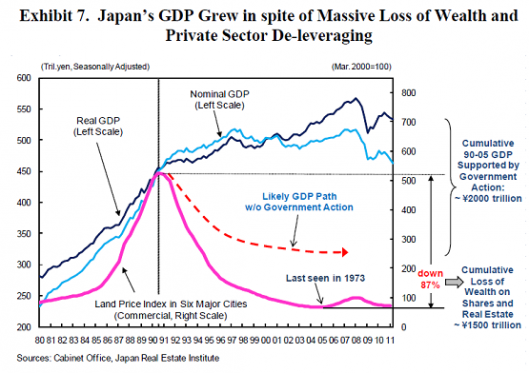

Japan’s Great Recession has given us a roadmap for how a post bubble economy can have a prolonged workout phase and render most policy tools ineffective.

Japanese GDP stayed above bubble peak levels despite plunging corporate demand and a loss of national wealth of around 85% on asset and equity prices.

Here we have to imagine the counter-factual, which is never easy. The fact that GDP grew in the face of such precipitous asset declines may be viewed as a success. Koo says

“In a Hollywood world, the hero is the one who saves hundreds of lives after the crisis has erupted and thousands have died.

But if a wise individual recognizes the danger in advance and successfully acts to avert the calamity, there is no story, no hero and no movie…..Japan successfully avoided economic apocalypse for fifteen years. But from the perspective of the media, which has never grasped the essence of the problem, the government spent 140 trillion yen and nothing happened. So they twisted the story to imply the government wasted the money.”

So Koo is saying it was only because the government engaged in fiscal stimulus to the extent that it did that stopped a collapse in Japan’s GDP and in its standard of living. Imagine if the S&P 500 or FTSE 100 fell 80% from its current level over the next 15 years and the average home price was circa $20,000 – do you think we’d have had positive GDP growth!?

If this is the case, and the Japanese government more or less did a great job, then does that mean that a Japanese scenario is close to our best case scenario too? A scary thought indeed.

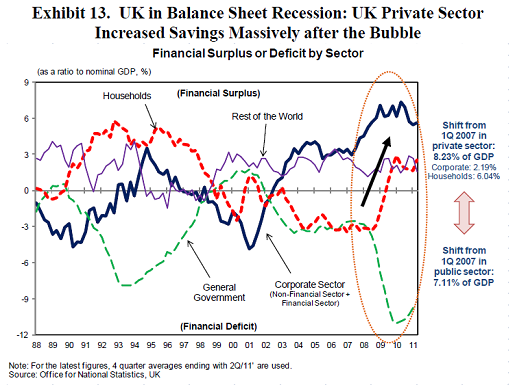

“A balance sheet recession is characterised by a deflationary gap equal to household savings plus net corporate debt repayment.” page 67

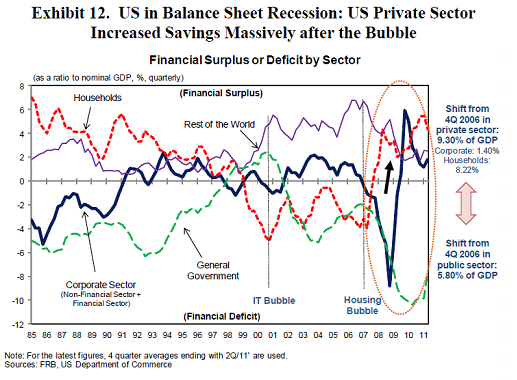

The United States Sectoral Balances

In the simplest of terms, the green line, the Government, needs to spend enough/ run a large enough deficit, to offset the surpluses being run by the Corporates (blue line) and the Households (red line). If they do not offset, then the economy will contract.

The problem is a chronic shortage of demand which Government needs to fill for GDP to be sustained at its current level. From this perspective, tax cuts are less effective than direct spending via New Deal-esque projects, because tax cuts are going to be partially saved by the newly conservative private sector. Robert Shiller of Yale has been advocating these “make work” schemes for some time now as a solution to structural unemployment and skill-wastage amongst much of the under utilised labour force in the US.