August 31, 2012

by Liz Ann Sonders

Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc..

and Brad Sorensen

CFA, Director of Market and Sector Analysis, Schwab Center for Financial Research,

and Michelle Gibley

CFA, Director of International Research, Schwab Center for Financial Research,

Key Points

- Stocks staged a nice rally to wrap up summer, but major events loom that could fuel further gains or cause the recent advance to evaporate. For now, macroeconomic developments in Europe, China, and the United States are in the driver's seat as companies remain cautious in the face of uncertainty.

- The end of summer was symbolically signaled by the annual Jackson Hole speech by Fed Chairman Ben Bernanke. While noncommittal as to timing or scope, the Central Bank has left little doubt they aren't happy with the pace of growth, but we wonder if the bar for further action has been met.

- Our belief that some of the worst possible outcomes in Europe are now off the table, combined with sustained underperformance by equity markets, now lead us to upgrade our view of European equities to a more neutral position; although risks remain. Meanwhile, we remain somewhat disappointed and cautious on investments in China for the time being.

Stocks staged a relatively impressive rally this summer that has received little respect or notice. Equities moved close to their highest level in four years and bond yields moved higher, indicating an increased appetite for risk; although the move was discounted by many as volume remained anemic. Additional doubt was cast on the legitimacy of the rally when the S&P failed to break through a relatively important technical level around 1420.

We understand investors' disdain for the market in light of volatility, trading scandals, the "flash crash," the Facebook IPO debacle, etc. But it's been in the face of a market that has more than doubled since the bottom in March 2009. This again illustrates the importance of remaining invested in a diversified portfolio, with the appropriate time horizon in mind—meaning at least 3-5 years for equities.

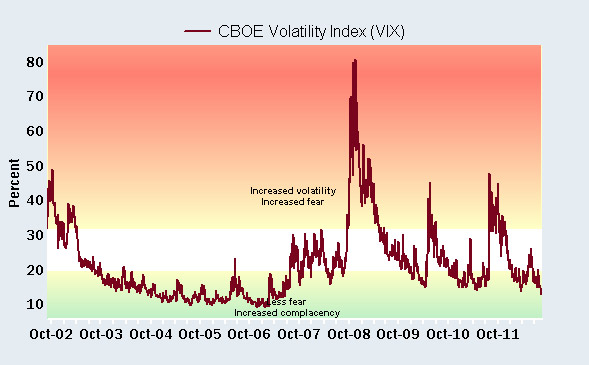

There are signs the rally is losing steam in the short term. Investor sentiment based on the Ned Davis Research Crowd Sentiment Poll recently reached levels that indicate excessive optimism; a typically contrary indicator that often portends a pullback. And during the move higher, we saw the VIX, a measure of volatility, move to extremely low levels, suggesting rising complacency.

/strong>Volatility to increase?

Source: FactSet, Chicago Board of Trade. As of Aug. 24, 2012.

And with a Fed meeting upcoming, European policymakers coming back to work, and the US election season heating up, it seems the conditions for a rockier ride in the stock market for the next several months may be in place.

Better sluggishness?

We would still characterize US economic growth as sluggish, but helping to contribute to the recent rally in stocks was a batch of data that was better than anticipated. Importantly, after three consecutive months of declines, retail sales rose 0.8% in July, the best reading since February; helping to alleviate concerns that the all-important consumer was retrenching even further. Unfortunately, however, stocks were not the only asset class to rise recently, as we've seen oil move from around $80/barrel at the end of June, to about $100/barrel. As this move flows through to the consumer in the form of gasoline and heating expenses as cooler months approach, it could put another dent in consumers' already tight pocketbooks. There has also been concern that the rise in corn costs, caused by the US drought, could dent the economy even further. We're less concerned about that at present. In the near term, there are substitutions that can be used, while in many of the packaged food products produced in the United States, the actual percentage of the cost that comes from commodities such as corn is extremely low. We'll be keeping an eye on developments, and next year's season will be important to watch as another year of bad harvests could start to cause more severe problems, but for now we believe the impact in the United States will be relatively minimal.

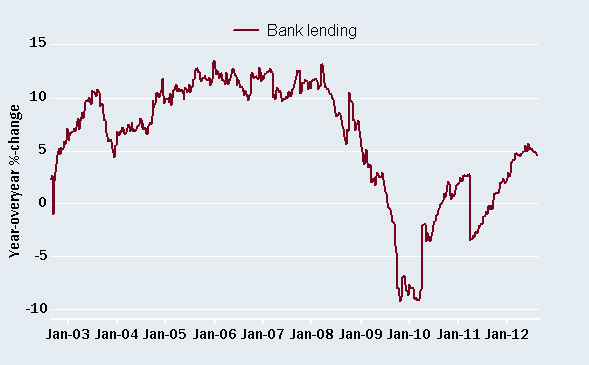

Meanwhile, also helping support the consumer is the improvement in housing. Recently, we saw building permits, which is a forward-looking indicator, rise 6.8% to the highest level in four years; the National Association of Homebuilders sentiment index rose again; new home sales rose 3.6%, while inventories fell to their lowest level since at least 1963; and the Federal Housing Finance Agency said home prices in the second quarter moved up 1.8%, the biggest gain since the fourth quarter of 2005. It appears that a combination of a slight increase in the willingness of banks to lend, combined with continued near-record affordability and a slow reduction of inventory, may now be conspiring to help the much maligned housing sector turn the corner.

