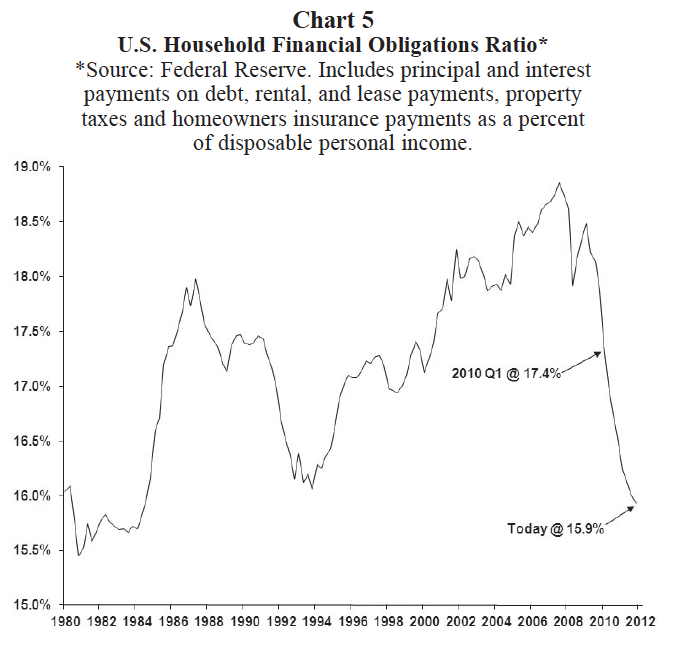

Finally, and most importantly, the U.S. consumer is no longer languishing under an oppressive debt burden. Chart 5 shows the U.S. household financial obligations ratio reported by the Federal Reserve. This ratio includes all debt service payments, lease and rental payments, property taxes, and homeowners’ insurance payments as a percent of disposable personal income. It reached an alltime record high in 2007 of about 19 percent illustrating the weak and vulnerable position of the U.S. household sector just prior to the last recession. Indeed, this burden was still 17.4 percent when the first spring swoon hit the recovery in early 2010. Today, however, this ratio has fallen below 16 percent, and rather than being at an all-time record high, it is now close to a record low!

The 2012 consumer is simply much healthier and far less vulnerable to shocks than was either its 2010 or 2011 cousins.

Euro Zone to Improve (Not Worsen) and Emerging Economies to Quicken (Not Slow)

The euro-zone crisis first arrived on the scene in January 2010 and may have prompted the 2010 U.S. spring swoon. It undoubtedly was at the epicenter of the 2011 swoon which culminated with the euroinduced downgrade of the U.S. government. In both instances, however, the European crisis persistently worsened with no clear response from leaders in the region. From its beginning at the start of 2010 until late 2011, the European crisis went virtually untreated as leadership in the region simply refused to give the infected patient any economic antibiotics. Predictably, euro-zone problems (the infection) kept spreading.

This finally changed late last year when a new ECB chairman promptly cut interest rates for the first time since the crisis began and has subsequently lowered interest rates again. Moreover, authorities also finally placed a liquidity ring around troubled financial institutions, the ECB finally dramatically expanded its balance sheet (Chart 6) and “bond haircuts” were finally enforced beginning the process of eliminating failed debts.

So far, the newly treated patient is doing much better—the upward trajectory of bond yields in the region has seemingly been broken (Chart 7). Like any pesky infection, although it may intensify from time to time, the European crisis (while not over) seems to have been brought under much better containment.

Although emerging world policy did not play a major role in the 2010 spring swoon, it did exacerbate the economic and stock market stall during 2011. By late 2010, some emerging market officials began employing tightening policies in order to moderate recoveries. Their efforts became even more pronounced in 2011. Subsequent fears of a hard landing in China and elsewhere in the emerging world certainly magnified last year’s almost 20 percent decline in the stock market. By contrast, in recent months, most emerging economic officials have been easing policies attempting to once again quicken their respective economic recoveries.