Inter-Market Analysis in Guiding Cross-Asset Allocation

Monthly Strategy Report September 2011

Alfred Lee, CFA, DMS,

Vice President & Investment Strategist, BMO ETFs & Global Structured Investments. BMO Asset Management Inc.

alfred.lee[at]bmo.com

Although it is debated in financial academia as to what percentage asset allocation contributes to portfolio volatility1, we can perhaps agree that it is significant. Therefore in a volatile market environment, in which the CBOE Implied Volatility Index (“VIX”)2 remains elevated, as we have recently witnessed, portfolio construction becomes increasingly important. In fact, we will go further and say that going forward your asset allocation will be one of, if not the most, important drivers in the returns of your portfolio strategy. This month we wanted to take a closer look at the recent trends developing between the three major asset classes we track: equities, fixed income (or credit) and commodities. For our own purposes, we also monitor currencies and volatility as alternative asset classes, to better understand the inter-market relationships between the three major asset classes previously mentioned.

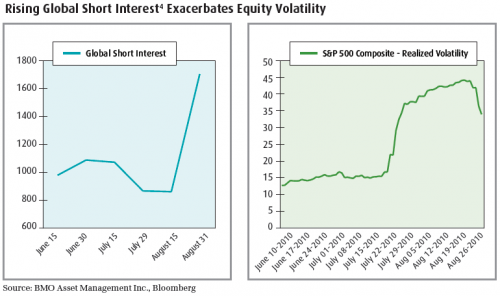

About a month ago, shortly after U.S. Treasuries were downgraded by the credit rating agency Standard & Poors (S&P), we issued a special bulletin recommending investors increase their allocation to bonds. Although, we wouldn’t be surprised to see frequent relief rallies in equities, we anticipate stock market volatility to remain elevated over the short-term. This is due to increased shorting activity in the market, leading to short-covering, causing upside and downside moves to be exaggerated. In addition, macro-economic uncertainty remains, further compounding price movements as the market will have difficulty pricing the fair value of assets.

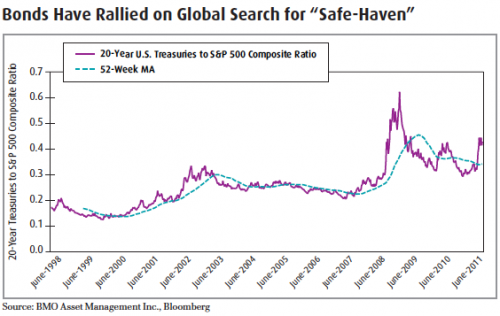

As a result, we believe bonds at this time are a good solution to increase stability in volatile times. Furthermore, as we have mentioned in previous reports, the amount of leverage in the financial system makes diversification within one asset class ineffective in providing downside protection as intra-market correlation remains elevated.

Although, we came into the year more bullish on equities, our appetite for risk has deteriorated as the year has progressed. Economic data now suggests that the market weakness is more than just seasonality or a soft-patch largely caused by supply chain disruptions, and the market awaits clues of further monetary stimulus after the market’s negative reaction to “Operation Twist3.” In response, the bond market has rallied significantly against equities over the last month, as global investors seek out safe-havens. This recent trend in both U.S. and Canadian fixed income over their respective equity markets supports our thesis that fixed income is the preferred asset class for the time being.

Fixed Income Exposure:

In terms of traditional fixed income, investors may want to consider slightly extending their duration exposure. With the Bank of Canada (BoC) taking a much more dovish tone towards monetary policy at their last meeting, interest rate hikes, barring surprise inflation, is likely pushed-off until 2012. Some have even called for an interest rate decrease before the end of this year. A change in direction of lending rates is more significant than the amount of a rate move in our opinion and unless conditions deteriorate dramatically, the BoC will likely stand pat. Regardless, this should benefit the long end of the yield curve, especially if the U.S. Federal Reserve’s (Fed) Operation Twist impacts the Canadian yield curve by bringing down the long end. For traditional fixed income, increasing duration to the middle of the curve may be warranted, which would also help increase yield.

Potential Investment Opportunities:

- BMO Mid-Corporate Bond Index ETF (ZCM)

- BMO Mid-Federal Bond Index ETF (ZFM)

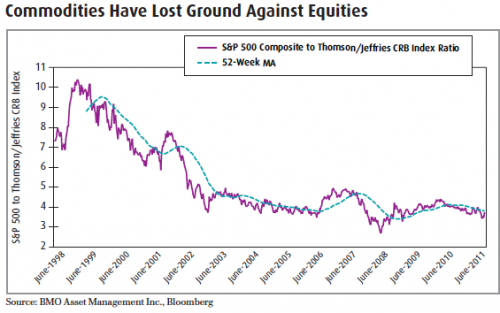

Commodities Losing Ground to Equities, Target Your Exposure Wisely As we have highlighted in the past, we believe commodities to be in a super-cycle and for that reason, we have a secular bias towards commodities. However, the Thompson/Jefferies CRB Index, which is a broad commodity index, recently started losing ground to equities in the short-term. As the different commodity sub-groups react very differently to macro-economic and political risk, a more targeted approach to investing in commodities is warranted at this point.

As our readers are aware, we have been positive on gold over the long-term. However, we stated that we wouldn’t be surprised to see some retracement over the short-term. Moreover, any temporary band-aid solution to the European sovereign debt issues could lead gold to quickly fall. The recent rally in the U.S. dollar could also serve as a temporary headwind.

Potential Investment Opportunities:

- BMO Precious Metals Commodity Index ETF (ZCP)

– Buy on pullbacks and use stop loss order

- BMO Junior Gold Index ETF (ZJG)

– Buy on pullbacks and use stop loss order

We also believe agriculture commodities are a good long-term investment despite short-term pressure. The Economist magazine has estimated world population to hit 7 billion at the turn of the year, a factor contributing to food shortages, driving prices higher. Moreover, with elevated oil prices, the demand for bio-fuels is placing further demand on corn. Agriculture based futures allow investors to gain pure price exposure to the underlying grains.