by Alfred Lee, CFA, DMS, Vice President & Investment Strategist, BMO ETFs & Global Structured Investments

BMO Asset Management Inc.

alfred.lee[at]bmo.com

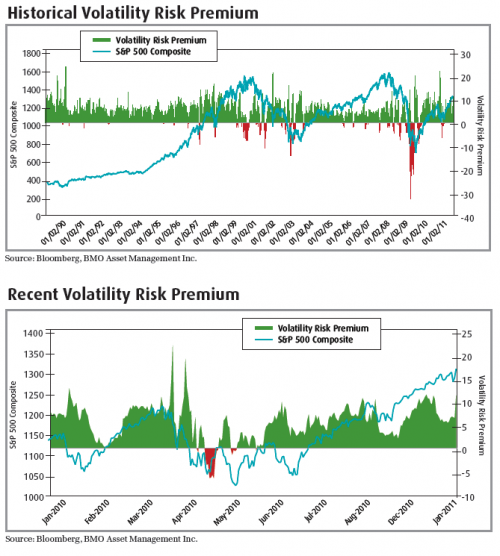

As mentioned in our BMO ETF 2011 Outlook Report last month, although we anticipate market volatility to decline throughout the year, for the time being we expect sudden shocks of volatility in equity markets to be a common theme. At just a month into the new year, news of civil unrest in Egypt had already temporarily caused some turbulence in global markets. As we also noted in last month’s report, during periods where realized volatility is on the high end, investors have had a tendency to be extra-cautious, which is reflected through higher sensitivity in implied volatility and thus widening volatility risk premiums1. In fact, taking a closer look at the historical gap between realized volatility and implied volatility, the tendency for a positive volatility risk premium indirectly implies that the market as a whole “over-reacts” most of the time. Interestingly, when “jump risk2” or “black swan3” events occur, the financial crisis of 2008 as an example, the market has under-reacted. On a whole, this suggests that perhaps markets are not

as rational as financial academia believes it to be.

The notion that markets may not be efficient is interesting as potential opportunities could present themselves when markets are acting on significant irrationality. At such times, although easier said than done, investors should rationally attempt to decipher whether market shocks are an overreaction or a true tail-risk4 event. As we believe the S&P/CBOE Implied Volatility Index (VIX) to be more sensitive than actual realized volatility this year, those points of widening positive volatility risk premiums could present investors with potential market entry points. Therefore, investors who remain calm when the market overreacts in a kneejerk manner (similar to when news broke out about civil unrest in Egypt) could see some potential buying opportunities at times when shocks aren’t a real concern to the global economy.

Since we anticipate intra-market and inter-market correlation to gradually decline this year, beta allocation and sector selection will become increasingly important in generating portfolio alpha. To follow up on last month’s BMO ETFs 2011 Outlook Report, our big picture strategy is to increase high yielding fixed income exposure, while offsetting this risk exposure with a low duration, high credit quality credit positions and also to lower beta equity positions to keep overall portfolio risk allocation in-check. Below, we highlight some portfolio strategies that investors may want to consider for tactical asset allocation themes.

