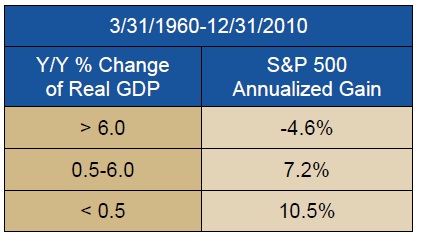

When I was in college, the hardest concept for freshman and sophomore economics students to understand was that bond prices fall when interest rates rise and bond prices rise when interest rates fall. Most of my classmates just memorized the concept without understanding why it happens. Since 1980, when I came into the investment business, the hardest concept for investors to understand is that stock prices rise when the Federal Reserve Board practices “easy” money policies during very poor and anemic economic growth periods. When normal business does not use the newly created money supply, it sloshes around and finds its way into the stock and bond markets. Stocks also have a tendency to perform poorly when the US economy grows at rates above 6% for an extended time. See the chart below:

Source: Liz Ann Sonders, Charles Schwab, Market Outlook February 2011

Source: Liz Ann Sonders, Charles Schwab, Market Outlook February 2011

We at Smead Capital Management are very excited about the next three to five years because we believe it is likely that Main Street will start to compete with Wall Street for capital and economic growth will accelerate. Unemployment rates would fall in that scenario and “pent-up” demand for goods and services could come out of the woodwork among average American households. What we mean by saying this is that capital will begin being demanded for business activities. As capital gets demanded for business activities ranging from housing to business expansion, the cost of capital will rise and bond prices would fall.

In a better Main Street economic environment where capital is being demanded, investors would be put in a position of having to differentiate between companies. As the US stock market rebounded from the once in 50-year fears of another great depression, almost every boat was floated by the wave of money created by the activities of the US Treasury and the Federal Reserve Board. Commodities rebounded, gold went parabolic, corporate bond prices soared and common stocks of all shapes and sizes moved in tandem off of the March, 2009 lows. This culminated last fall in the highest correlations among S&P 500 index stocks in the last 25 years at around 86% in October of 2011. The tide came in and all boats floated. As we wrote in July of 2011, we had reached what we call asset allocation “Nirvana”.

The question for those of us who like to “skate to where the puck is going to be” is which sectors of the S&P 500 and which companies are likely to be strong investments in this coming environment? This would include economic growth at 3-5% and would likely allow the Fed to let short-term interest rates gravitate to market rates. This new environment would also see those historically high correlation levels disappear. Lastly, improved economic growth, higher interest rates and less government dole could severely impact corporate profit margins.

In a normal economic cycle, the energy, heavy industrial and basic materials sectors of the S&P 500 index are slow out of the starting gate in the early stages of a bull stock market. They don’t begin hitting their stride until economic growth accelerates, because their attractiveness usual coincides with capacity becoming scarce. It makes sense, because sales usually pick up before inventories are replenished and before new capital goods are required. However, the globalization of large-cap US cyclical stocks like Caterpillar (CAT), Deere (DE), Schlumberger (SLB) and Joy Global (JOY) has caused them to be much more sensitive to the international economy and much less sensitive to US economic growth. Caterpillar only gets 27% of its revenue from the US and we believe the US is the least reliant on commodities and most energy efficient it has ever been. For example, energy consumption per real dollar of Gross Domestic Product was 18% in 1970 and was 7.3% at the end of 2011. The US is the largest economy in the world. It is as big as the next four country GDP totals combined, yet commodity prices have increased more in the last ten years as in any ten-year stretch over the last 205 years. This is despite the fact that commodities matter the least to the gross domestic product of the US as they have ever mattered.

Therefore, we believe that the normal bull market in cyclical sectors has been spent on the excitement that China and the BRIC-trade related countries have created the last ten years. We also believe that the slowdown in the emerging world and acceleration of the US economy is the death knell of the commodity bull market of 1999-2011. Finally, utility and telecom companies should enjoy some positive effect of the rebound in the US economy, but that is offset by potentially higher borrowing costs for these capital intensive industries. We are avoiding all five capital intensive sectors of the S&P 500 index.

This leaves us consumer discretionary, financials, healthcare (Pharmaceuticals) and technology. We believe all of these sectors stand to benefit from the next stage in the US economic recovery. Consumer discretionary companies would benefit from the unleashing of the pent up demand, while financials would prosper from the rebound in housing and lending. Pharmaceutical companies would gain from lower unemployment and greater prosperity and technology profits would be driven by meeting the capital good needs of these commodity efficient industries. We believe this is especially true for companies with the best balance sheets and those which have the best free cash flow, because they won’t have to fight with Main Street for borrowed capital as it makes its comeback.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. Some of the securities identified and described in this missive are a sample of issuers being currently recommended for suitable clients as of the date of this missive and do not represent all of the securities purchased or recommended for our clients. It should not be assumed that investing in these securities was or will be profitable. A list of all recommendations made by Smead Capital Management with in the past twelve month period is available upon request.