by Richard Bernstein, Richard Bernstein Advisors

Is buy-and-hold dead?

If one searches in Google for “Does buy-and-hold work?”, more than 191 million results will appear. If one searches for “Is buy-and-hold dead?”, more than 81 million results will appear. However, if one searches for “Successful buy-and-hold strategies”, only about 9 million results will appear. It’s pretty clear that the investing world believes that buy-and-hold strategies are basically dead and gone.

Is the consensus correct, and are buy-and-hold strategies truly dead? The answer, if you ask us, is a definitive no. Buy-and-hold is very much alive and well.

Navigate the Noise

In Navigate the Noise – Investing in the New Age of Media and Hype (Wiley: 2001), I pointed out that investment returns can be significantly hurt by strategies based on short-term, noise-driven strategies. The data clearly and consistently showed that extending one’s investment time horizon was a simple method for improving investment returns. Eleven years later, those conclusions remain very much intact.

There are sound economic reasons why extending one’s time horizon can benefit investment returns. Changes within the economy tend to be very gradual, and significant adjustments rarely happen within a short period of time. Certainly, there is plenty of daily news, but how much of that news is actually important and worth acting on? The data suggest very little of that information is meaningful and valuable. Most of it is simply noise.

Chart 1 shows the probability of losing money in the S&P 500 based on varying time horizons. As one extends one’s investment time horizon, and increasingly focuses on the fundamentals of the slow-moving economy, the probability of losing money decreases. In fact, short-term trading is like flipping a coin; it is virtually a 50/50 proposition.

Using longer investment time horizons to improve investment returns seems to work for a broad range of financial assets, but does not seem to work particularly well for real assets such as gold and commodities. (See the charts at the end of this report).

Buy-and-hold isn’t dead, but one has to buy-and-hold the correct assets

Buy-and-hold strategies typically do perform well, but their success is predicated on buying and holding the correct assets. Having exposures to the correct market segments is called beta management, and investors tend to be very poor beta managers.

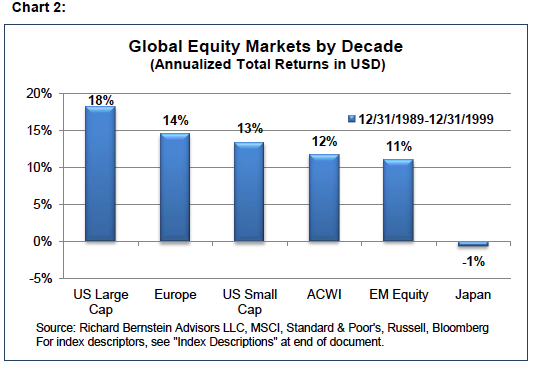

“Stocks for the long run” was the theme of the late 1990s and early-2000s, and investors were encouraged to buy-and-hold S&P 500 index funds. That seemed to make sense to them at the time because the US stock market had just finished one of its most successful performance decades in history. As a result, investors preferred US stocks. Unfortunately, US stocks subsequently underperformed.

Chart 2 shows why investors wanted to accentuate US stocks in their portfolios at the beginning of the 2000s. Chart 3 shows what actually happened in the subsequent ten years, and why investors perceive that there was a “lost decade in stocks” and that “buy-and-hold is dead”.

However, if one had bought and held emerging market stocks in 2000 rather than US stocks, one would be very happy today. If one had bought and held BRICs, one would be very happy today. Buy-and-hold has continued to be a viable investment strategy, so long as investors bought and held the correct stocks!

Ironically, many investors today seem to be following the same formula they followed last decade, and are again buying and holding the prior decade’s winners. In our opinion, these investors are positioning their portfolios for another “lost decade in equities”.

A “lost decade” in emerging markets?

This decade has so far been another decade of change. Chart 4 shows the performance of equity segments since December 31. 2009. Note that the prior decade’s winners are so far not fairing very well. Might there be a “lost decade” in the emerging markets?

Buy-and-hold isn’t dead

Buy-and-hold seems alive and well. The Sirens’ song of daily economic and financial noise lures investors away from investing with longer time horizons. In addition, investors need to be careful not to chase past performance, and carefully manage the beta-exposures of their portfolios.

Our strategies continue to be highly disciplined to limit the detrimental portfolio effects of short-term noise, we continue to maintain longer-term investment time horizons, and we continue to combine that discipline and time horizon to try to get more effective beta exposures within our portfolios.

The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website.

The past performance of an index is not a guarantee of future results.