by Richard Shaw, QVM Group

Rail, trucking and package delivery are among key indicators of business activity in the United States. The recent relative performance of transportation stocks and the S&P 500 suggests that stocks overall might be somewhat ahead of themselves, or perhaps set up for a correction.

- $SPX = S&P 500 (proxies: SPY, IVV and VOO)

- $TRAN = DJ Transports (proxies: IYT and XTN [XTN is equal weighted])

- $DJUSRR = DJ Railroads (members CSX [CSX], Norfolk Southern [NSC], Union Pacific [UNP])

- $DJUDTK = DJ Trucking (member J.B. Hunt [JBHT])

- $DJUSAF = DJ Delivery services (members, Fedex [FDX] and UPS [UPS])

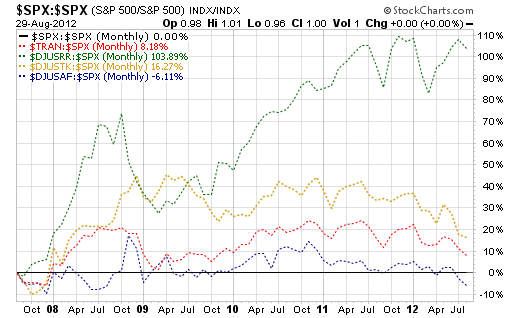

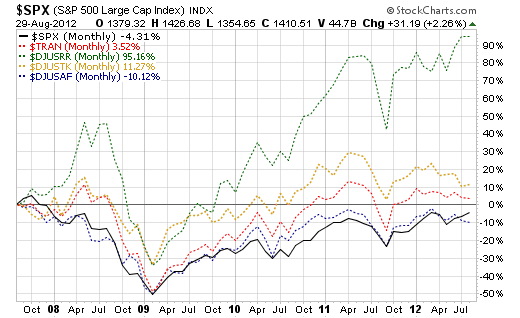

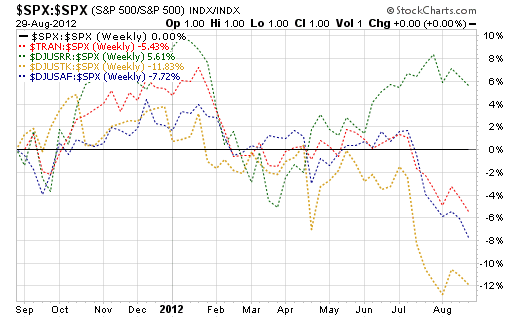

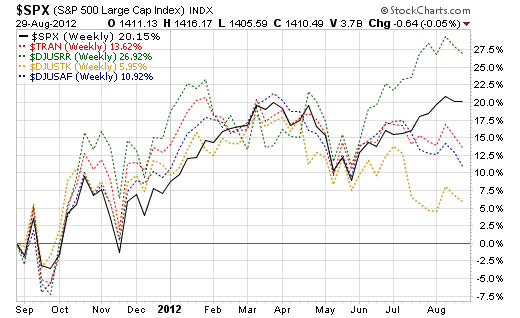

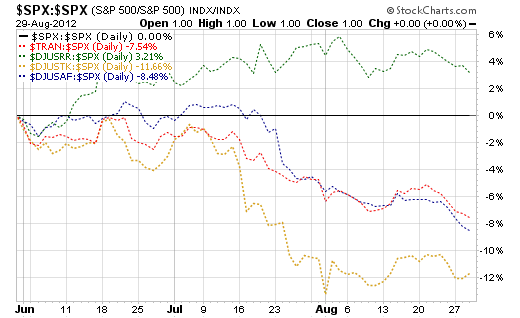

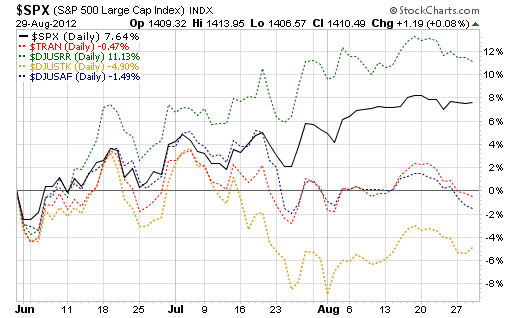

RELATIVE PERFORMANCE and ABSOLUTE PERFORMANCE of the S&P 500 AND TRANSPORTATION INDEXES

These three charts plot the ratio of the price level of each of several transportation indexes versus the S&P 500.

5 Years Monthly Relative

5-Year Monthly Absolute

The 5-year chart generally is outperforming the S&P 500 since the market bottom in 2009 until mid-2011, when it was basically flat with the broad index, and then under-performing in 2012.

1 Year Weekly Relative

1-Year Weekly Absolute

The 1-year chart more clearly shows the turn to negative relative performance in 2012 for all but railroads — and they too have turn down on a relative basis recently.

3 Months Daily Relative

3-Months Daily Absolute

The 3 month chart clearly shows that over the past month, the overall transports and it railroad, trucking and delivery services components are in a down movement. That probably as a lot to do with the flattening of the S&P 500 in the same period.

Disclaimer and Disclosure:

This and every post on this blog is subject to our general disclaimer. As of the date of this post (August 29, 2012), we have positions in SPY and NSC.

Copyright © QVM Group