by Chuck Carnevale, F.A.S.T. Graphs

Introduction: Don’t Sell the US Economy (or the World’s) Short

In the past, I’ve written numerous articles positing a long-term optimistic outlook for both our economy and the attractive future growth prospects of our great American businesses. Even though I hate to forecast the market in general, I have even presented evidence indicating that the general market as represented by the S&P 500 is currently reasonably priced and even slightly undervalued. My most recent contribution can be found here.

Unfortunately, at least in my opinion, optimistic views on our economy and/or our markets are generally met with resistance and even criticism. One of the most common arguments to counter my optimism is the statement by my antagonists that they are realists. Thereby they are implying that my optimism is unrealistic, and moreover, that a pessimistic outlook is more realistic than an optimistic one. Yet, there is a preponderance of supporting evidence for optimism that is both ignored and even refused to be given consideration to.

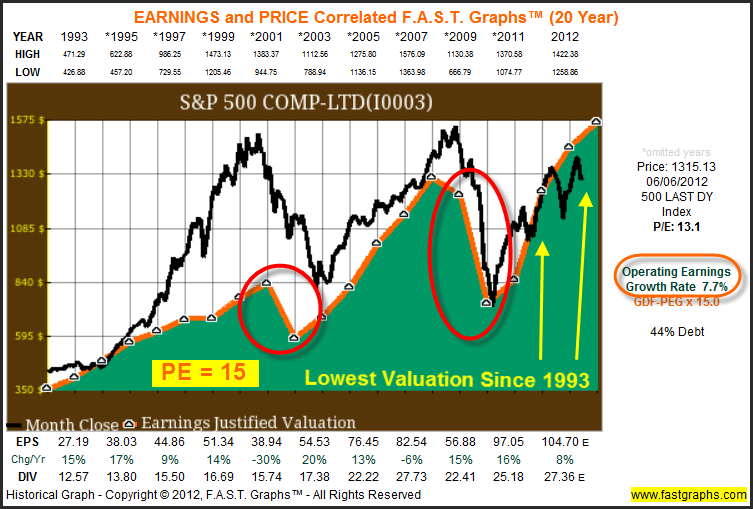

In an attempt to clarify my point, I presented the following F.A.S.T. Graphs™ (actually one very close to this one, but with slightly different dates) in my most recent article reflecting that the S&P 500 is modestly undervalued at this time. The orange line on the graph represents a PE ratio of 15 applied to an earnings growth rate (slope of the line) of 7.7% since the beginning of calendar year 1993. All of the data is historical actual, with the exception of an estimate for 2012 earnings currently at $104.70 per share.

Now, what this graph clearly shows is that the actual blended PE ratio of the S&P 500 of 13.1 based on actual earnings since 1993, is one of the lowest it has been (remember the orange line is a PE of 15). This is not a statistical reference, but a picture of what has actually occurred and how the market has actually valued the S&P 500 since 1993. Clearly, the market has overvalued the S&P 500 (the black price line above the orange line) for most of this almost 20-year period, until and since March of 2011. This is important information, with no conjecture or hypothesis involved just pure unadulterated facts.

Getting back to my optimism vs realism theme, the graphic also shows two time periods where earnings fell. The first time occurred during the recession of 2001, and then once again during the recession of 2008. The realist in me recognizes that these temporary economic interruptions can and do occur. However, the optimist in me recognizes that they are always temporary, where growth will eventually return, as it always has. In other words, it is realistic to acknowledge that business cycles occur, but even more realistic to realize that they do correct themselves. Consequently, I never fear them.

But here is where the argument really gets interesting. The naysayers will immediately point out, and almost take great pride and even glee in stating that the good economic times are permanently behind us and that the once great American economy is now doomed. Therefore, forecasts for future earnings growth are Pollyanna optimistic because our economy is now weak and soon set to implode. The rationale behind their belief that the American economy is weak and collapsing will usually focus on the huge debt load of our government. Next they will further lament on how the same potential bankruptcy exists for all of Europe as well.

My biggest problem with this line of reasoning is that I believe they are erroneously equating the health of government with the health of our economy. Contrary to what most people believe, or are willing to accept, government does not run the economy, and government is not the economy. In fact, I believe and I will be discussing it in more detail later in this series of articles, that what our economy really needs is a lot less government and our markets a lot more freedom. In short, government is an expense and not a factor of production.

