Was Barclay’s Incompetent When Dealing with FSA?

Here is the FSA’s report from June 27th.

I will admit when I first looked at it, it seemed pretty damning. The dialogue was awful and the charts looked bad. But as I look through the details I have to say, Barclay’s seems incompetent in its own defense. I owe some of this report to Simone Foxman who looked at one of the trades in some detail, but here is a closer look at some of the accusations in the report and what impact it had.

My assessment so far is that Barclay’s was incompetent at moving LIBOR and was incompetent at defending itself against the FSA. I expect that the financial crisis period will be a lot more interesting as there is some real divergence and the potential influence on LIBOR is big and real.

Lost Reputation with Little Accomplished is what analysis of FSA examples demonstrates

- Barclays’ Derivative Traders would request high or low submissions regularly in emails, for example on 7 February 2006, Trader C (a US dollar Derivatives Trader) requested a “High 1m and high 3m if poss please. Have v. large 3m coming up for the next 10 days or so”. Trader C also expressed his preference that Barclays would be “kicked out” of the average calculation. Trader C’s aim was therefore that Barclays’ submissions would be high enough to be excluded from the final average calculation, which could have affected the final benchmark rate.

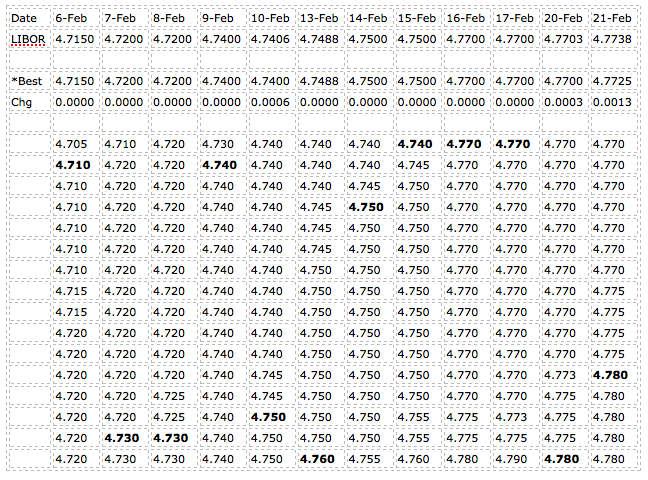

So this looks bad. On Feb 6th, 2006 a trader asks for a high 3 mth Libor setting over the next 10 days. Here are the submissions by each bank. Barclay’s is in a nice Barclay’s blue.

So you can see that they went from being at the “tight” end on February 6th, to the high end. Since the memo wasn’t clear on 10 business days or calendar days, or exact start, so I have gone out to the 21st which would be 10 business days starting on the 8th.

It is clear that at some times Barclay’s was not actually the highest and was even at the low end a couple of times. Assuming they were trying to get LIBOR higher, what was their impact?

Let’s assume Barclay’s was going to be the lowest setting otherwise. That is the worst case, that they “lied” and had they not “lied” they would have tied for lowest. That is the most possible damage they could have caused LIBOR.

On 9 of the 12 days I looked at, that would have caused NO change in the LIBOR for the day. On one day it would have created a 0.0006% shift in LIBOR as it would only have been 4.7400% rather than 4.7406%. Even with the law of large numbers, that is small, and had Barclay’s just submitted at the average than tightest, no impact.

The second last day had an even smaller move, a maximum potential LIBOR manipulation of 0.0003%. On the final day, which I’m not even sure was in the 10 day window, they could have manipulated it by as much as 0.0013%. One basis point is 0.01% so it is an 1/8th of a bp. I’m not condoning their behavior, but I am surprised they capitulated on such small moves – and had they just submitted the average rather than what they submitted, only the last day would have been impacted, and that by 1/16th of a bp.

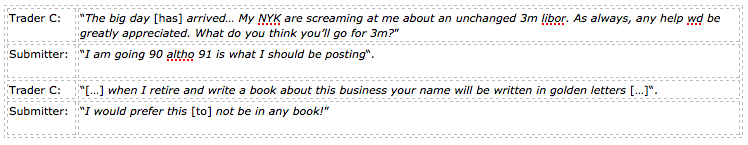

59. On Friday, 10 March 2006, two US dollar Derivatives Traders made email requests for a low three month US dollar LIBOR submission for the coming Monday:

i. Trader C stated “We have an unbelievably large set on Monday (the IMM). We need a really low 3m fix, it could potentially cost a fortune. Would really appreciate any help“;

ii. Trader B explained “I really need a very very low 3m fixing on Monday – preferably we get kicked out. We have about 80 yards [billion] fixing for the desk and each 0.1 [one basis point] lower in the fix is a huge help for us. So 4.90 or lower would be fantastic“. Trader B also indicated his preference that Barclays would be kicked out of the average calculation; and

iii. On Monday, 13 March 2006, the following email exchange took place:

Okay, this looks promising, and is actually the one Business Insider took a look at.