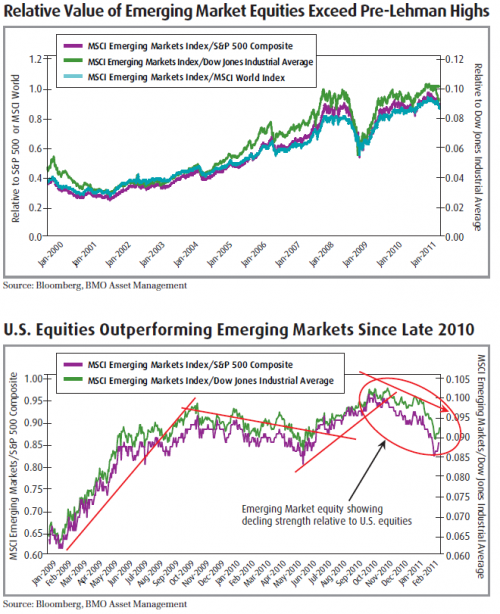

- U.S. Equities Continue to Outperform Emerging Market Equities. One of our major asset allocation decisions this year, at least for the first half, is to pare back emerging market stocks in favour of U.S. equities. While we do believe economic power is gradually shifting from the west to developing countries out east, emerging titans such as China and India will for the time being remain focused on tightening monetary policy in attempts to quell inflation concerns. In addition, although areas of recent civil unrest are a small portion of most broad emerging market indices, its sentiment impact will likely create headwinds for the equity markets of developing areas while benefitting those of developed areas through a flight to safety affect. Early reports have shown a steady global reallocation with fund flows out of emerging market related equities and into that of developed markets. This too is further encouraged by recent improving economic data in the U.S.

In our last monthly report, we recommended using exchange-traded funds (ETFs) to efficiently access U.S. equities. We then followed this up with a further Trade Opportunity Report titled “Dissecting the Dow” which outlined the Dow Jones Industrial Average Index (DJIA) as a means of gaining exposure to multinational companies. Already in the last several months, we are seeing a divergence between U.S. and emerging markets equities. The recent reallocation trend or tactical shift out of emerging markets coupled with inflation concerns may cause equities in developing areas to face headwinds. Though we favour U.S. equity over emerging markets for the time being, from an economic perspective, we believe rising income in developing areas remains a secular trend and investing in large U.S. companies with international exposure is potentially a way in which investors can access both our anticipated tailwinds of U.S. equities and the growing middle class in emerging nations.

Potential Investment Opportunities:

- BMO Dow Jones Industrial Average (ZDJ)

- BMO U.S. Equity Hedged to CAD Index ETF (ZUE)

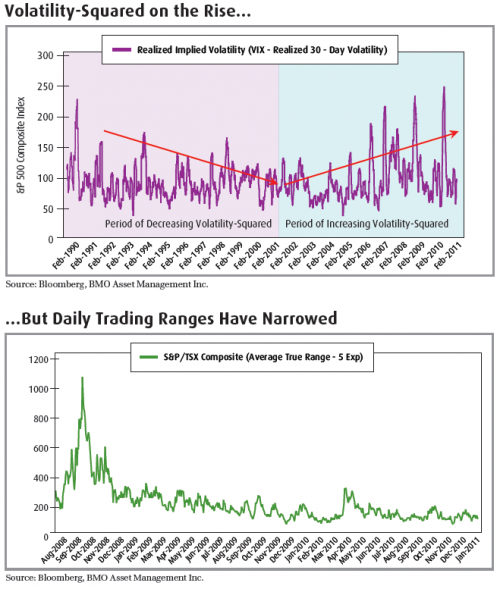

- Pocketing Monthly Income. With the European sovereign debt crisis still unresolved and concerns of a U.S. municipal bond meltdown still lurking, the rising trend of volatility-squared (the “volatility of volatility”) over the last several years could continue, even in an environment of falling market volatility. This is possible due to sudden shocks in volatility from a combination of investors wanting to participate in the market rally while counteracted by investor tepidness due to the 2008 financial crisis still being fresh on their minds. In these times, increasing income and distributions in a portfolio is an approach that will allow investors to collect distributions while waiting for volatility-squared to decline. Combining our recently launched BMO Monthly Income ETF (ZMI) with a lower risk bond ETF such as the BMO Short-Federal Bond ETF (ZFS), is a quick and efficient way to execute a similar asset allocation strategy to the one we recommended in our 2011 Outlook report and briefly mentioned above. For those investors that would rather build a high yielding portfolio using an a-la carte approach, this can also be done efficiently through a combination of ETFs that trade on the Canadian and U.S. exchanges.

