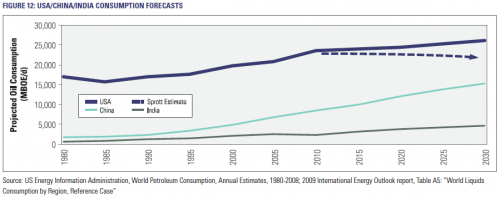

In Figure 12 below, we have added a dashed line representing our revised US consumption estimate to the EIA’s forecasted consumption of barrels of oil equivalent per day (boe/d) for the USA, China and India. This revision is meant to reflect the poor history of EIA projections regarding production and account for the potential decrease in US dollar purchasing power of available future oil supplies. This dashed line is strictly illustrative but it neatly presents our view that the oil supply will remain constrained and concerted consumption growth for both developed and developing nations will not be possible.

The forecasted consumption growth in India and China may well turn out to be accurate but we believe it will unfortunately have to come at the expense of US consumption – as there simply won’t be enough oil to go around. The price will eventually be driven high enough in US dollar terms to force a rebalancing in global consumption.

Conclusion – Hedge Yourself

For North American workers and investors, one way to hedge against a decline in living standards is to use your current relative advantage in oil purchasing power to accumulate oil reserves that will be developed in the future. This purchasing power advantage, currently evident in the time a worker in the West must work to earn a barrel of oil, will eventually dissipate, as world labour markets recalibrate and shift wealth from West to East. This will mean that workers in the West will be working for less and the balance of trade will be increasingly settled in commodities, in particular oil, and not in inflated Western labour costs. This strategy of oil accumulation will help to preserve your standard of living, as it ensures each hour of your labour earns you many hours of someone else’s labour at current rates.

The recent market decline and ongoing volatility is affording investors with an opportunity to invest in oil producers and service companies, in particular junior and mid-cap companies, at attractive valuations. Equities are pricing in much lower oil prices over the long-term. Our view is that while there may be additional volatility in the crude oil price in the short-term, long-term pricing will remain high and equity prices will rise to correct this disconnect. Although the newspapers might not be writing about oil as much today, we believe this is a great time to focus on it. For more information about Sprott Asset Management’s investment insights and award-winning investment capabilities, please visit www.sprott.com.

Endnotes:

1 Eric Sprott & Sasha Solunac, "Peak Oil – Are We There Yet?" (April 18, 2005) Markets At A Glance.

2 ICE Futures Exchange.

3 International Energy Agency, World Energy Outlook 2008 (Paris: OECD/IEA, 2008).

4 George T. Abed et al., "The Arab World in Transition: Assessing the Economic Impact" (May 2, 2011) Institute of International Finance, Inc.

5 Paul Sankey & Winnie Nip, "The Death of Non-OPEC:Oil Production declines Q2 for 40 Major Oils" (August 12, 2011) Deutsche Bank.

6 National Bureau of Statistics of China (www.stats.gov.cn).

Kevin Bambrough Market Strategist

Sprott Asset Management LP

Between 2002 and 2009, Mr. Bambrough held a number of positions with Sprott Asset Management, including Market Strategist, a role in which he devoted a significant portion of his time to examining global economic activity, geopolitics, and commodity markets in order to identify new trends and investment opportunities for Sprott’s team of portfolio managers. He is a recognized leader in the natural resource sectors and in 2007 founded Sprott Resource Corp. Since 2009, Mr. Bambrough has also served as President of Sprott Inc., one of Canada’s leading asset managers with $10 billion in assets under management. In 2010, Kevin was ranked as #1 in Casey’s NexTen list of next generation leaders in the natural resource industry. He also received an Honoury Chieftainship from the Blood Tribe in recognition for the valued partnership between the Tribe and One Earth Farms, a company founded by Mr. Bambrough.

Paul Dimitriadis Chief Operating Officer

Sprott Resource Corp.

Mr. Dimitriadis is Chief Operating Officer for Sprott Resource Corp. Mr. Dimitriadis originates, evaluates and structures transactions, coordinates and conducts due diligence and is involved in the oversight of the company’s operating subsidiaries. He serves on the board of directors of Waseca Energy Inc. and Stonegate Agricom Ltd. He has been with Sprott since 2007. Prior to joining Sprott, Mr. Dimitriadis practiced law at a national Canadian law firm. Mr. Dimitriadis holds an L.L.B. from the University of British Columbia and a B.A. from Concordia University.

Copyright © Sprott Asset Management