“Is it time to sell emerging market equities?” That’s what many investors are wondering given that emerging market stocks are up significantly since fall lows and have modestly outperformed developed markets year to date.

“Is it time to sell emerging market equities?” That’s what many investors are wondering given that emerging market stocks are up significantly since fall lows and have modestly outperformed developed markets year to date.

Despite emerging markets’ strong recent performance, I believe there are two major reasons why investors should still consider overweighting select countries relative to their weight in the MSCI ACWI benchmark.

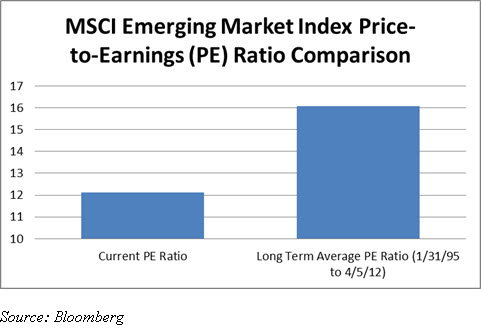

Cheap Valuations: First, and most importantly, emerging markets remain cheap compared both to their own history and to developed markets. Currently, the MSCI Emerging Market Index is trading for around 12x earnings. As the chart below indicates, this is a significant discount to the index’s long-term average multiple of 16.

The current valuation of roughly12x earnings is also a 22% discount to where the MSCI World Index is trading. And historically, when emerging market stocks have been at a 20% or more discount to developed market equities, they have significantly outperformed over the next year.

Falling Inflation: A second factor supporting emerging market equities is that inflation continues to decline in most emerging markets, India being a noticeable exception. For instance, over the past nine months, inflation in China has fallen from 6.5% to roughly half that level, while inflation in Brazil has decelerated to around 5% from 7.5%. Lower inflation should provide for some multiple expansion in emerging market stocks.

However, since not all emerging markets currently look attractive, I continue to advocate overweighting only certain areas through a regional and country implementation.

In particular, I like Latin America, Brazil, China and Russia, and I prefer to access these markets through the iShares MSCI Emerging Markets Latin America Index Fund (NASDAQGM: EEML), the iShares S&P Latin America 40 Index Fund (NYSEARCA: ILF), the iShares MSCI Brazil Index Fund (NYSEARCA: EWZ), the iShares MSCI China Index Fund (NYSEARCA: MCHI) and the iShares MSCI Russia Capped Index Fund (NYSEARCA: ERUS).

Meanwhile, investors looking for a lower risk alternative for accessing emerging markets may want to also consider the iShares MSCI Emerging Markets Minimum Volatility Index Fund (NYSEARCA: EEMV).

Source: Bloomberg

The author is long EWZ and ERUS

Investing involves risk, including possible loss of principal. Past performance does not guarantee future results.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Securities focusing on a single country may be subject to higher volatility.