During the Crisis, Barclay’s Submission Rarely Counted

So I take a look at the period from September 1, 2008 until March 31, 2009 as being the height of the crisis. According to yesterday’s testimony, Del Missier claims that in November he was told to bring LIBOR down.

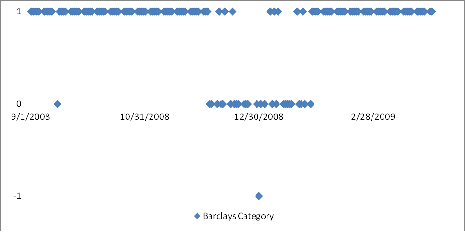

This simple chart just looks at whether Barclay’s was included in the calculation of LIBOR or not.

Of 149 LIBOR business days during that period, Barclays’s was excluded 121 times for being one of the 4 highest submissions, it was excluded once for being one of the 4 lowest submissions, and was only included in the calculation 27 times.

Since Barclay’s is accused of submitting LIBOR rates that were too low, the days that they were excluded because they were excluded as being too high can be ruled out. They may have lied those days to make their LIBOR lower, but the lie had no impact on the setting of LIBOR (it may have impacted market psychology, but that is a different issue).

The November Phone Call

Barclay’s was basically not included in the calculation because they were one of the 4 highest submissions until December 4th. From December 4th until January 26th Barclay’s submitted rates that were often included in the calculation, or in one case were so low, their submission was kicked out. After January 27th, they went back to submitting LIBOR’s that were excluded for being too high, so we now have a crucial set of dates to look at. Barclay’s has admitted submitting rates that were too low after the call, so let’s see what their impact was.

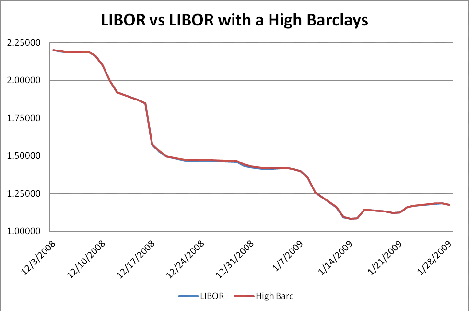

So, I took the liberty of assumign that LIBOR was recalculated for those days, but that Barclay’s submitted the highest rate. So they wouldn’t have been used, and one of the previously kicked out high rates would have been used. This is the maximum difference Barclay’s could have had.

Yes, there are two lines. The red one, assuming that Barclay’s had submitted a high rate is slighly higher in some spots than the blue.

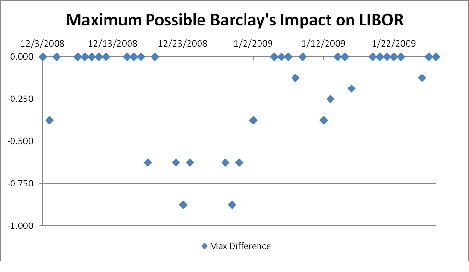

The next chart is a better way to look at it. It “highlights” the impact Barclay’s could have had. This isn’t the impact they actually had, this is theoretically the largest possible impact they could have had on LIBOR.

They in theory could have shifted LIBOR by almost 1 basis point on 2 days. Yes, even on their most manipulative day, the most they could possibly have affected LIBOR was by 0.875 bps.

All the potential manipulation during this criticial time, September 1, 2008 until March 31st 2009 resulted in only 20 days where they could possibly have impacted LIBOR. Of those 20 days, only 7 could theoretically have affected LIBOR by more than ½ a bp and none could have had an impact of one full basis point.

I am not condoning their behaviour, but proving LIBOR was off by ½ a bp on a single day because of a single dealer in the midst of the trading frenzy of that period seems difficult. The bid/offer on most products was at extreme levels, so proving this was really off is hard.

Barclay’s as Whistle Blower

Barclay’s looks like they may have started to “lie” or be aggressive with their settings in December. That is consistent with testimony we have heard so far. What everyone seems to be ignoring is Barclay’s seemed to be saying that everyone else way lying! Barclay’s wasn’t saying their high rates were wrong, they were saying at least other banks’ low rates were wrong! That is the real story.

Who was submitting artificially low LIBORs?

That is the real question. If Barclay’s started lying to catch up to other liars, who were they? Clearly Barclay’s wasn’t driving LIBOR lower through its submissions, even after they admit they were lowering rates, their changes had minimal impact. If there are big losses for LIBOR holders, it has to be OTHER banks were lying MORE and LONGER.