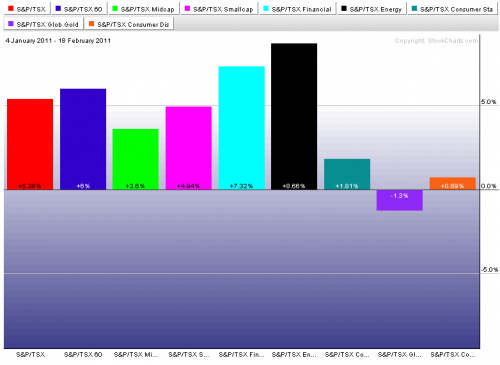

TSX and Subgroups Week Ending February 18, 2011

TSX and Subgroups YTD

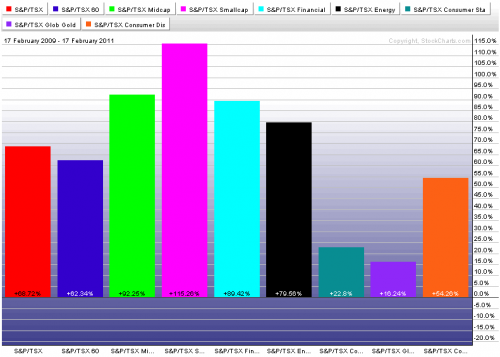

TSX and Subgroups 1-year Ending February 18, 2011

Strengths

Carney Says `Possible' Canada Fourth-Quarter Growth Faster Than Projected

Bank of Canada Governor Mark Carney said it's "possible" the economy grew at a faster pace in the fourth quarter than the central bank projected last month. [Bloomberg]

Canada defies global trend with tame inflation

Canada's annual inflation rate slipped to a relatively tame 2.3 percent in January as a strong currency helped it buck a global trend that has seen several major nations struggle to control rising prices.

Canada's January inflation rate edged down to 2.3% [RBC]

In January, Canadian consumer prices increased by 0.3%, which was in line with market expectations. The annual inflation rate, however, eased to 2.3%, lower than December's 2.4% pace. Core inflation, which excludes the eight most-volatile items and the effect of changes in indirect taxes, was unchanged in January and below expectations for a 0.1% rise. The annual rate edged down to 1.4% from 1.5%. [RBC Economics Research]

U.S. Fed members more confident about sustained economic recovery [RBC]

The minutes of the January meeting show a modestly upgraded forecast for the U.S. economy in 2011 although with the expectation of slow progress toward the Fed's dual objectives of price stability and full employment. The minutes indicate that incoming data "would need to be solid for a while longer to justify a significant upward revision to their outlook." As such, we see no need to change our view that the Fed will complete its current round of U.S. Treasury bond buying and maintain the Fed funds target in its current range. [RBC Economics Research]

Banking on a business-led recovery

As the country's major banks get ready to report earnings this week, investors are taking a closer look at two areas of the balance sheet – commercial loans and consumer lending. Each will have something to say about what kind of a quarter it was in banking, but the real value of the data will be the statement it makes about the Canadian economy in the year ahead. {Globe and Mail]

Canadian new home prices rose to highest level on record in December [RBC]

Statistics Canada's New Housing Price Index rose 0.1% on a month-over-month basis in December 2010 following the unrevised 0.3% advance in November. While the increase was slightly below expectations (market expectations were for a monthly increase of 0.2%), the rise in home prices moves the index to establish a new record high for the second consecutive month. On a year-over-year basis, the pace of growth in new home prices decelerated for sixth consecutive month, slipping to 2.1% from 2.3% in November. [RBC Economics Research]

Weaknesses

A merger that will only bring mediocrity

The executives of the London and Toronto exchanges are pumping their proposed merger so hard that you wonder how either bourse managed to survive on its own. Together, apparently, they would be a world-beating marvel. Left to their own inadequate devices, they would fade away like old soldiers, or simply get squashed by the new breed of monster exchanges like the baby deer in the classic Bambi Meets Godzilla cartoon. [Globe and Mail]

Canadian December manufacturing sales show disappointing increase [RBC]

Manufacturing sales in December 2010 managed to rise only 0.4% in the month. This increase failed to reverse the 0.6% drop recorded in November 2010, even with the decline lessened from the 0.8% decline previously reported. The volume of sales unexpectedly dropped 0.5% in the month. Expectations were for a much stronger increase in December of 3.0%, on a nominal basis, in the face of an earlier reported 9.7% surge in December merchandise exports and indications of the completion of auto sector retooling by the end of November. [RBC Economics Research]

Opportunities

U.S. retail shakeup will spread North: Desjardins

The U.S. retailing scene has been whipped into a frenzy, as activist investors and private equity players take a shining to the sector at a time when companies are reviewing their strategies.

And it's only a matter of time before there's a spillover effect in Canada, contends Desjardins Securities Inc. analyst Keith Howlett. [Globe and Mail]

Threats

RBC: U.S. January inflation rate rose more than expected

U.S. consumer prices increased by 0.4% in January 2011, thereby beating market expectations for a 0.3% increase, although in line with RBC's forecast. The annual inflation rate rose to 1.6% as a result, slightly faster than December 2010's 1.5% pace. Core inflation, which excludes food and energy prices, posted a 0.2% monthly gain, also beating expectations for a 0.1% rise, and the annual rate rose to 1.0%. The rise in the core inflation rate marked the third consecutive increase from October 2010's 0.6% all-time low. [RBC Economics Research]

TSX sells, Canada sold down the river

Diane Francis states: The proposed takeover of the TSX Group is unacceptable and would injure Canada's competitive advantages. [Financial Post]

Tar sands row threatens Canada-EU trade deal: sources 2:31pm EST

BRUSSELS (Reuters) - Canada has threatened to scrap a trade deal with the European Union if the EU persists with plans that would block imports of Canada's highly polluting tar sands, according to EU documents and sources. [Reuters]

Canada PM Stephen Harper says no budget "horse trading" 4:44pm EST

VANCOUVER (Reuters) - Canadian Prime Minister Stephen Harper said on Monday he is not "horse trading" with opposition parties over the budget, but that does not mean he is trying to force an election this spring. [Reuters]

Stock trading patterns prior to mergers raise more red flags

A super-sized rally preceding the public announcement of a takeover raises difficult questions: Was the run-up in Norsemont shares simply a case of traders realizing the company was a likely takeover target and bidding up its price? Or did word of the pending deal leak out, allowing unscrupulous investors to take advantage? [Globe and Mail]