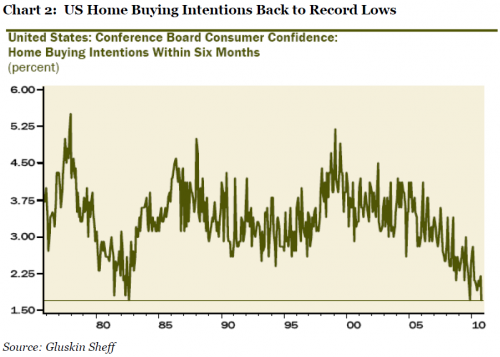

David Rosenberg of Gluskin Sheff produced a very interesting chart the other day, showing the recent trend in US home buying intentions (see chart 2). On the basis of that chart I can only conclude that US house prices are still too high and need to come down further. This will continue to put a significant damper on US economic activity well into 2011 and possibly beyond despite many other industries doing rather well. On that basis I would suggest that US economic growth will be subdued in 2011, but I would put the probability of a double dip at less than 20%.

# 3: Japan’s debt mountain

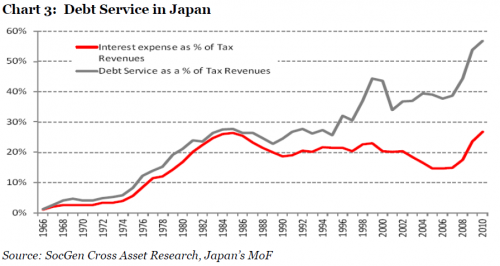

Next on my risk radar for 2011 (# 3) is what I call the sinking ship of Japan (I know – that header is not going to make me many friends in Japan). The question here is not so much the ultimate outcome, but rather the timing of their demise, and I could be wrong by several years! The essence of the Japanese problem is an ever growing pile of debt (see chart 3), which needs to be supported by a rapidly aging population. See our November 2010 letter here for further details.

# 4: Beggar thy neighbour

Japan desperately needs for the yen to depreciate in order to regain some

of the lost competitiveness vis-à-vis other Asian countries in particular but also against countries such as Germany. But so do many other countries. I am sure Portugal, Spain, Greece and Italy all would give their proverbial right arm for a 30% drop in the value of the euro (which wouldn’t actually fix their problems, but that is another story altogether). The urge to drive exchange rates lower is fast becoming a global disease and has created a beggar-thy-neighbour mentality which is # 4 on our list for 2011. For more details, see the September 2010 Absolute Return Letter here.

# 5: Too hot to handle

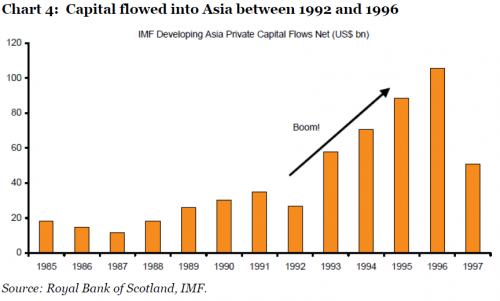

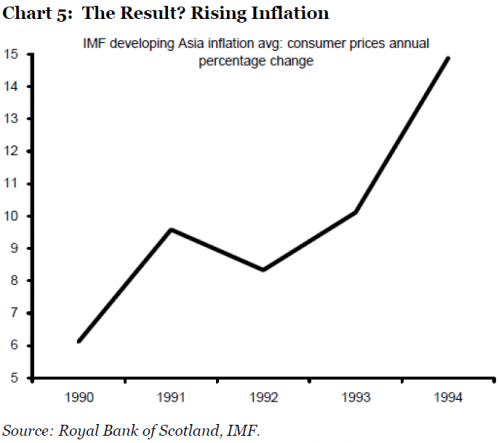

Next on our list is what I have called capital flows too hot to handle (# 5). Asia is at the receiving end of enormous amounts of capital these days, not dissimilar to the experience of the early to mid 1990s (see chart 4). This has two implications, both of which may dent investor appetite for Asia longer term. First of all, one key lesson learned from the 1990s experience is that with strong capital flows come the risk of inflation (see chart 5).

Secondly, should capital continue to flow into emerging economies in general and to Asia in particular, stricter capital controls may be the only option left for governments worried about skyrocketing exchange rates. Whilst bad news for risk assets the alternative is almost certainly worse – overheating economies where the cost of capital is far too cheap relative to the underlying growth rate of those economies. This is the true price of a miscalculated currency policy where governments of the fast growing economies of Asia thought the link to the US dollar would offer stability. In reality, precisely the opposite is now happening.

# 6: Chinese inflation

No country has attracted more capital from abroad than China. But China’s

problems run deeper than that, hence risk factor # 6: Chinese inflation out of control? As recently as 6-8 weeks ago, this issue was on virtually nobody’s radar but, more recently, it has attracted a lot of attention. Based on official Chinese data, inflation is rising but still very much under control. CPI was last reported to have risen 4.4% year-on-year. However, good friend Simon Hunt, who has spent the last few weeks travelling through China, paints a very different picture.