Improved bank lending adds fuel to the fire

Source: FactSet, Federal Reserve. As of Aug. 24, 2012.

Finally, the Index of Leading Economic Indicators rose 0.4%, providing further evidence of continued growth in the United States, albeit at a subdued pace.

Fed stands ready, but Congress stands around

Despite this slight improvement in the economic picture, growth remains slow, and the Federal Reserve has made clear that it is unsatisfied with the pace of improvement. They have been quite explicit that they are ready to enact further stimulus measures if growth doesn't begin to pick up and unemployment come down, which was reiterated by Chairman Bernanke in his Jackson Hole speech. With no concrete statement coming out of Chairman Bernanke, however, sentiment is mixed as to whether the Fed's meeting in a couple of weeks will yield any real easing measures or whether it will result in more verbal posturing. We are in the camp that they lean toward refraining from major action, choosing to save what few remaining bullets they may have for later; but also believe that their ability to substantially influence what ails the economy at present is extremely limited.

There's only so much monetary stimulus can do without some help on the fiscal side via a resolution of the "fiscal cliff." In surveys of CEOs and comments gleaned from executives over the past several weeks, it is apparent to us that the fiscal cliff—specifically uncertainty regarding tax policy—is resulting in companies putting investment and/or expansion plans on hold. The most basic thing Washington could do is provide some certainty as to the tax structure. American businesses have an amazing ability to succeed in myriad environments, but they have to know what the rules are before they can even suit up.

September could hold Europe's keys

In comparison to the Fed, stimulus from the European Central Bank (ECB) has been tepid both in scale and timing; due to prior concerns about inflation, as well as legal restrictions. However, with the sovereign debt crisis threatening to spiral out of control, it appears as though the threshold for stepped up ECB action may have been reached.

As a result of the ECB's August meeting, we had two important takeaways that we believed could potentially change and stabilize the crisis. First, firepower to fight the crisis could be bolstered in a dual-barreled approach if the ECB makes unsterilized sovereign bond purchases in tandem with countries tapping bailout funds. Secondly, we believed German policymakers could soften their resistance to bond purchases as a result of the ECB's "conditionality" for action. The outline for ECB intervention provided thus far is that after a country asks for aid from the bailout funds and signs a legal commitment to fiscal targets and reforms, the ECB may potentially buy bonds in the secondary market.

On the potential for increased size of firepower, comments seems to substantiate the potential for both unlimited and unsterilized purchases (prior ECB purchases were sterilized, where injections of money into the system were completely offset by withdrawing the same amount of money using short-term market operations).

While the Germans could still be a barrier, we are encouraged by what we perceive as a gradual shift in a positive direction. Despite resistance by Germany's central bank president Jens Weidmann, the other German on the ECB Governing Council, executive board member Jörg Asmussen, appears to be siding with ECB President Mario Draghi by citing market dysfunction due to concerns about the viability of the euro as the reason to act.

Meanwhile, the waiting game continues, with September holding the potential for some important deadlines that could turn the tide in Europe. Spain has indicated it won't ask for aid until it receives details about the ECB bond purchases; which are not likely to be provided at the September 6 ECB meeting. ECB officials have indicated the details won't be forthcoming until after the September 12 German Constitutional Court ruling on the legality of the permanent bailout fund, the European Stability Mechanism (ESM). Court watchers believe the likely outcome is a positive ruling with conditions on the use of the ESM. However the risk is that the Court could rule the ESM unconstitutional, and European policymakers would have to go back to the drawing board to find a way of providing longer-term access to bailout funding.

Downsides in Europe well known—are there reasons to be optimistic?

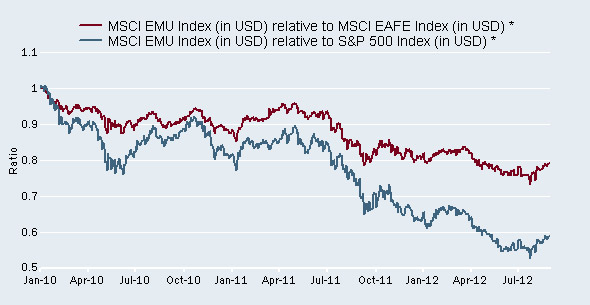

The lingering sovereign debt crisis has weighed on both economic growth and stock market performance in the eurozone for over two years. As a result, eurozone stocks have dramatically underperformed relative to both the S&P 500 Index and the broader MSCI EAFE Index. In US dollar terms, the MSCI EMU Index has underperformed the S&P Index by roughly 4900 basis points since the beginning of 2010.

