Guest post submitted by John Aziz of Azizonomics

The Contrarian Indicator Of The Decade?

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.

Sir John Templeton

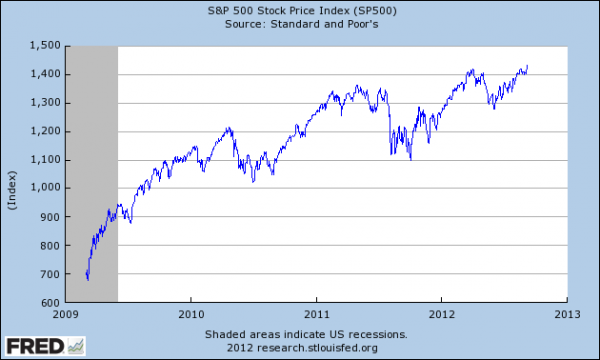

Buy the fear, sell the greed. Since bottoming-out in 2009 markets have seen an uptrend in equity prices:

Now it seems like the euphoria is setting in. And in perfectly, deliciously ironic time, as shares of AIG — the behemoth at the heart of the 2008 crash — are returning to the market. Because reintroducing bailed-out companies to the market worked well last time didn’t it?

Markets are down a hair today, but the theme of the morning is clear: Uber-bullishness. Everywhere.

This is the most unanimously bullish moment we can recall since the crisis began.

Note that this comes as US indices are all within a hair of multi-year highs, and the NASDAQ returns to levels not seen since late 2000.

Big macro hedge funds, who have been famously flat-footed this year, are now positioned for a continued rally.

Bank of America’s Mary Ann Bartels:

Macros bought the NASDAQ 100 to a net long for the first time since June, continued to buy the S&P 500 and commodities, increased EM & EAFE exposures, sold USD and 10-year Treasuries. In addition, macros reduced large cap preference.

J.P. Morgan’s Jan Loeys:

We think the positive environment for risk assets can and will last over the next 3-6 months. And this is not because of a strong economy, as we foresee below potential global growth over the next year and are below consensus expectations. Overall, we continue to see data that signal that world growth is in a bottoming process.

SocGen’s Sebastian Galy:

The market decided rose tinted glasses were not enough, put on its dark shades and hit the nightlife.

And the uber-bullishness is based on what? Hopium. Hope that the Fed will unleash QE3, or nominal GDP level targeting and buy, buy, buy — because what the market really needs right now is more bond flippers, right? Hope that Europeans have finally gotten their act together in respect to buying up periphery debt to create a ceiling on borrowing costs. Hope that this time is different in China, and that throwing a huge splash of stimulus cash at infrastructure will soften the landing.

But in the midst of all that hopium, let’s consider at least that quantitative easing hasn’t really reduced unemployment — and that Japan is still mired in a liquidity trap even after twenty years of printing. Let’s not forget that there is still a huge crushing weight of old debt weighing down on the world. Let’s not forget that the prospect of war in the middle east still hangs over the world (and oil). Let’s not forget that the iron ore bubble is bursting. Let’s not forget that a severe drought (as well as stupid ethanol subsidies) have raised food prices, and that food price spikes often produce downturns. Let’s not forget the increasing tension in the pacific between the United States and China (because the last time the world was in a global depression, it ended in a global conflict).

It would be unwise for me to predict an imminent severe downturn — after all markets are irrational and can stay irrational far longer than people can often stay solvent. But this could very well be the final blow-out top before the hopium wears off, and reality kicks in. Buying the fear and selling the greed usually works.