via Business Insider

We've spent a lot of time this year discussing this chart.

The green line is the S&P 500. The orange line is the yield on a 10-year US Treasury.

It's weird because you'd think that as stocks rose -- indicating increased risk appetite and expectations of growth -- that yields would rise too, since demand for risk-free instruments would want. But that hasn't happened. Stocks have had a really nice run, but yields have gone nowhere.

In a note out this morning, Credit Suisse's Andrew Garthwaite listed this as his top anomaly in the market right now.

There are various theories as to why this disconnect is in place: Some blame the Fed and "financial repression", artificially depressing rates.

But one thing you'll notice is that to a varying degree, this is a global phenomenon.

So for example, check out Australia.

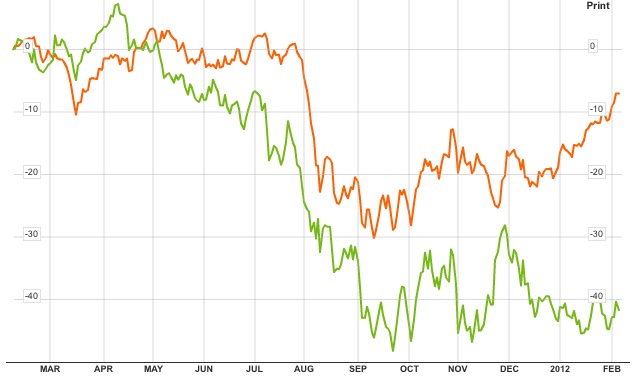

The green line is the Australian All Ordinaries Market and the orange line is the yield on the Aussie 10-year.

Once again, the great disconnect emerges, and it's especially apparent since mid-December.

And here's Sweden.

And here's Germany. Once again, you see a massive disconnect beginning in December.

And finally Japan. Again, the equity-bond disconnect begins in December.

So this is a global phenomenon, which strongly suggests that this isn't just about the Fed buying Treasuries in the US, though naturally all markets are connected.

One thing that all these countries have in common is their borrowing is done in their home currencies, meaning they're essentially risk-free except from a currency perspective.

A decent theory is that despite the big pickup in optimism, there's still a shortage of vehicles available to investors looking for "risk-free" assets. So the countries that can offer these bonds are still seeing unusually high demand. That's just a theory. Bottom line though: This isn't just an S&P/Treasury phenomenon. It' global.