/strong>Eurozone stocks have underperformed

Source: FactSet, MSCI. As of Aug. 24, 2012.

* Indexed to 100 as of Dec. 31, 2009. A lower number below 1 denotes greater underperformance of the EMU relative to each respective index.

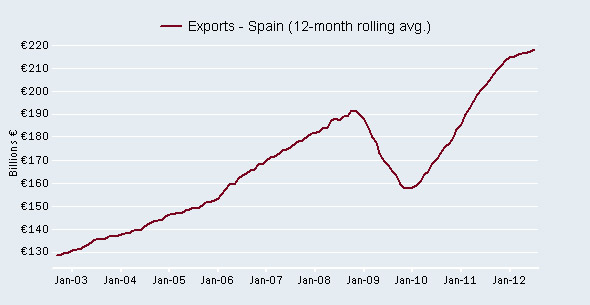

While economic growth has been and will likely remain dour, we believe eurozone stocks may already be pricing in a lot of downside. Negative sentiment has reduced expectations to a level where they can be beaten and there have been some upside economic surprises. July eurozone retail sales and the August preliminary composite PMI (the combined manufacturing and services purchasing manager indexes) were better than expected, lending to businesses rose in July; and Spanish exports reached a new high.

/strong>Not all is bad in Spain: exports at a new high

Source: FactSet, Bank of Spain. As of Aug. 24, 2012.

We believe that German acceptance of use of ECB bond purchases to increase the firepower to fight the crisis could be a significant change that keeps extreme downside risks off the table, buying time until more progress can be made on both a banking and fiscal union. With sentiment already negative, it may not take much good news for eurozone stocks to rally relative to other global markets. As such, we are removing our underperform rating on eurozone stocks, believing that weightings inline with long-term asset allocations are appropriate. Although our base case is that ESM will be approved, it is still a risk, and more cautious investors may want to wait for the September 12 ruling to make moves.

Are expectations for China still too high?

The slowdown in China was largely initiated by the government halting new infrastructure projects and instituting regulations to reduce property speculation; but the slowdown in Europe has complicated the government's objectives by reducing export growth. As a result, there are now multiple sectors of the Chinese economy slowing in tandem. While many economic indicators continue to point to further slowing in China, consensus economic and earnings forecasts are expecting a rebound on the premise that bad economic data will force the government to pursue stimulus.

However, there are few things the government can do to stimulate exports, other than reduce export taxes and depreciate the currency. Additionally, the government is reluctant to relax property restrictions because prices are still difficult to afford. While interest rates have been cut, demand for loans has declined because businesses are concerned about their revenue outlooks, particularly for export orders. The government could provide consumer stimulus such as tax rebates, subsidies and incentives for purchases of consumer goods, and potentially discounts for consumer credit. The problem is that consumer stimulus may take time before consumers act and these measures are likely to be small in scale.

That leaves infrastructure spending. While local governments have announced a flurry of big spending plans, many of these plans aren't rooted in reality—they are too large relative to local GDP and there is unlikely to be capital available to finance these plans. That said, we do believe a modest uptick in infrastructure spending is likely and project starts have improved.

Without more forceful stimulus and amid still high expectations, we believe continued caution is warranted for the Chinese stock market.

Read more international research at www.schwab.com/oninternational.

So what?

After a lull that was likely welcomed by many on the Street, we believe action will heat up as summer winds down. All eyes will be on Europe as investors look to see whether promises that have been made come to fruition. And while we remain skeptical, we do believe some of the worst outcomes in Europe have come off the table and now may be the time to add to European exposure in a measured way. Volatility will likely increase and it will be important for investors to keep their long term goals in mind in order to stomach the roller coaster ride that may be coming.

Important Disclosures

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

The MSCI EMU (European Economic and Monetary Union) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of countries within EMU. The MSCI EMU Index consists of the following 11 developed market country indices: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, and Spain.

The S&P 500 Composite Index® is a market capitalization-weighted index of 500 of the most widely-held U.S. companies in the industrial, transportation, utility, and financial sectors.

The Chicago Board of Exchange (CBOE) Volatility Index (VIX) is an index which provides a general indication on the expected level of implied volatility in the US market over the next 30 days.

Indexes are unmanaged, do not incur fees or expenses and cannot be invested in directly.

Past performance is no guarantee of future results.

Investing in sectors may involve a greater degree of risk than investments with broader diversification.

International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Investing in emerging markets can accentuate these risks.

The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. This report is for informational purposes only and is not a solicitation or a recommendation that any particular investor should purchase or sell any particular security. Schwab does not assess the suitability or the potential value of any particular investment. All expressions of opinions are subject to change without notice.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.