#12: Israel vs. Iran

Finally, # 12 is a bit of a wild card. So wild, in fact, that some of my colleagues have ridiculed me for including it on this list (not for the first time, by the way). Israel is clearly not happy with developments in Iran, and it is not entirely inconceivable that they decide to launch a preemptive strike on Iran’s emerging nuclear facilities. Only a few days ago a leading Iranian nuclear scientist was assassinated in Tehran. I have no idea who did it, but it is clearly not in the interest of Iran to kill its own nuclear talent, so some foreign power must have been involved.

At the same time, in recent weeks, we have had two important revelations with respect to the dynamics between Israel, Iran and the United States. When George W. Bush published his memoirs last month, it became apparent that the US administration did not endorse the Israeli attack on Syria’s nuclear facilities back in 2007, which suggests that the Israelis will not necessarily shy away from taking unilateral action if they feel sufficiently threatened.

Even more recently, WikiLeaks documents suggest that King Abdullah of Saudi Arabia has privately been pushing for an ‘endlösung’ in Iran. Again, the Americans did not take the bait. All this is telling me that the Americans do not rate this problem as highly as the Israelis and the Saudis do. That is potentially an explosive cocktail. How likely is a conflict? Probably less than 30%, but the implications are quite nasty, should anything happen.

Summing it all up That pretty much sums up our landscape of risks and uncertainties as we

prepare to enter another calendar year. You may agree or disagree. I can already see my inbox filling up with emails saying: what about inflation risk? My view on that remains unchanged. In Europe, Japan and North America, deflation risk remains a bigger concern than inflation, at least for now. Only in emerging markets do we see a significant risk of inflation for the next 12 months. Will it go on the list in the future? Possibly, but most likely not until 2 012-13 at the earliest.

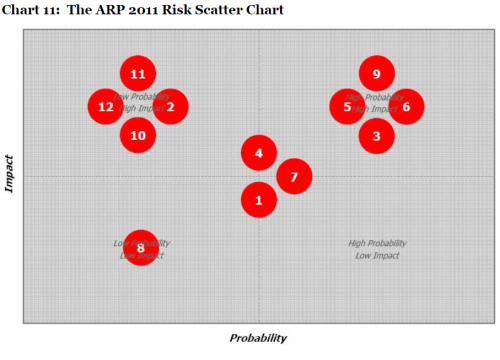

In order to give you a sense of how we rate each of the risk factors in terms of probability and potential impact, we have developed a new proprietary risk scatter chart (see chart 11), which we will update regularly going forward. As a reminder, the 12 factors are:

1. High yield priced for perfection?

2. The risk of double dipping

3. The sinking ship of Japan

4. Beggar thy neighbour mentality

5. Capital flows too hot to handle

6. Chinese inflation out of control?

7. Food inflation induced civil unrest

8. Is India an accident waiting to happen?

9. European contagion and solvency risk

10. Massive refinancing programme

11. Premature withdrawal of monetary support

12. Israel launching a pre-emptive strike on Iran’s nuclear facilities;

All of us at Absolute Return Partners would like to wish you a happy and prosperous 2011, both at a personal and a professional level. For those of you wondering what happened to our new equity fund, we are hopefully only days away from obtaining final regulatory approval. As soon as that has been obtained, those of you who have expressed an interest will receive all the necessary documentation.

Niels C. Jensen

© 2002-2 010 Absolute Return Partners LLP. All rights reserved.

Important Notice

This material has been prepared by Absolute Return Partners LLP ("ARP"). ARP is authorised and regulated by the Financial Services Authority. It is provided for information purposes, is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. The information provided is not intended to provide a sufficient basis on which to make an investment decision. Information and opinions presented in this material have been obtained or derived from sources believed by ARP to be reliable, but ARP makes no representation as to their accuracy or completeness. ARP accepts no liability for any loss arising from the use of this material. The results referred to in this document are not a guide to the future performance of ARP. The value of investments can go down as well as up and the implementation of the approach described does not guarantee positive performance. Any reference to potential asset allocation and potential returns do not represent and should not be interpreted as projections.

Absolute Return Partners

Absolute Return Partners LLP is a London based private partnership. We provide independent asset management and investment advisory services globally to institutional as well as private investors, charities, foundations and trusts.

We are a company with a simple mission – delivering superior risk-adjusted returns to our clients. We believe that we can achieve this through a disciplined risk management approach and an investment process based on our open architecture platform.

Our focus is strictly on absolute returns. We use a diversified range of both traditional and alternative asset classes when creating portfolios for our clients.

We have eliminated all conflicts of interest with our transparent business model and we offer flexible solutions, tailored to match specific needs.

We are authorised and regulated by the Financial Services Authority. Visit www.arpllp.com to learn more about us.

DOWNLOAD [PDF]

Notes:

1 To the best of my knowledge, the first to distinguish between uncertainty and risk was Frank Knight in his 1921 book work “Risk, Uncertainty and Profit”.

2 Source: www.boombustblog.com

3 Source: Simon Hunt Strategic Services

Absolute Return Letter Contributors

| Niels C. Jensen | njensen [at] arpllp.com | tel. +44 20 | 8939 | 2901 |

| Nick Rees | nrees [at] arpllp.com | tel. +44 20 | 8939 | 2903 |

| Tricia Ward | tward [at] arpllp.com | tel: +44 20 | 8939 | 2906 |

Copyright (c) Absolute Return Partners