U.S. Equity Strategy, September 14, 2012

What’s Driving the Equity Market? P/E or the E?

Prepared by Ryan Lewenza, CFA, CMT, V.P., U.S., Equity Strategist, TD Wealth

Highlights

- From the June low of 1,266.74, the S&P 500 Index (S&P 500) is up over 13%, which has entirely been driven by multiple expansion. As we have outlined in recent publications, it’s our belief that the move higher in the S&P 500, due to an expansion in valuation multiples, has been driven in part by the prospect of additional central bank liquidity.

- The European Central Bank (ECB) followed through on its strong signals of additional stimulus, with President Mario Draghi announcing that the ECB would launch a new bond buying program on September 6th. The Federal Reserve (Fed) then followed up on September 13th by announcing yet another bond buying program, which will see the Fed buy $40 billion of mortgage-backed securities per month, with an open-ended mandate. This action led to a strong rally in the equity markets, with the U.S. equity market rallying over 1.5% on the day, being driven by continued P/E expansion.

- As history has shown, equity markets perform well in periods of additional monetary stimulus, such as QE, which we believe could occur with the latest round as well.

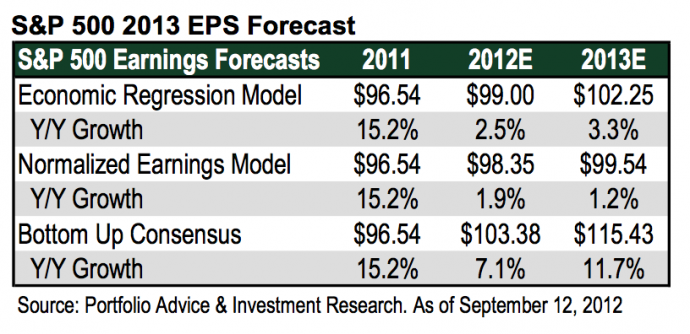

- We are introducing our 2013 S&P 500 earnings forecast of $102.25, which if realized, would represent a significant slowdown in corporate profit growth next year. Based on our estimates, profit growth would slow to 3.3% in 2013, compared to 7.1% expected for 2012, and the 15.2% growth seen in 2011. The bottom-up consensus estimate for 2013 stands at $115.43 (11.7% Y/Y growth), but we believe the current consensus estimate is too high, and is likely to be revised lower in the coming months

- All told, our EPS models point to continued healthy earnings in 2013, however we believe earnings will come in below the current optimistic consensus estimates, and that U.S. earnings could peak in 2013. If correct, further upside in equity prices will have to be driven by continued P/E expansion, as the support of higher earnings growth begins to wane.

U.S. Equity Strategy (What's Driving the Equity Market) - September 14, 2012