A Lot of Interest in Interest Rates!

by Gareth Watson, CFA – Vice President, Investment Management and Research, Richardson GMP

In this last week before U.S. Q1 reporting season begins, it was monetary policy makers in Europe and China who influenced market direction as central banks in both regions raised lending rates. The lending rate increase in China to 6.31% was the fourth interest rate hike we’ve seen from that country since October of last year and was a surprise to some economists that thought that the People’s

Bank of China would pause on rate hikes until later in 2011. But obviously the Bank of China felt enough inflationary pressure in the Chinese economy to make the move. Rate increases in China usually cool the performance of the TSX as some commodity prices come under pressure and this time would be no different as the TSX index closed the week lower than Tuesday when the interest rate hike occurred.

The European Central Bank also raised rates this week, but it was the first interest rate hike we’ve seen in Europe since mid 2008. While some European markets fell following the rate increase, it was shrugged off on Friday as many European markets finished the week higher. Higher interest rates in Europe and an ongoing budget battle on Capitol Hill did nothing to help the U.S. dollar as the U.S. trade weighted dollar finished the week at its lowest level since December 2009. This weakness also led to support for commodity prices, namely oil and precious metals, as oil prices reached levels not seen since 2008, silver prices pushed above US$40.00 per ounce (not seen since 1980) and gold prices achieved a record high. With all the talk about rate hikes fighting inflation combined with U.S. dollar weakness, it’s no surprise that we saw precious metal prices moving higher. And it was also no surprise to see the Canadian dollar strengthen. However, some investors may have been surprised by the magnitude of the strength as the loonie has appreciated by almost 4 cents in only 2 months. Not only does the Canadian dollar have commodity price strength supporting it, it’s also expected to benefit later this year when the Bank of Canada could start raising interest rates again.

Pumping up the Rates!

In what some economists called a surprise move this week, the People’s Bank of China raised its lending rate by 25 basis points to 6.31%. This was the fourth interest rate hike by the Bank of China since the fall as that country tries to fight off inflationary pressure. Our chart of the week tracks the lending rate in China going back to 2007. As was observed in most countries, China cut rates during the financial crisis of 2008, but started raising them again in October of last year. Such moves can be influential to the TSX Index as rate hikes in China can often cool commodity price strength for a short period of time. While some economists believe that the Bank of China may start to back off raising rates since we’ve had 4 in 7 months, other investors believe that the rate hikes are going to continue throughout 2011 as inflationary pressures could be persistent, especially wage inflation, which is expected to accelerate.

The Trading Week Ahead

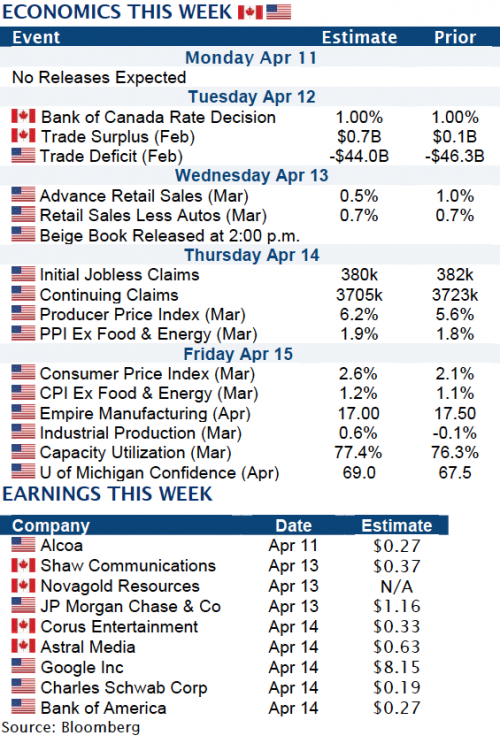

While monetary policy moved to the forefront this week, we could see the focus of the markets move back to corporate news next week as Alcoa will kick off Q1 U.S. reporting season on Monday. It

will be followed by tech heavyweights such as Google and financial heavyweights such as Bank of America on Thursday. Canadian reporting season will likely not get into full swing until the last week

of April.

We won’t be able to get too far from interest rate discussions as the Bank of Canada will make an interest rate announcement on Tuesday where the central bank is expected to keep rates unchanged for the time being at 1.0%. We’ll also see two key inflationary measures in the U.S. with the Producer and Consumer Price Indices ready for release on Thursday and Friday. While we certainly don’t expect the Federal Reserve to raise interest rates any time soon, inflation is definitely on Ben Bernanke’s radar screen.

It’s Friday and we still have not heard anything about a budget agreement in Washington. If an agreement is not reached by midnight tonight then the U.S. government will be forced to shut down which will likely put further pressure on the U.S. dollar next week and possibly help commodity prices and the Canadian dollar yet again. We believe a shut down is quite likely for political reasons as both Democrats and Republicans already start to position themselves for the 2012 election, but we also believe that any shut down will be short lived as will any consequences to the market.

It’s evident that the interest rate increase in China halted the advance of the TSX Index this week. However, looking forward the potential for a weaker U.S. dollar, increased discussion about inflation, continued turmoil in the Middle East and North Africa, and continued financial troubles in certain parts of Europe could lend some further support to the Energy and Materials subindices. Such support can normally only mean good things for the loonie and for Canadian shoppers that love a nice cross border bargain.

China raised interest rates again this week as did the European Central Bank for the first time in a while. What have the major central banks of the world been doing with interest rates since the financial crisis of 2008?

When Canadians think of the major central banks of the world, we think of the U.S. Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of England, the People’s Bank of China and the Bank of Canada. In the table below, we outline what the highest interest rate was for each bank before it started cutting interest rates along with the month when those rate cuts started. You’ll

notice that rates were already on the decline in the U.S., England and Canada long before the financial crisis escalated. We also show what the lowest interest rate has been recently and whether any of these banks have started to raise rates. The Bank of Canada was actually the first of these banks to increase rates by 75 basis points from June to September of 2010, while China has raised rates

4 times since October 2010 and the European Central Bank started with its rate increase on Thursday.

Copyright © Richardson GMP