The Absolute Return Letter

June 2012

First Mover Advantage

“The problem with socialism is that you eventually run out of other people's money.”

- Margaret Thatcher

Bubble? What bubble?

Sometimes I wish I could have a second go at my writing. Last month, and not for the first time, I realised that what had seemed pretty clear and unequivocal to me was misunderstood by many readers. More specifically, I am referring to the concluding remarks in last month’s Absolute Return Letter where I stated that Asia has the potential to become a re-run of Europe. My argument was based on the simple but undeniable fact that policy rates are well below where they ought to be when taking into consideration the overall level of economic activity and inflation (the so-called Taylor rule).

Those comments were interpreted by many readers as if I expect an imminent crisis in Asia of the sort we currently suffer from in Europe. Nothing could be further from the truth. Allow me to explain:

Following the introduction of the euro, Spain and Ireland, and to a lesser degree Portugal, experienced an enormous construction-led economic boom which was the direct consequence of easy access to cheap capital. The ECB was certainly aware of the potential problems this might create down the road; however, it had no choice but to set the policy rate at a ‘one size fits all’ level, and the German economy badly needed some stimulus back in the early stages of the euro era. By choosing to support the weakest link in the chain, the ECB had effectively sown the seeds of a bubble which would blow up almost a decade later.

There are at least two lessons to be learned from that experience, the first one being that bubbles take a long time (as in many years) to build up and, in the meantime, there is usually a great deal of money to be made. Secondly, when the ECB responded to the bursting of the dot.com bubble, as most central banks did in 2001-02, the law of unintended consequences kicked in. By their very nature, bubbles create echo bubbles. What is currently happening in Asia - and I throw in Australia for convenience - could very well turn out to be an early to mid stage echo bubble.

I had been planning on writing on the topic of Asia in much more detail this month, partly to clarify my views expressed in last month’s conclusion (which I hope I have accomplished now) but also to address some of the nearer term issues Asia is facing. Then things in Europe got out of hand again, following the Greek elections, so Asia will have to wait until next month.

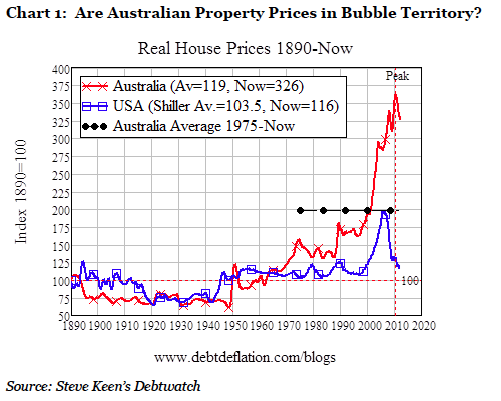

As a primer to next month’s letter, I couldn’t resist the urge to throw in just one chart, produced by the great economist and blogger Steve Keen from Down Under. Steve has produced a long term chart of Australian versus US property prices (see chart 1 below and the whole paper here). Steve finds it outright comical that Australians are in complete denial as to where they are in the property cycle. Bubble? What bubble? Much more on this topic next month.

It is a banking crisis idiot!

Now back to Europe. The eurozone crisis has always been a banking crisis. It only morphed into a sovereign crisis because of political incompetence. Solve the banking crisis and you have solved the euro crisis. That is my prediction. On the other hand, as long as the Germans continue to say Nein to pretty much anything that anyone puts on the table, we are still a long way away from solving the crisis. Only a few days ago Angela Merkel reiterated her rejection of the idea of mutualising eurozone sovereign debt. The proposal came from SPD, the major opposition party in Germany, with the idea being that all eurozone debt within 60% debt-to-GDP should be mutually guaranteed. However, Merkel said Nein. Again.