This leads me to perhaps some of the most important statements I will make in this whole series of articles. The true strength of an economy lies within its productivity capabilities. In this context, there is no economy that exists today, nor any economy that has ever existed on the face of this earth that is more productive, and therefore more powerful and healthy than the US economy of today. But even more importantly, our future productivity over the next couple of decades is poised to grow exponentially. As this occurs, future prosperity and the opportunities it brings with it are nothing short of remarkable. Yes, that is an optimistic statement, but also realistic at the same time. Over the course of this series, I intend to provide numerous reasons and evidence behind my cheerful view of our country’s exciting future economic potential.

Building The Case For Optimism Factoid Number One

Human beings worldwide seem to have a penchant for pessimism. Surrounded by amazing and exciting reasons to be grateful and to feel good about our futures, we will obsess upon problems perceived and/or imagined and blow them completely out of proportion. However, that is not the worst part, because in so doing we become oblivious to the good and therefore overwhelmed by the less relevant bad that we only acknowledge.

I will once again turn to my friend John Bodnar to put what I said thus far into perspective as he so uniquely is capable of doing. The following excerpt from one of his recent writings provides an interesting spin on my thesis for optimism over pessimism:

“Boring! As the sages in the media fixate on inequality,” Occupy” encampments and street confrontations, one of the mega- trends of the new millennium continues to steam roll across the planet, and will very soon achieve a historic milestone. Very soon my friends, for the first time in history, a majority of our fellow residents on God’s green Earth will live above the global poverty line. More folks ABOVE the poverty line than BELOW it. Hallelujah! Yet no parade. Why? Because the truth flies in the face of the negative narratives of the declinists and their lap dogs in the media .

A monster mega-trend ignored by the media? Should that shock us? Only if you were shocked that there was gambling at Rick’s in Casablanca. The information that most investors get is terrible. Akin to financial pornography. The latest drumbeat is Europe; avoid Europe at all costs. Here’s a memo to all financial journalists: the year is 2012 and the zip code of the home office of the company is now officially irrelevant. As investors we should care only about where the company’s customers and earnings are located.

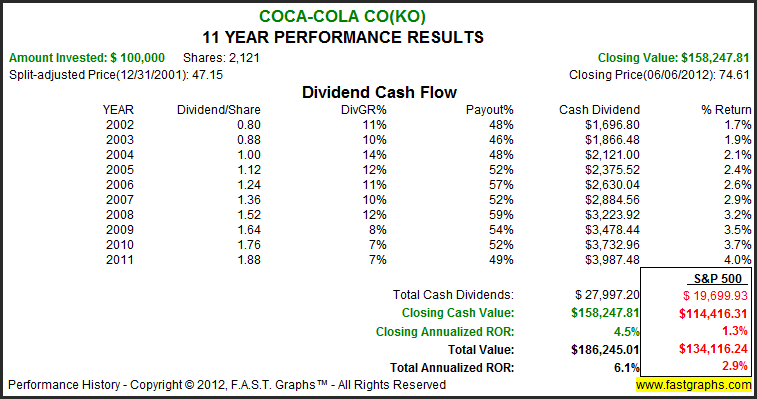

The greatest companies in the world know their competitors and are globally diversified. Which company is the bigger USA play? Coke with an Atlanta zip code and only 20% of sales in the USA, or Nestlé domiciled in Switzerland with more sales in the US than Coke? Journalists constantly ask who will be the Nike of China? Answer: Nike. Investors should not confuse companies with countries. What do companies make and where do they sell it? That is what is important.

We are witnessing, in real time, a major increase in the buying power of the majority of the people on our planet. Mass affluence, Aging and New technologies (especially in data transmission and storage), all translate into monster opportunities for the greatest companies in the world. Emerging market customers want what we in the West have, and they want it right now! And the great companies of the world are busy providing it to them. Defeat the declinists…buy companies”

