The multi year-ish Fed funds yield plan has had many outsize effects, not the least of which is a massive transfer of wealth from savers to debtors. Those savers, many usually a very conservative bunch, have been desperate to pick up any sort of meaningful yield to keep ahead of inflation – or to reach those promised annual return assumptions of 7%+ if you are a pension fund. As Treasury bond rates have swooned, so have corporate bond rates – both at the high end and at the low end of quality as economics 101 kicks in. As demand swamps supply, prices go up – which in the bond market means yield goes down.

Eventually, like all Fed policies that eliminate any form of realistic supply and demand in a market, this will end badly. Many people in "safe" investments (i.e. Treasuries) are going to be introduced to principal loss, and those in other form of bonds are going to face interest rate risk – even in places where it is atypical, such as the high yield market. The question as always is "when" – this could continue for years, or the game could be up in a few months/quarters. The WSJ takes a closer look at the environment in junk bonds, and the new risks brought in by ultra low rates.

- U.S. companies with junk credit ratings are piling into the debt markets at a record pace, seizing on some of the lowest borrowing costs in history and strong demand from investors craving higher returns. Companies and investors both have benefited. Many corporate borrowers have been able to refinance debt at much lower rates, and others have been able to raise money cheaply for investments.

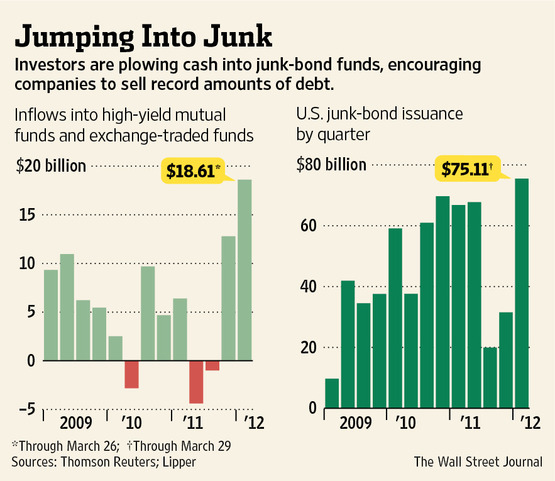

- Some 130 U.S. junk-rated companies, from commercial lender CIT Group Inc. to car-rental company Hertz Global Holdings Inc., have sold $75 billion in junk bonds this quarter, according to Thomson Reuters, up 12% from the same period last year and a record for any quarter going back to 1980 when Thomson began keeping data. "This is nirvana" for many low-rated companies, said Jim Casey, co-head of global debt capital markets at J.P. Morgan Chase & Co. The rally in junk bonds extends an advance that began in early 2009 and can be traced largely to the Federal Reserve's policy of keeping benchmark interest rates near zero.

- Investors of all stripes have been diving into junk. Many of them are searching for investments that yield more than the meager rates offered by Treasurys and investment-grade corporate bonds. They are flooding into high-yield mutual funds and exchange-traded funds, market data show.

- High-yield corporate borrowers paid an average rate of 7.98% on bonds they have sold this year, according to Thomson Reuters. That is the lowest since the junk-bond market was created in the 1980s. That compares with yields of little more than 1% on comparable Treasury notes and an average of about 3.4% on all investment-grade bonds, based on the Barclays Aggregate Bond index. For the most part, companies are using money from the debt sales simply to refinance existing debt, or they are hoarding the cash, data show.

- This year, investors poured a record $18.6 billion into high-yield mutual funds and exchange-traded funds through March 26, according to Lipper Inc. That exceeded the previous record $12.8 billion set in the fourth quarter last year.

- But investors run the risk of having the tide turn against them should interest rates start rising. Some analysts have begun suggesting that day could come soon. "This is the talk of the market," said Matt Conti, who helps manage $50 billion of high-yield investments at Fidelity Investments. "My general view is it's time to be defensive."

- Historically, investors in junk debt have focused on the threat that a company might default and have purchased that debt at a yield that properly compensates them for taking on the risk. Typically that yield is in the high single or low double digits, which insulates the price of the junk bond from swings in underlying Treasury rates. But with more crossover investors — like investment-grade bond managers — coming into junk because of anemic yield in their markets, that cushion is compressing, said Sandy Rufenacht, manager of $1.3 billion in high yield assets at Three Peaks Capital Management LLC. “While the high yield guy is looking at a 5% coupon and saying ‘are you kidding me?’ a crossover guy is licking his chops and saying ‘Wow, it’s 5%!’” Rufenacht said.

- Over 1/3 of the $75 billion in U.S. junk bonds sold this year paid yields under 6%, making them far more likely to drop in price when Treasury rates start to rise.