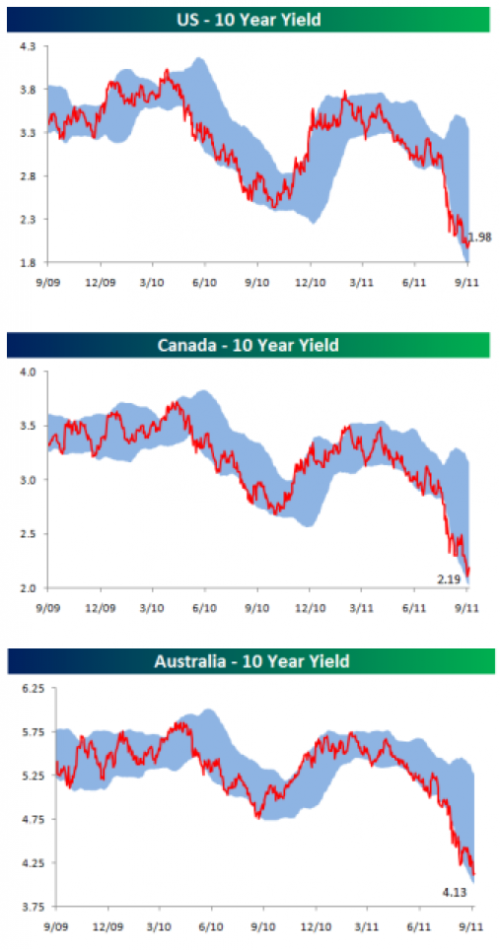

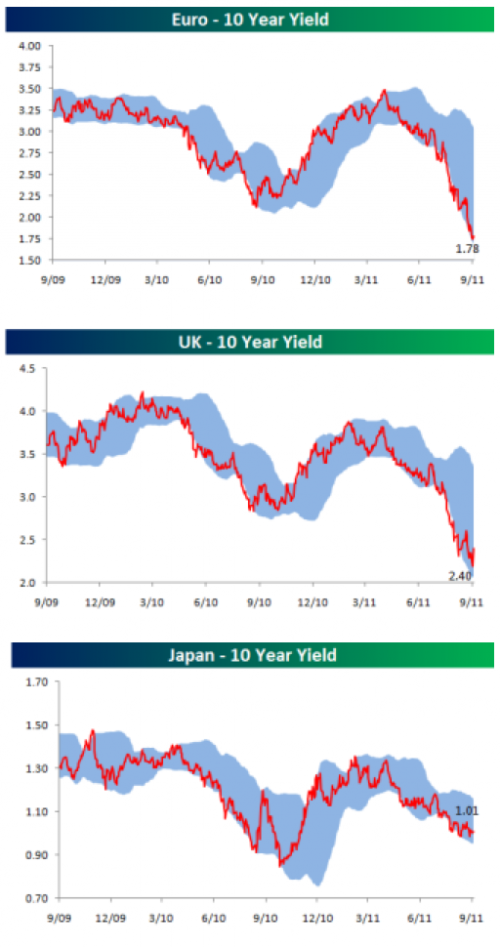

While skyrocketing long-term interest rates in many of the troubled European countries have been widely covered, the charts below highlight the yield on ten-year government debt from major countries/regions around the world that aren't in the midst of their own debt crises (...at least according to the conventional wisdom). As shown in the table to the right, ten-year yields in the US are currently just under 2%. The only other markets where ten-year debt is trading below a 2% yield are ECB and Japanese debt. Currently, ten-year debt in Canada is yielding 2.19%, while UK long-term debt is yielding 2.4%.

The big outlier of the group is Australia, where 10-year debt is trading at a yield of 4.13%. Relative to most other regions of the world, Australia's economy is booming given that its economy is heavily leveraged to commodities.