Potential Investment Opportunities:

- BMO Monthly Income ETF (ZMI)

- BMO Equal Weight Utilities Index ETF (ZUT)

- BMO Equal Weight REIT Index ETF (ZRE)

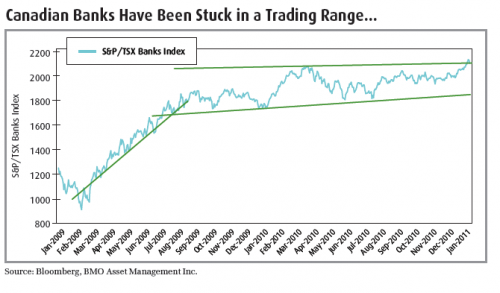

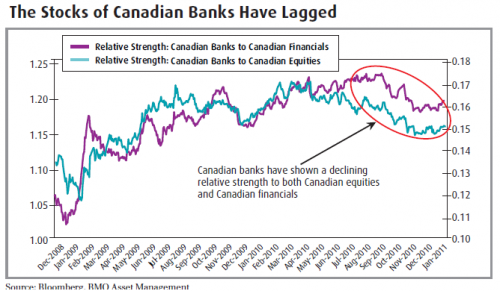

- Banking Some Income. Last month, we mentioned that Canadian banks could potentially underperform the broad Canadian equity market this year since we believe many of the “Big Six” banks are looking for acquisitions. After displaying much resilience during the financial crisis, Canadian banks are now armed with ample capital reserves to take on these accretive activities, especially with their global competitors trading at attractive valuations. We have seen the Canadian banks’ willingness to engage in acquisition activity over the course of the last few months, with a wave of announced deals closing the year. On a whole, we believe these activities will further strengthen and enable the Canadian banks to build their global brand and diversify their businesses. The short-term, however, could be a different story. These activities require capital outlay and potential execution risk and as a result, bank share prices could face headwinds as already evidenced by the S&P/TSX Banks Index weakening relative strength (RS)5 to both the S&P/TSX

Composite Index and the S&P/TSX Financial Index.

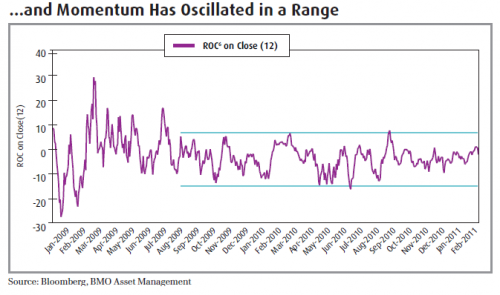

With the potential for Canadian banks to underperform and/or trade in a range-bound pattern, investors could either use pull-backs as long-term buying opportunities or utilize a covered call strategy with Canadian banks.

For more information on the mechanics of a covered call strategy, please visit our website.

Potential Investment Opportunities:

- BMO Covered Call Canadian Banks ETF (ZWB)

- BMO S&P/TSX Equal Weight Banks Index ETF (ZEB)

The markets have recently shown a significant step in its stage towards a recovery. Coming off the bottom in March 2009, stocks as a whole have shown a strong tendency to move in unison. At the time, the implied correlation of the markets remained stubbornly high and elevated considerably at times when implied volatility levels escalated. Now, with a number of impressive quarterly earnings sessions in the rear view, the stock market rally from September has been showing inspiring breadth. As mentioned, news items such as civil unrest in the Middle East will likely continue to cause markets to temporarily overreact given the number of concerns in the global economy that remain.

In terms of monitoring risk, it is important to determine which items are likely to be true black swan events and/or have a real likelihood to impact a portfolio. Recently, with implied correlation and implied volatility starting to show a divergence, the much popularized “risk-on, risk off” trade may become increasingly less pronounced. Therefore, going forward, the importance of beta allocation and sector selection will become increasingly prominent in addingvalue to a portfolio strategy.

Footnotes

1 Volatility risk premium: The difference between implied volatility and subsequent realized volatility.

2 Jump Risk: The risk associated with a changing portfolio value due to large swings in market prices. It is also referred to as “event risk” or “fat-tails”.

3 Black Swan: An event or occurrence that deviates beyond what is normally expected of a situation and that would be extremely difficult to predict. This

term was popularized by finance professor Nassim Nicholas Taleb.

4 Tail Risk: A form of portfolio risk that arises when the possibility that an investment will move more than three standard deviations from the mean is greater than what is shown by a normal distribution.

5 Relative Strength (RS): A measure of one asset’s price relative to another.

6 Rate of Change (ROC): A technical indicator that measures the percentage change between the most recent price and the price “n” periods in the past.

Comments are closed.