by James Montier, GMO

This paper is based on a speech delivered at the 65th Annual CFA Institute Conference in Chicago on May 6, 2012.

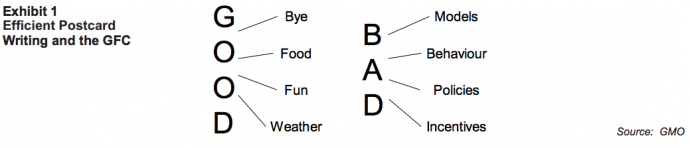

As a child, watching my parents write postcards whilst we were all on holiday was an instructive experience. My mother would meticulously write out the card, scattering a few interesting holiday tidbits within the text. My father, whose sum total of postcards sent was invariably just one (to his office), opted for a considerably more efficient approach. His method is shown at the left in Exhibit 1.

I think we can construct a similar diagram to explain the Global Financial Crisis (GFC), represented at the right in Exhibit 1. In essence, the GFC seems to have sprung from the interaction of the following four “bads”: bad models, bad behaviour, bad policies (which is really just bad behaviour on the part of central banks and regulators), and bad incentives.

In an effort to rethink finance, I want to examine each of these factors in turn, beginning with bad models. Bad Models, or, Why We Need a Hippocratic Oath in Finance

The National Rifle Association is well-known for its slogan “Guns don’t kill people; people kill people.” This sentiment has a long history and echoes the words of Seneca the Younger that “A sword never kills anybody; it is a tool in the killer’s hand.” I have often heard fans of financial modelling use a similar line of defence.

However, one of my favourite comedians, Eddie Izzard, has a rebuttal that I find most compelling. He points out that “Guns don’t kill people; people kill people, but so do monkeys if you give them guns.” This is akin to my view of financial models. Give a monkey a value at risk (VaR) model or the capital asset pricing model (CAPM) and you’ve got a potential financial disaster on your hands.

The intelligent supporters of models are always quick to point out that financial models are, of course, an abstraction from reality. Just as physicists can study worlds without frictions, financial modelers should not be attacked for trying to reduce the complexity of the “real world” into tractable forms.

Finance is often said to suffer from Physics Envy. This is generally held to mean that we in finance would love to write out complex equations and models as do those working in the field of Physics. There are certainly a large number of market participants who would love this outcome.

I believe, though, that there is much we could learn from Physics. For instance, you don’t find physicists betting that a feather and a brick will hit the ground at the same time in the real world. In other words, they are acutely aware of the limitations imposed by their assumptions. In contrast, all too often people seem ready to bet the ranch on the flimsiest of financial models.

Read the whole letter in the slidedeck below (Fullscreen for the easier read, or download)