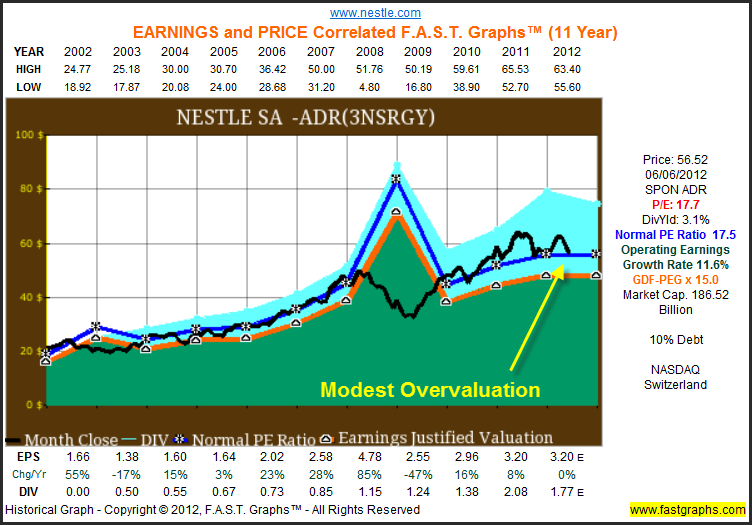

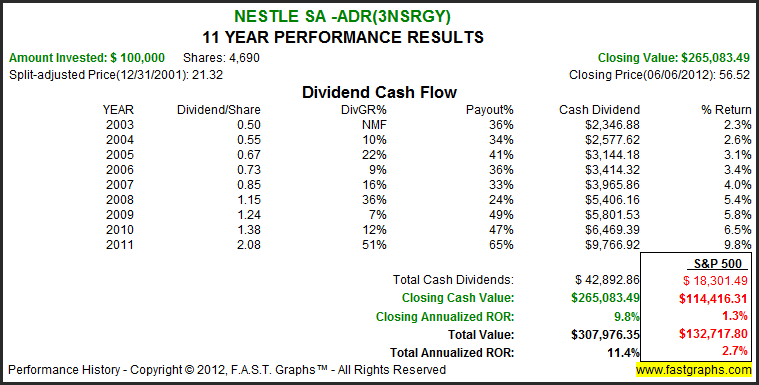

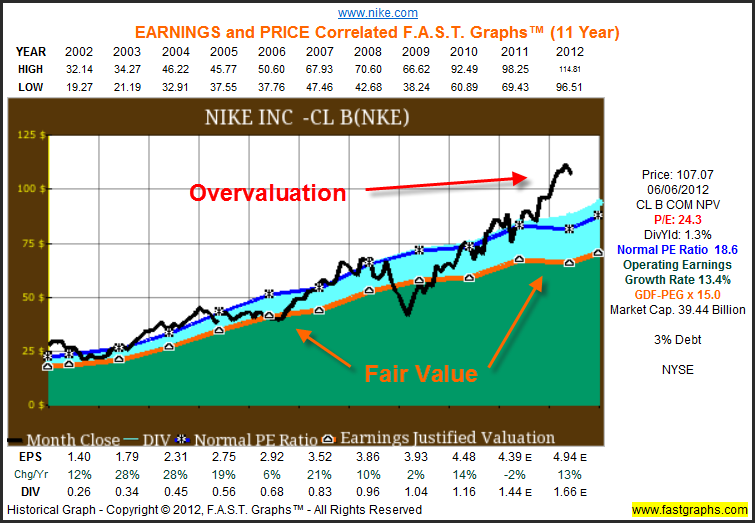

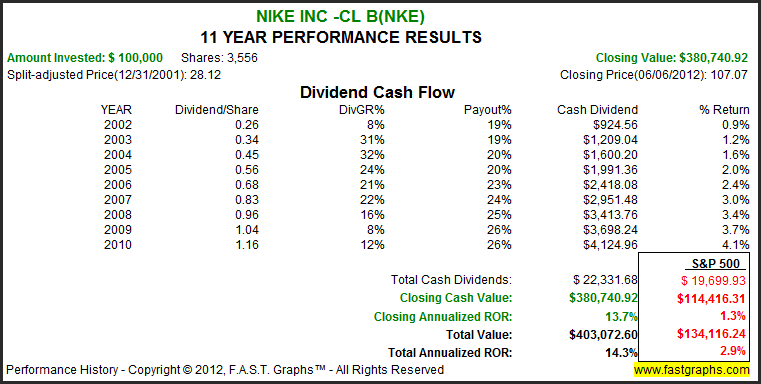

In order to support my position as a realist, I thought it would be fun to show the three companies that John mentioned in his writings. Like John, I believe that these are all examples of “great companies of the world”, however, the realist in me is concerned about valuation. When looked at through the lens of F.A.S.T. Graphs™ we see that Nestle (3NSRGY) and Coca-Cola (KO) are both fully valued to slightly overvalued, and Nike (NKE) is significantly overvalued. Therefore, although I am optimistic about all three, I would wait for a better entry point before I invested in any of them.

