraded the stock from Equal Weight to Underweight. The stock has a negative technical profile. Intermediate trend is down. The stock recently fell below its 20 and 50 day moving averages and likely will open below its 200 day moving average. Short term momentum indicators are trending down. Strength relative to the TSX Composite has been negative since mid-July. Seasonal influences are about to enter a negative period. Better opportunities exist elsewhere.

Shoppers Drug Mart Corporation (TSE:SC) Seasonal Chart

Autozone Inc. Nevada (NYSE:AZO) – $353.50 fell 1.2% after the company reported less than consensus fourth quarter revenues. The stock has a negative technical profile. Intermediate trend is down. The stock recently fell below its 20, 50 and 200 day moving averages. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index has been negative since early June. Better opportunities exist elsewhere.

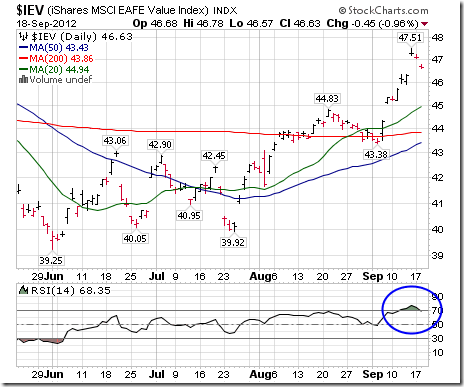

Interesting Charts

More evidence of a pre-third quarter report slump in equity markets has appeared. Negative guidance by FedEx yesterday set the stage. Overbought broadly based equity indices and economically sensitive sectors saw their RSI fall below the 70% level yesterday. A break below the 70% level frequently is an early warning sign of at least a short term correction.

Third Quarter Earnings Outlook for S&P/TSX 60 Companies

The third quarter earnings outlook for S&P/TSX 60 companies is less promising than the outlook for S&P 500 companies and Dow Jones Industrial Average companies. Consensus (Average Median) shows that third quarter earnings on a year-over-year basis are expected to decline 7.78%. Thirty two companies are expected to report lower earnings per share, two companies are expected to report no change and twenty six companies are expected to report higher earnings. Energy and Mines & Metals are expected to record the largest declines. Financial Services are expected to record the largest gains.

* Median companies

Source: Zachs Investment Research

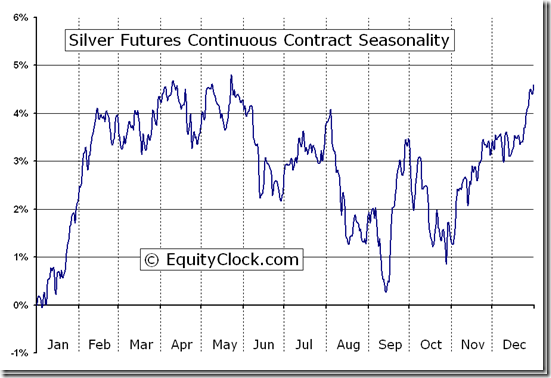

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Silver Futures (SI) Seasonal Chart

FP Trading Desk Headlines

FP Trading Desk headline reads, “Central bank easing good for cyclicals: Scotia strategist”. Following is a link to the report:

FP Trading Desk headline reads, “Net redemption of equity funds a drag for mutual funds”. Following is a link to the report:

FP Trading Desk headline reads, “Semiconductor sector downgraded as inventory cycle stalls”. Following is a link to the report:

http://business.financialpost.com/2012/09/18/semiconductor-sector-downgraded-as-inventory-cycle-stalls/

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

Horizons Seasonal Rotation ETF HAC September 18th 2012

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/0101b3c9b9a78348a9541a2795cb7ab9.png)

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/a63126a53d0db153059215045dbc75c1.png)

![clip_image003[1] clip_image003[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/b92b2442eae8913f581fcd9c4c343276.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/87ff9d7fdc5577cf21c9a34d01ac4a85.png)