Gold Market Radar (March 5, 2012)

For the week, spot gold closed at $1,712.60 down $59.85 per ounce, or 3.38 percent. Gold stocks, as measured by the NYSE Arca Gold BUGS Index, rose 3.05 percent. The U.S. Trade-Weighted Dollar Index rose 1.40 percent for the week.

Strengths

- Silver prices leapt to a 7-month high in India on the same day that prices fell 7 percent in the international market. Traders in India have said that investors have turned bullish on silver since the metal has posted an 18 percent gain in the last eight weeks, and expect a 35 percent rise by the end of 2012.

- China continued as the world’s largest platinum consumer in 2011, confirmed by data released by the Platinum Guild International. Global recession or not, Chinese net demand for platinum was up 10 percent from the previous year, at 1.325 million ounces.

- Despite a nearly $60 fall in gold this week, gold ETF buying was strong, with investors adding 338,000 ounces on Wednesday, the largest daily increase to global holdings since late January. The SPDR Gold Shares ETF accounted for the bulk of ETF flows, having increased by just less than 300,000 ounces this week. Gold ETF holdings currently sit at an all-time high of 80,030,000 million ounces after about 900,000 ounces of additions last month, in line with January inflows. So far this year, investors have increased gold ETF investment by 1,860,000 ounces, showing investors’ confidence in the metal and a distrust of paper assets.

Weaknesses

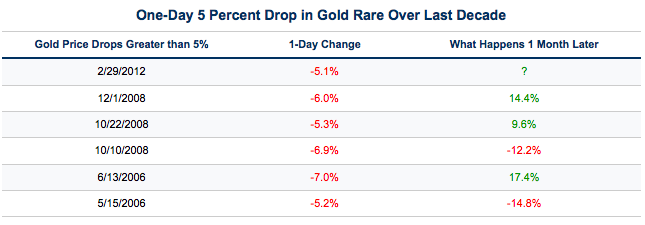

- Gold dropped by an alarming $90 this Wednesday, as a reported 31 tonne sell order on the CME took spot gold prices down from $1,784 to $1,697. This dip unravels approximately half of gold’s gains since the beginning of the year. A drop of over 6 percent has not happened since December 2008.

- Scotia Capital, despite being bullish on gold, is not expressing a similar enthusiasm for silver, citing a growing mine surplus and the necessity for industrial and investment demand.

- The Scotia Capital analysts say their biggest concern is increased mine silver supply that is driven by non-primary producers, such as base metals companies that secure silver as a by-product of mining copper, zinc or lead. According to Scotia, "As these companies make development decisions, the silver price is often immaterial to their project economics, and thus new sources of silver can come onto the market regardless of the silver price environment."

Opportunities

- The recent pullback in gold could provide an opportunity to purchase gold and gold equities at a slightly cheaper level. The net accumulation of bullion by gold ETFs when there is a large selloff is a positive signal that investors are on the sidelines, ready to add to their holdings on any weakness.

- Japan has joined the ranks with the American and Europeans who want a weak currency so they can get a competitive advantage in trade. With Japan finally capitulating on this front, there are few options, other than hard assets, for an investor to hold and protect wealth. Since the start of the year, the Japanese yen has fallen 6 percent relative to the dollar. When investors realize that governments are not committed to respecting the value of their assets, investors lose trust that the purchasing power of paper assets can be relied upon as a store of value.

- In an interview on the Gold Report, Lawrence Roulston confirmed that there is optimism within the resource sector, and that the smart money is looking for deals that have real upside potential, such as the junior sector. Looking forward, the devalued currencies resulting from governments worldwide throwing trillions of dollars in bailouts to prop up failing companies and countries, should prove positive for gold and silver, serving as long-term hedges against currency devaluation. Additionally, with growing trading volumes and prices for the equities, the trend remains positive. All these factors point to an opportune moment to be getting into the market in junior mining companies which have been beaten down to the point where the major risk factors have been more or less put aside.

Threats

- A report written by a team at Chatham House proposed that a return to a gold standard could be damaging. The team determined that as the dominance of the U.S. in the global financial system weakened and other powers emerged, the likelihood for greater financial volatility and uncertainty would grow. "In such an environment, gold is likely to continue playing a useful role as an effective hedge and safe haven. But despite gold's positive attributes, the evidence which emerged from the taskforce's deliberations led to the conclusion that in today's world there is little scope for gold to play a more formal role in the international monetary system," they said.

- While listening to mining company presentations this past week at the BMO Global Metals and Mining Conference, it was disconcerting to note how many companies continue to boast about low cash-costs as a metric to communicate their high profitability. Thinking that rock-bottom cash costs will attract investors is short-sighted; instead, the companies are essentially placing a target on themselves for tax and royalty increases from the countries in which they operate.

- Now that Impala Platinum is set to restart operations next week, this could mean that platinum no longer deserves the supply-risk premium it has been enjoying in the last several weeks. Impala reported that 13,500 workers out of the 17,200 that were dismissed have now reapplied for their jobs, and the company aims to start ramping up production on Monday. However, it may take some time to get back to full production due to the safety measures that have to be in place before work can resume. The company has lost 100,000 ounces as a result of the strike, which may be unrecoverable. This somewhat improves platinum’s supply/demand balance at the present moment, but could still be a headwind to watch out for.