What has been discovered and brought into production in the past few decades are smaller fields, which normally have higher decline rates. As these new smaller fields replace production from larger fields, and older larger fields age, we can expect the global observed decline rate to increase from the current estimated rate of 6.7% (or 4.7 million barrels per day annually).

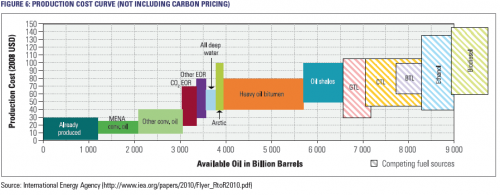

Rising Production Costs Necessitate High Prices

Oil prices are also high due to rising production costs, and it’s worth noting that new production sources, such as offshore, tar sands and other unconventional sources are amongst the highest cost producers today. These oil sources now make up a significant and growing percentage of global production. As a result, it is becoming clear to many industry analysts that current oil production cannot be sustained under $75 a barrel and the price required to sustain production seems destined to continually rise.

Middle East Exports are Increasing in Cost and Risk

There have also been significant political developments of late which have permanently altered the dynamics of the oil markets. The so-called “Arab Spring” uprisings in countries such as Egypt and Libya are forcing these and other major oil producing nations to spend more of their oil revenue on social assistance programs. For example, as a result of newly announced social spending in Saudi Arabia, it is forecasted by The Institute of International Finance, Inc. that the budget balancing price of Saudi oil will jump from $68 per barrel in 2010 to $85 per barrel in 2011 and then continue to rise, but at a slower pace, to $110 per barrel by 2015.4

In general, it can also be said that political instability and social unrest are very detrimental for oil investment and production. Recently, as Libya collapsed into civil war, production went to near zero causing extreme volatility in the Brent Crude price. As the Middle East region continues to experience riots and protests, we can only assume that there will continue to be heightened risk of disorderly political change which could dramatically increase prices in the future.

Regardless, it now appears that even if, politically speaking, the status quo is maintained, the majority of the Middle East exporting nations are now producing at or near capacity while domestic consumption is increasing. Their economies and populations are continuing to grow and mature and, as a result, their exporting capacity will in turn be limited and possibly begin to terminally decline.

Major Oil Companies’ Production in Decline

The struggle to grow oil production, especially non-OPEC production, was highlighted in a recent report by Deutsche Bank’s Paul Sankey that measured the dramatic oil declines for major oil companies in Q2 2011.5 Despite $120 per barrel Brent pricing during Q2 2011, the results of more than 20 major oil companies showed a 1 million barrels per day year-over-year decline. The sample group in the report accounted for over 1/3 of global production, so it would be difficult to expect smaller companies to make up their shortfall.

Supply Constrained and Prices to Remain High

In summary, even though the oil price has been averaging 4-5 times higher than the most knowledgeable industry watchers would have expected just eight years ago, global production has remained relatively stagnant. Government agency production estimates have been overly optimistic and a review of the oil market environment suggests production will continue to disappoint. High prices are now required just to maintain current global production. Even with robust pricing, it is beginning to appear that a tremendous amount of our existing production is at risk due to rising rates of decline and political instability. These factors may soon push global production into an irreversible decline.

Demand – Who Will Win the Battle for the Limited Oil Supply?

Given that increasing global supply will continue to be a challenge, individual nations will soon be forced to compete outright for oil. Emerging market economies are currently out-growing Western economies not just because of urban population growth but also because employment is naturally shifting to jurisdictions with lower labour costs. As this globalization path continues, we can expect job growth to be higher in countries where the citizenry are willing to work harder for less. This roughly characterizes the emerging market countries which for the most part are also large exporters of goods and services, run significant trade surpluses and have strengthening currencies. These factors are combining to put the emerging markets “in the driver’s seat” and enable them to continue to increase their per capita and total oil consumption. Conversely, higher wage Western nations are fighting rising unemployment, trade deficits, weakening currencies and, consequently, are being forced to reduce their oil consumption. Simply put, the emerging markets are outworking developed economies for a greater slice of global commodity production and the tight oil market is a key battleground.