The Absolute Return Letter

March 2011

From Dublin to Tripoli

“Experience is the name everyone gives to their mistakes”

Oscar Wilde

A remarkable month

Two remarkable events unfolded during the month of February. One cleared the front pages all over the world. The other one barely got a mention - outside of its home country that is. Both have the ability to derail the economic recovery currently unfolding. The first one is not surprisingly the uprising in the Middle East and North Africa. The other one is perhaps less obvious; I am referring to the Irish elections.

A new dawn in Ireland?

Let’s begin in Ireland where the electorate has finally had its say on the banking fiasco, which has taken the country to the brink. Fianna Fáil, having been at the helm of Irish politics for the past 14 years, was severely punished by the voters in last Friday’s elections and had its number of seats cut by 58 to 20 (its worst result ever). Fine Gael gained 25 seats to 76, making it twice as big as the second biggest party in the Dáil (the lower house and principal chamber of parliament), yet not with enough votes to secure outright majority in the 166 seat parliament. This leaves the Labour Party – usually only the third largest party in Ireland – in a strong position with 37 seats, a gain of 17. According to Irish media reports, Fine Gael and the Labour Party are already in advanced talks to form a coalition government.

How Ireland ended up in this mess is not the objective of this letter. For that I suggest you turn to Michael Lewis (author of Liar’s Poker), who has recently produced a blinder of an article about Ireland’s predicaments, which you can find here. It comes strongly recommended. What I want to focus on instead is how the Irish may decide to challenge the EU leadership and the effect that may have on financial markets.

Now, the Irish are not like the Greeks. One should not expect to see them on the barricades just because they have been robbed of any chance of prosperity for at least a generation. The Irish vote with their feet instead. Following more than a decade of net immigration, the tide has turned and Ireland is again losing tens of thousands of people every year – mostly the young and the well-educated - which is a rot that must be stopped, as the Irish will need all the economic growth they can muster in the years to come in order to work their way out of the current mire.

An industry in meltdown

Of even bigger concern near term, though, is the near meltdown of the Irish banking industry. It took me a while to get to the bottom of this, but what I found was truly astonishing. The Irish banking industry is a complex beast. About 450 financial institutions operate in the country, but only 20 of those serve the domestic economy. Table 1 represents those 20 ‘domestic’ banks, and the picture is horrifying. Over the past twelve months, €135 billion pounds, or one-quarter of all deposits, have left the country. In an economy with a GDP of €155-160 billion that is a very large number indeed.

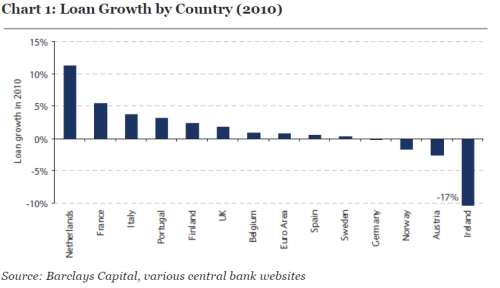

Obviously, with a deposit drain of that magnitude, the Irish banks have had to scale back their lending. Despite substantial emergency funding being provided by the Irish Central Bank and the ECB (to the tune of about €145 billion), loan growth has gone into reverse with a fall in total loans outstanding of approximately 17% last year (see chart 1), and with further declines to be expected for 2011.

Facing this harsh reality, it was no wonder that Fine Gael in the weeks leading up to last Friday’s election let it be known that it favours a restructuring involving a haircut for holders of Irish sovereign bonds. The Irish intent was clear; if it is so important for the EU leadership to keep Ireland afloat, then the EU should damn well pay for it. This sparked frantic activity in Brussels and Frankfurt with several statements being issued aimed at damage limitation. Applying some unusually strong wording, various EU leaders made it clear that Irish dissent would not be tolerated.

A surprisingly strong hand

In reality, though, the Irish have a stronger hand than generally perceived. With their banks sinking faster than other European investors can offload their exposure to Ireland, what would Ireland actually lose from calling the EU’s bluff and let bondholders take a haircut? Perhaps even walk away from the euro and go back to the punt? Usually, one of the strongest arguments against leaving a currency union is the inevitable run on the banks. But if the bank run is already in full bloom, that argument loses much of its power.

If the deposit drain continues at the current rate, the day will soon come where the price of leaving the euro will no longer be punitive. At a minimum, the new Irish government should push aggressively for a renegotiation of the rate of interest it pays on the emergency funding. At 5.8% there is plenty of scope for improvement of terms.

After all, the EU’s main concern is not Ireland. No, what the EU is desperate to maintain is the illusion that the EU’s banking sector in general, and Germany’s in particular, is sound and healthy. In reality, the German landesbanks, together with the Spanish cajas and the Austrian banks, are amongst the weakest in Europe in terms of their capital base, and the German banks have plenty of exposure to Ireland. In other words, keeping Ireland afloat is a critical part of Merkel’s strategy to keep its own banking sector alive. This very fact, which the German government is doing everything in its power to conceal, provides Ireland with a once-in-a-lifetime opportunity to renegotiate its borrowing terms.

It’s food prices stupid!

Now, let’s shift gear and move our attention to the Middle East momentarily. Recent events have been portrayed in the international media as a mix of religious warfare and a cry for political freedom. In reality it is none of them. It is the result of rapidly rising food prices combined with high youth unemployment throughout the region. However, for now, developments are serious enough to drive up energy prices to levels which are capable of doing significant damage to the fledgling economic recovery.