by Andrew Horowitz, The Disciplined Investor

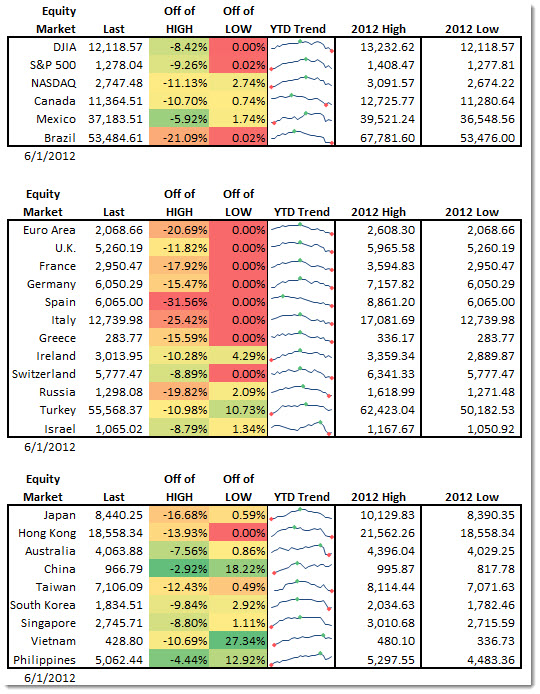

Looking at the table below, it seems that the year has been one big waste of effort for most equity markets. Closing in on the lows in the EuroZone and just above the weekly lows in the U.S. markets.

But, Asia has been remarkably strong. In fact, China (up until very recently) has not wanted to budge from its high perch. Even with much of the bad news that is being thrown at it, Chinese stocks have been relatively resilient.

If you were thinking that they were just too cheap after the shellacking they took last year – consider the the continuing downtrend for Spanish and Indian shares.

Information on the table below looks at year-to-date trends for 2012 through June 1st.

The continuing prompts, promises and pledges from the Chinese government on additional stimulus measure has clearly been well engrained (brainwashing anyone?) into the investor’s psyche. So, either the economy is going to get better without stimulus, or additional provisions will need to come in a rapid manner as markets have a short memory.

Which is it?

Copyright © The Disciplined Investor