The person did as they were asked. They put in 4.90 as the rate and it is pretty clear 4.91 was the “right” rate. But LIBOR was set at 4.91 so the “manipulation” accomplished nothing. LIBOR was not affected by the action – just Barclay’s reputation. On the 14th they remained low, and had they actually submitted at the high end, they could have influenced LIBOR by as much as 0.0006%.

- In response to a request from Trader C for a high one month and low three month US dollar LIBOR submission on 16 March 2006, a Submitter responded: “For you…anything. I am going to go 78 and 92.5. It is difficult to go lower than that in threes, looking at where cash is trading. In fact, if you did not want a low one I would have gone 93 at least“.

So here again, the fix came in and we see Barclay’s at 4.925. Yes, 4.93 was the “right” level, but the submission didn’t affect the outcome. Had Barclay’s submitted at 4.95 (which incidentally seems high and makes you wonder what BofA was trying to accomplish) the LIBOR setting would still have been 4.93% so once again only the reputation was affected and NOT LIBOR.

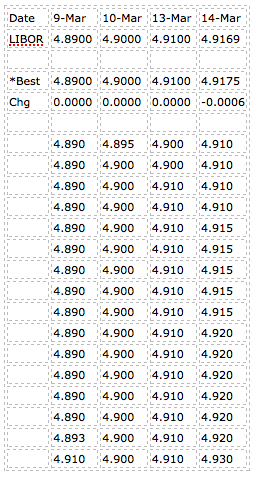

- Trader C requested low one month and three month US dollar LIBOR submissions at 10:52 am on 7 April 2006 (shortly before the submissions were due to be made); “If it’s not too late low 1m and 3m would be nice, but please feel free to say “no”… Coffees will be coming your way either way, just to say thank you for your help in the past few weeks“. A Submitter responded “Done…for you big boy“.

How could anything that ends with “big boy” end well.

This one appears to have done marginally better, though it is hard to tell. The day before and after the “request” Barclay’s was already at the low end of the range. Maybe they were axed (or had their own agenda) or just thought LIBOR was there. In any case, had they submitted 5.04% (the high end of the range) they would have accomplished making LIBOR 0.0006% on that day. That would be a “stunning” success by their standards of manipulation but the fact that they seemed to be low anyways leaves some doubt as to whether they were low for other reasons, and that is a maximum they could have shifted LIBOR.

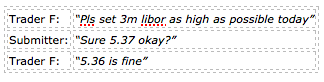

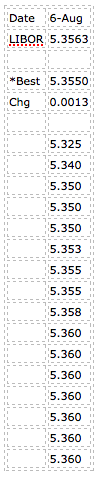

- On 6 August 2007, a Submitter even offered to submit a US dollar rate higher than that requested:

So the 5.37 was “unnecessary” it was just overkill, but 5.36 doesn’t seem unreasonable. Had Barclay’s submitted 5.35 or less, LIBOR would have shifted by 0.0013% as the full basis point would have counted. That is potentially meaningful, but again, 5.36 certainly doesn’t seem out of line (unless a consortium was set up to do 5.36). I’m almost more curious why UBS was in at 5.325, which seems like more of an outlier than 5.36. Given the trader’s willingness to put in 5.37 I suspect that 5.36 is where he (or she) thought the rate should be – consistent with many other dealers.

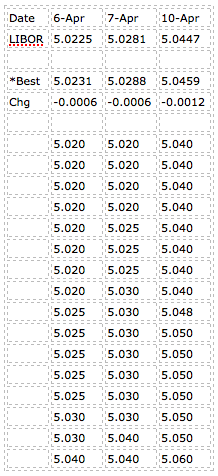

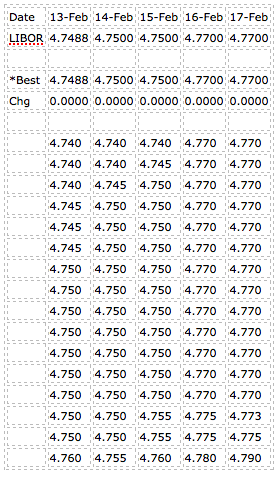

- For example, on 15 February 2006, Trader C made a request in relation to Barclays’ three month US dollar LIBOR submission: “Please go for [unchanged], or lower if poss“. A Submitter sent a positive response to this request. The following graph illustrates the changes in Barclays’ submissions as compared to the final three month benchmark rate:

In this one, the FSA pulls up some fancy charts how on the 13th Barclay’s was at high end, on 15 the low end, and back to high end.

But the keystone cops of LIBOR manipulation are back at it. Yes, they were the highest quote on Feb 13th and the lowest by Feb 15th, but they didn’t impact LIBOR. Had they submitted 4.76 on the 15th rather than 4.74, LIBOR would still have come out at 4.75. What a waste. On any of the days in question, had Barclay’s matched the highest rate the LIBOR setting wouldn’t have been affected.

I’m not sure whether shareholders should be angrier about the manipulation or about how bad they were at manipulating it. I think the focus needs to shift to the “crisis” period where