by Douglas Coté, ING

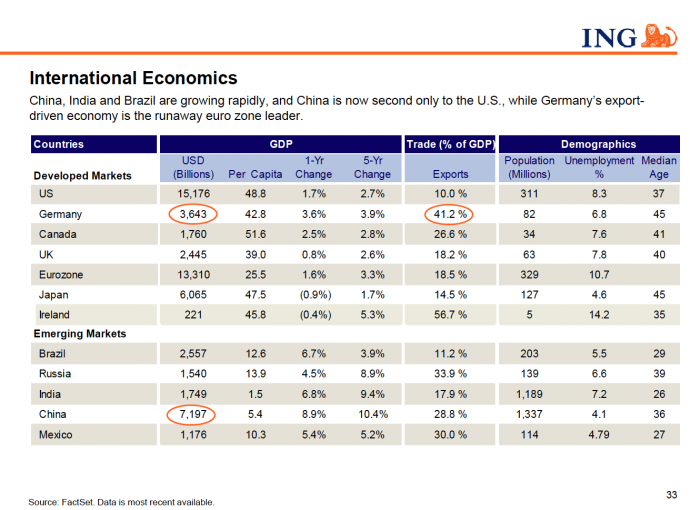

We have discussed the possibility, and risk, of a hard landing in China (growth slowing to less than 7%), but what has been going on in some of the other BRIC’s like India and Brazil? Right now India is in the midst of budget negotiations which would reign in its gross fiscal deficit to 5.9% of GDP (total debt is around 50% of GDP). India’s GDP growth is expected to subside to 6.9% after two solid years of greater than 8% growth. A global slowdown as well as high oil prices have contributed to the decrease. However, Indian financial officials expect a return to 9% plus growth in the future. Meanwhile Brazil has just overtaken the U.K. to become the sixth largest economy in the world. Brazil grew 2.7% in 2011 compared to U.K.’s meager .8%. And with substantial oil and gas reserves fueling their exports, Brazil has their eye on number 5. You can find some key statistics about India and Brazil as well as other emerging markets on page 33 of the Global Perspectives book.

Click on images below for PDF

Copyright © ING Investment Management