Going Global Can Pay Dividends

by Brad Kinkelaar, PIMCO

- In today’s low yield environment, many investors now include dividend-oriented equities in their portfolios in an effort to reach their income goals.

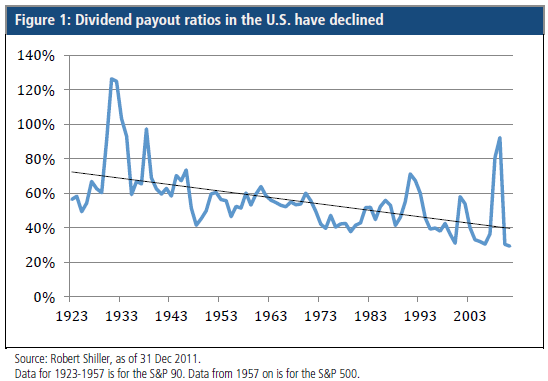

- U.S. investors with home market bias risk severely limiting their income potential because in the U.S., dividend payout ratios are on the decline, taxes are potentially on the rise, and valuations in sectors that typically offer attractive dividends are near historical highs.

- In our view, global equities can provide more attractive dividend income opportunities and offer potential for additional benefits, including diversification

You don’t have to look very far these days to find yield-oriented investors starving for attractive income options. With 10-year Treasuries yielding about 2%, the usual playbook of generating income from a simple portfolio of government bonds has proven inadequate. This has serious implications for investors: As the large number of people born between 1946 and 1964 – the baby boomers in the U.S. – begins to retire, many retirement portfolios, once the recipients of net inflows, are under the strain of increasing distribution requirements.

In search of solutions, many investors now include dividend-oriented equities in their asset allocations. In an effort to reach their income goals, the temptation is great for these many investors to simply survey the local U.S. market and buy the highest yielding stocks. But we believe that in many cases, investors are over-reaching for yield in the wrong places and for the wrong reasons, which could have negative consequences for those sensitive to downside risk. In our view, global equities can provide more attractive dividend income opportunities and offer potential for additional benefits, including diversification.

The dangers of a home bias today

With the current yield environment as backdrop, dividend equity strategies have enjoyed significant popularity. Over the past year alone, these strategies have received over $41 billion of net inflows, despite outflows of an equal magnitude from all equity funds. As a result, some have called dividend investing a “crowded trade” or “overvalued,” and recent articles in the press have warned that dividend funds carry “considerable risk” and are an “unsafe bet.” One even warned the unknowing “dividend stampede” that it faces a dilemma in owning dividend equities. The one thing all of these warnings have in common is that they address a U.S.-focused dividend approach, and for this reason, we think they may be right.

We believe the root of the problem for portfolios today, from individual retirement accounts to institutional pensions, is home market bias. Think of it as putting all your eggs in one basket: With this home-market bias, U.S. investors risk severely limiting their income potential because yield opportunities in the U.S. are slim pickings, in our view. Beyond telecom and utilities, no U.S. sectors yield much more than 3% today. Dividend managers constrained to the U.S. might reach beyond these sectors to include real estate investment trusts (REITs) or master limited partnerships (MLPs), but the universe is still relatively narrow.

Constructing a dividend equity portfolio with a home market bias thus shifts the focus from being diversified across sectors to reaching for yield and overweighting securities in a narrowly defined group. This increases concentration risk in the portfolio and the potential for loss if one sector falls in value. Despite this risk, over the past year, the majority of inflows have gone to U.S.-focused dividend mutual funds and exchange-traded funds (ETFs), prompting much of today’s concern.

Beyond the dearth of yield among U.S. equities generally, we think there are other fundamental problems with a U.S.-only dividend strategy, including:

- Dividend payout ratios in the U.S. have been in secular decline, as shown in Figure 1. Reasons for the decline are the subject of some debate, but that doesn’t change the reality. Conventional wisdom in the U.S. is that companies exhibiting earnings growth and those issuing dividends are mutually exclusive. Since the dot-com driven market of the 1990s, U.S. investors have been led to believe that you must ask for either dividends or growth – that you can’t expect both – so shareholders don’t routinely demand a healthy dividend payout from all their companies. Additionally, the U.S. now has the highest corporate tax rate in the world, and multinational U.S. companies that may have the ability to issue dividends may not have the willingness to repatriate international profits under the current tax regime.

- Since 2003, U.S. individual investors have enjoyed a lower tax rate on the qualifying dividends they receive, but this may change as the tax rate on dividends is scheduled to significantly increase at the end of 2012, barring new legislation. Because of this, U.S. companies with a high domestic individual investor base may face further pressure from shareholders to lower their dividends and attempt to redistribute profits in other ways, such as stock buybacks.

