Stocks can go up — even when the market doesn’t

Prepared by Capital International Asset Management

Should investors shun stocks from countries with economic troubles? The past 20 years in Japan suggest that some companies can prosper even when economic and market conditions aren’t favorable.

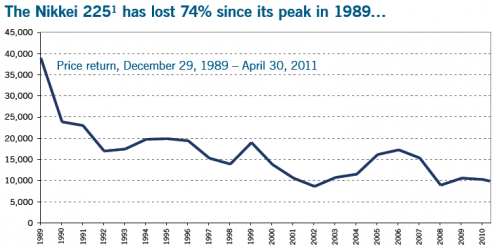

Japanese stocks hit an all-time high on December 29, 1989, in the midst of the Japanese real estate bubble. Since then, the Nikkei 2251 index has lost 74%, as Japan has endured recessions, deflation and a banking crisis, followed by the 2011 earthquake and tsunami. The Tokyo Stock Price Index,. with dividends reinvested, declined 63% over the same period.

Source: Morningstar, in Japanese yen, based on monthly prices (December 1989 – June 1995); daily prices thereafter. Price return only; does not include reinvested dividends.

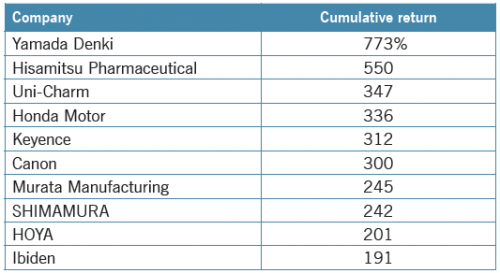

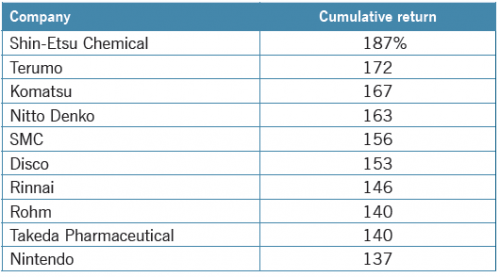

Source for best-performing stock returns: Bloomberg.

…yet many Japanese stocks have generated positive returns

20 best-performing Japanese stocks from December 29, 1989 to April 30, 2011, in Japanese yen, with dividends reinvested

Despite this difficult environment, strong global brands, pricing power and cutting-edge technology have helped many

companies continue to grow. Careful research can help investors identify companies with strong prospects — in any location.

Footnotes:

1Nikkei 225, the most widely quoted index of Japanese equities, tracks 225 of the largest stocks on the Tokyo Stock Exchange.

2TOPIX (Tokyo Stock Price Index, which tracks about 1,700 of the largest companies listed on the Tokyo stock exchange) used since Nikkei 225 Index data is not

available with dividends reinvested prior to 1993.

Disclaimer

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative or an endorsement of any specific investment. For illustrative purposes only; please consult your financial and/or tax advisors regarding your individual situation.

This document is for informational purposes only and is not intended to provide any tax, legal or financial advice. Capital International Asset Management (Canada), Inc. or its affiliates assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained about each product or firm, as the case may be, has been supplied without verification by us and may be subject to change. The Capital International portfolios are available through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Despite this difficult environment, strong global brands, pricing power and cutting-edge technology have helped many companies continue to grow. Careful research can help investors identify companies with strong prospects — in any location.

Copyright © 2011 Capital International Asset Management (Canada), Inc.