Energy and Natural Resources Market Radar (June 25, 2012)

Strengths

- Due to high temperatures in the American Midwest, grain prices, specifically corn, have risen over the past week by about 1.9 percent. There has been more heat than precipitation recently, and more is expected to come.

- European thermal coal was a top-performing commodity this week, as the API 2 index for the third quarter increased approximately $4 per ton to $90 per ton, despite the macro circumstances surrounding Europe.

Weaknesses

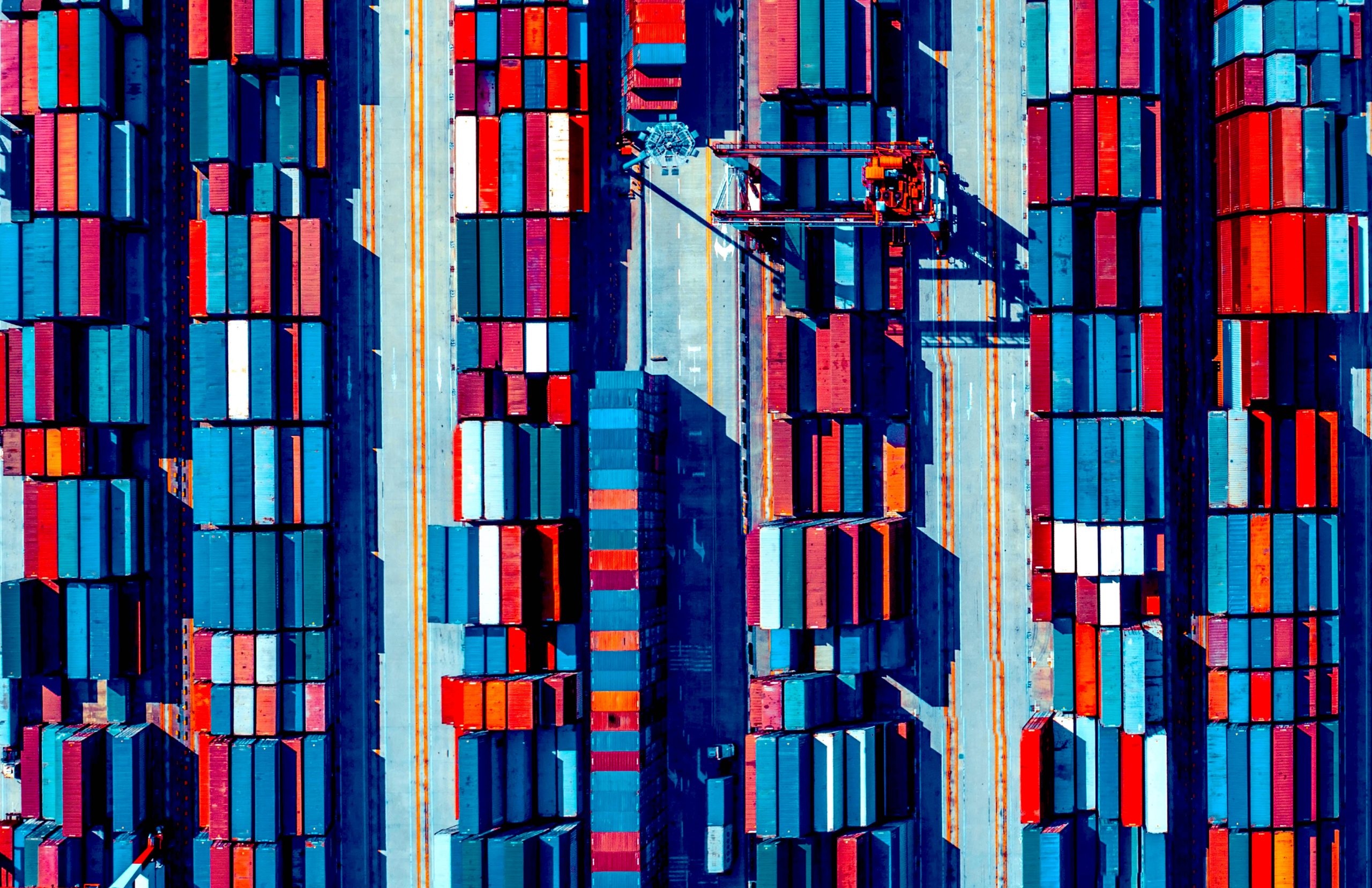

- Brazilian exports of iron ore are down 19 percent in value from January to May compared to the same period last year, as demand from China has slowed recently. Some Chinese steel mills have even postponed shipments of iron ore from miners worldwide, resulting in an over one-month rise in inventories.

- Oil prices reached an eight-month low this week, and briefly fell below $80 per barrel. The International Energy Administration reported that production of oil per day exceeds that of consumption by nearly 1 million barrels. This may be due to a slowdown in demand resulting from the economic unrest in Europe.

- The diamond market is under pressure as demand shows signs of decreasing. Botswana’s diamond mining industry accounts for about one-third of the nation’s total output, and the Bank of Botswana recently reported that the country’s diamond exports have dropped. Also, in the midst of the eurozone crisis, European banks, which have been the main source of financing for diamantaires, have been capping their credit. As a result, inventory levels of diamond manufacturers have gone down.

Opportunities

- Low prices in copper have led to increased interest by Chinese consumers after months of inactivity. President Hu Jintao affirmed that China is maintaining “steady and robust growth,” an indicator of what may lead to more infrastructure spending throughout the country. China has used this to its advantage, importing at a very high rate in the expectation of not only meeting domestic demand, but also future international demand.

- Martin Buzzi, the governor of the Chubut Province in Argentina, has called for legislation to change the regulation of mining in the region. The proposal permits open pit mining in selected areas, including the site where the Navidad Project of Pan American Silver Corp. is located.

- Statoil, an energy company specializing in oil and gas production, announced expectations to triple its current North American based output by the end of the decade. To meet an expected 40 percent increase in global energy demand by 2040, Statoil will expand through investment in oil-rich prospects.

Threats

- Although China has been importing copper at a rapid rate over the past few months, this may begin to decline as borrowing on credit becomes easier through decreased interest rates. Importers of metal use letters of credit to buy and use the metal as collateral in an effort to secure a cheap bank loan. Some companies use the same metal to obtain financing from multiple banks, which is why tighter regulation on financing has come about.

- A labor dispute at Cerro Dragon resulted in a suspension of oil production. This Argentinean oil field, controlled by Pan American Energy, accounts for 15 percent of the country’s total output. If this unrest continues, nearby towns will be severely affected by the lack of energy provision.