Historical Trends Favoring Commodities, Stocks

By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

In January, we felt winds had shifted among global markets, anticipating that easing actions taken by many central banks around the world might provide welcome relief to investors. Two months later, we are seeing the positive results from their actions.

For the third month in a row, a leading indicator for global manufacturing activity, the JP Morgan Global Manufacturing Purchasing Managers’ Index (PMI), remained above its three-month moving average as of February 29.

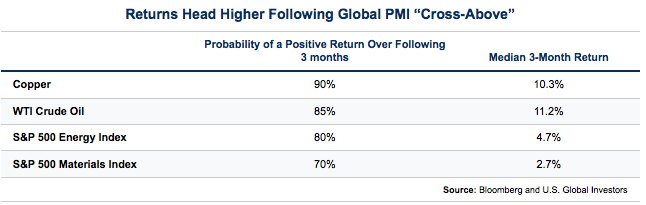

Going back to the 1998 inception of JP Morgan’s index through the end of 2011, there have been only 20 occurrences of “cross-above.” When this happened, there was a strong probability that copper, oil, and materials and energy stocks would head higher the following three months. Take a look at the historical data which charts the probability of a positive return, as well as the three-month median return after the “cross-above” happened:

So far in 2012, the historical pattern has been holding up. Over January and February, copper increased 13 percent; the S&P 500 Energy Index added 7 percent and the S&P 500 Materials Index went up 10 percent. WTI crude oil, while rising a significant 8 percent in the last two months, has not quite hit its historical median return. Read further to see why we believe oil should continue to increase.

As the global easing cycle continues, the trend of higher prices for these commodities and energy and materials should continue. “Global central banks are in full-on expansion mode,” says BCA. Early last year, many countries around the world were much more concerned about stemming inflation. This time around, ISI Group says that 99 stimulative policy initiatives have been announced from countries around the world since late August. Most recently, central banks from China, Hungary, Ireland, Japan and Sweden, announced initiatives such as boosting lending, easing bank rules, plans to create jobs and cutting reserve rates. This monetary easing should provide a boost to equities, especially commodity-related stocks and natural resources funds, such as the Global Resources Fund (PSPFX).

This is only one trend advisors can use with clients to counteract the hangover of apathy many investors are feeling. I recently talked about other positive trends that we are seeing, such as the fact that nearly 70 percent of the S&P 500 companies are paying dividends at an annualized rate greater than the yield on a 5-year Treasury. Considering that the latest CPI number for the U.S. is 2.9 percent year-over-year and the 5-Year Treasury is less than one percent, fixed-income investors are most likely earning a negative real interest rate on their money. Dividend payers appear to be attractive in today’s low-yield environment.