As I recently pointed out, despite mega caps’ recent outperformance, the stocks remain cheap on both a relative and absolute basis.

Now, here’s more evidence to add to the case for mega caps. As I write in my new Market Update piece, the current discount on mega-cap stocks is particularly hard to justify given that these large companies continue to be extremely profitable despite today’s tepid economic environment.

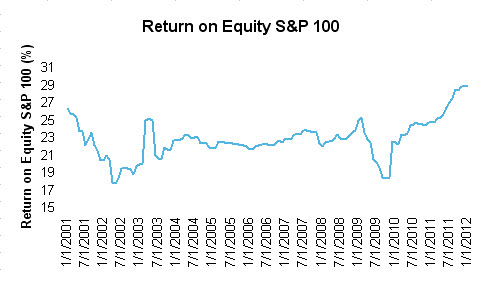

In fact, as the chart below nicely shows, the return on equity (ROE) for the S&P 100 index is slightly below 29%, the highest level since 2000 and well above the long-term average of 23%.

Source: Bloomberg, 1/31/2012

What’s more, as of the end of January, the largest companies were on average 20% more profitable than the broader US equity market. While large companies are typically more profitable, the current gap in profitability is particularly large and suggests that mega-cap valuations look even more compelling when you adjust for ROE. (potential iShares solutions: OEF, IOO, IDV and HDV).

Source: Bloomberg

Past performance does not guarantee future results.

Disclosure: Author is long IOO.