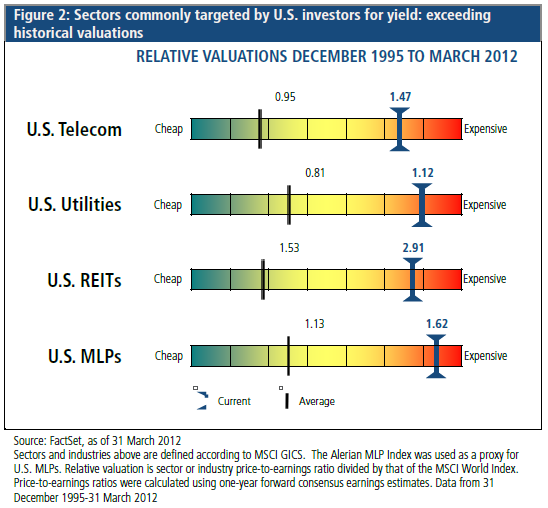

- Finally, and most importantly in our view, the U.S. equity sectors most commonly targeted by investors for income (telecoms, utilities, REITs and MLPs) are trading at historically high valuations, as shown in Figure 2. This supports our view that many investors are in the wrong places and for the wrong reasons. Current yields may be attractive, but we believe the high valuations of these sectors are at the heart of the concern about a crowded dividend trade today and why warnings to investors in U.S.-focused dividend strategies and ETFs are justified. These funds may just be carrying around a group of overvalued stocks, and buying overvalued assets has the potential to create significant downside risk. For all the importance of current yield and growing dividends to investors, we believe attaining capital appreciation by employing a valuation discipline should be an equally important goal.

Ongoing benefits of going global

A U.S.-centric portfolio constraint may be artificial and unnecessarily exclude the vast majority of available dividend stocks. A viable alternative is going global and unconstrained. We see a variety of reasons to embrace this approach to dividend investing, but we’d like to highlight three:

- While the U.S. offers a limited menu of companies with attractive dividend yields, loosening this constraint provides for diversification, not only by geography but also by country and sector. Going global enlarges the menu to a yield buffet, as Figure 3 illustrates. There are a number of reasons for this. For example, some countries have regulations that mandate a dividend payment, such as Brazil with a 25% minimum payout. More significant, we see a cultural difference in that global investors, unlike their U.S. counterparts, simply do not view earnings growth and dividends as mutually exclusive – global investors typically demand both, and investor demand can have great influence on company management decisions. We believe this dynamic also imposes a certain capital allocation discipline upon company chiefs, which in turn has the potential to produce better economic results for shareholders.

- Dividend policies that favor payouts are examples of companies aligning their interests with shareholders, and this goes a long way toward solving the classic “agency problem,” or conflicts of interest, that corporations often face. Among international companies, we more frequently see a dynamic that encourages this alignment of interests. Often, a local shareholder – an individual, a family or a government agency – has a controlling interest in a company and wants the same thing a dividend-focused investor does: that a portion of net income be paid out in dividends (a healthy payout ratio), and that these dividends grow with earnings. In some ways, dividend investors can think of this as being well-connected.

- Surveying the global landscape indicates to us that some of the best values in high-yielding companies are found outside the U.S. In past years, dividend stocks in the U.S. traded at a meaningful discount to the market. Today’s parity or premium to the market supports claims of a dividend bubble, but only in the U.S. Dividend stocks in Europe, the Middle East, Asia and Latin America offer better discounts relative to their respective home equity markets, as well as the U.S. equity markets in general, as Figure 4 shows.

Conclusion

The low yield environment has prompted many income-hungry investors to add dividend-oriented equities to their portfolio allocations. With so many investors piling in, have dividends become a “crowded trade” and an “unsafe bet?” Do they present investors with a clear and present danger and a dilemma? This may sound like hyperbole, but in the U.S., dividend payout ratios are in a long-term decline, taxes on dividends are potentially on the rise, and valuations in sectors that typically offer attractive dividends are near historical highs. For the investor whose dividend investments are focused in the U.S., these are certainly reasons to pause. However, the evidence suggests that for the global dividend investor – unconstrained by geography, market capitalization and benchmark – attractive opportunities still abound.

Past performance is not a guarantee or a reliable indicator of future results. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Sovereign securities are generally backed by the issuing government, obligations of U.S. Government agencies and authorities are supported by varying degrees but are generally not backed by the full faith of the U.S. Government; portfolios that invest in such securities are not guaranteed and will fluctuate in value. REITs are subject to risk, such as poor performance by the manager, adverse changes to tax laws or failure to qualify for tax-free pass-through of income. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss.

There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

The Morgan Stanley Capital International World Free Index is an unmanaged market-weighted index that consists of over 1,200 securities traded in 21 of the world’s most developed countries. Securities are listed on exchanges in the US, Europe, Canada, Australia, New Zealand, and the Far East. The index excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The index is calculated separately; without dividends, with gross dividends reinvested and estimated tax withheld, and with gross dividends reinvested, in both U.S. Dollars and local currency. It is not possible to invest directly in an unmanaged index.

This material contains the current opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. ©2012, PIMCO.