Think for a minute, if you will, about your equity portfolio. Do your investments there reflect any sentiment around sectors? For example, you may have shed some of your financial stocks over the past few years. Or you may see opportunity in industrials, so you’ve chosen a mutual fund or ETF that gives you exposure.

No matter which investment vehicle you’re using, chances are that your opinions about sectors are somehow reflected in your equity investments. But often that’s not the case in the fixed income portion of investors’ portfolios. With the investing tools available today – fixed income ETFs being a powerful example – expressing a precise view on bond sectors may be easier than you think.

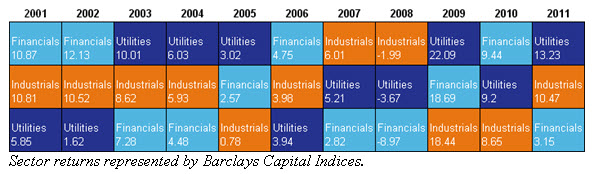

The US corporate bond market is comprised of 3 sectors: financials (33%), industrials (56%), and utilities (11%). Bonds are classified into one of these sectors based on the issuer’s primary line of business and the revenue streams that are used to repay their debt. As you can see in the periodic table below, the disparity of returns between these three is notable – the average annual return difference between the top and bottom performing sectors has been 4.2% in the past 10 years.

The returns also tell a story about the performance of the US economy over the past decade. From the strong performance in corporate bonds leading up to the financial crisis, to the underperformance of financials in 2008, and then the rebound that all three sectors experienced in 2009 and 2010.

Fixed income ETFs provide a compelling solution for investors wanting to make tactical plays or employ a sector rotation strategy in their bond portfolio. For example, if you have a negative view of financials, you can reduce your overall exposure to the sector by buying a broad corporate bond ETF (such as LQD) and then tactically overweighting an industrials ETF (such as ENGN) and a utilities ETF (such as AMPS). Or, a more hands-on approach might be to buy all three sector funds (ENGN, AMPS, and MONY), and then tactically manage the weights based on current themes and market events. No matter which strategy you choose, there is now a new set of tools to implement your views.

Index returns are for illustrative purposes only and do not represent actual iShares Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Bonds and bond funds will decrease in value as interest rates rise. In addition to the normal risks associated with investing, narrowly focused investments typically exhibit higher volatility. The Fund is subject to credit risk, which refers to the possibility that the debt issuers may not be able to make principal and interest payments or may have their debt downgraded by ratings agencies.