Summary

In part one of this three-part series I have merely introduced the very beginnings of why I believe that investors should be realistically optimistic about the long-term future of our great country and its economy. On the other hand, this does not mean that I deny the possibility of temporary interruptions in our growth. On the contrary, one of the unfortunate attributes of the exponential growth of technology is the inevitable creative destruction that comes with it.

In her book Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages, Carlotta Perez explains that before the great profits and benefits can occur from the deployment stage of technological advancements, we must first endure the process of creative destruction. During this phase, old business models must give way to the new and either adapt or die. This requires that people, corporations, and yes, even governments must unlearn the old paradigms before they can benefit from the new ones.

My point is that it would be unrealistic to believe that we can expect economic gain without expecting some pain. As any respectable bodybuilder would put it “no pain, no gain.” On the other hand, I would also argue that much of the pain has already passed us. Furthermore, I will add that government interference has greatly contributed to delaying and prolonging the healing process that inevitably occurs with free markets.

In my next installment I will introduce and elaborate on the information technology and telecommunications wave of prosperity that started in 1971 in the United States. According to Trends Magazine, that has written extensively on this subject over the years, this is the fifth wave of five waves that began with the industrial revolution in 1771. Furthermore, Trends Magazine states that all economic revolutions go through three phases:

“ 1. Installation-when an initial boom expands, inevitably leading to a bursting bubble.

2. Transition- when disappointed investors revalue the assets of the bubble.

3. Deployment-when the dominant technology matures and becomes the foundation for everything else in the economy

Trends then goes on to state:

“Regardless of how long this third phase lasts, once deployment gets going, it has always ushered in a “golden age” in which speculation and venture capital give way to an economy driven by real profits…..we argue that we are now at, or very near, the end of the” turning point” and poised to enter the “Golden age” of deployment for the silicone-based wave.”

Personally, I am confident that we are on the verge of one of the most exciting economic “golden ages” in our economy’s grand history. In the next two installments I will cite specific industries and provide several sample companies that I believe stand to greatly benefit from the advances in technology that have already laid the foundation for prosperity beyond what the world has ever witnessed before. This is no time to be pessimists about our future, there’s too much opportunity and profit ahead.

Industries Benefiting From The Great Inflection Point Ahead

The July 2012 issue of Trends Magazine has an article titled “Understanding the Great Inflection Point Ahead.” The beginning of this article recaps several of their previous articles dealing with the potential benefits of the information technology and telecommunications age, which they refer to as the fifth revolution that started in 1971 in the United States. The following excerpts highlight some important messages that this installment offers:

“We are four decades into the fifth techno-economic revolution. More importantly, we are now struggling through the current revolutions tumultuous inflection point—a profound transition from the first, investment-intensive phase, in which all of those investments will begin to pay off in wondrous new ways of communicating, innovating, and living, creating a quantum leap in human quality of life.

The next excerpt I would like to share looks back to their July 2011 issue where they revisit their article “Reengineering the US economy”:

The July 2011 issue, examined how the new technologies and business models of the fifth techno-economic revolution are likely to be applied to solve the debt crisis, redefine the social contract, and boost the economy by reinventing education, healthcare, and other industries.”

Conclusions

Thus far, I’ve only scratched the surface of introducing what I believe are the many numerous opportunities and advancements that I believe will benefit our long-term economic health. Unfortunately, these stories go almost totally ignored by the mainstream media which instead revels in focusing on our problems. To be sure, we do have problems that need to be solved. But more importantly, I believe, and the evidence validates my beliefs that we have the wherewithal and the capacity to get the job done. Therefore, I find it more realistic, and yes optimistic, to focus my attention on the solutions.

In part two, I will review, but again only scratch the surface, on several opportunities and solutions that I believe suggests a new golden age for our economy. Along with this golden age will come profitable growth to those companies smart enough to recognize and embrace the technological revolution. But to be clear, I am not just referring to technology companies. Opportunities will abound for virtually every industry. From infrastructure build out, healthcare, education, consumer goods and services to you name it, the techno-economic revolution will help them all become more profitable and grow. And of course, our economy along with it.

Disclosure: Long KO at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Copyright © FAST Graphs