Will Merge for Metal

David Andrews, CFA, Private Client Strategist, Richardson GMP

We are only a handful of days into 2011, yet we can see there was some heavy negotiating being done during the recent Holiday Season. No less than three major mergers/acquisitions were announced in the Canadian mining space this week alone. HudBay Minerals was the first to the tape with a modest but friendly $520 million deal to acquire copper producer Norsemont Mining. That deal was followed by the nearly $5 billion purchase of Consolidated Thompson Iron Mines by U.S.-based Cliffs Natural Resources. Finally, Inmet Mining and Lundin Mining trumped them all, as they agreed to a merger of equals valued at approximately $9 billion. The key conclusions to draw from the recent frenzy of deal making is that the current commodity rally looks to have lots of life left in it as it is fuelled by an insatiable Chinese appetite for the materials its economy wants and needs. We are also encouraged by the re-emergence of access to the financing required to get these deals done after two years of a virtual moratorium on bank financed mergers. We think this may be only the beginning, as we see much larger, hungrier fish lurking nearby...

Attention shoppers! Discount retailer Target agreed to make its first foray outside of the U.S. and paid $1.85 billion to take over the 220 Zellers leases from the Hudson Bay Company. Expect them to open 150 Targets in the next two years which gives Wal-Mart about a 15 year head start in Canada. Better late than never, we suspect.

Marathon Oil, the largest refiner in the U.S. mid-west announced plans to cut itself in two. Management’s expectation is the two pure-play pieces should be easier for the market to understand and to value. Intel beat the Street on both top and bottom line to help kick off fourth quarter Earnings Season. Alcoa beat on its bottom line in Q4.

On the macro front, successful bond auctions in Portugal and Spain and some hawkish talk about inflation fighting enabled the euro to rally 3.5%; its biggest rise against the U.S. dollar since March 2009. The spread between 2-year and 30-year widened as a 30-yearr auction sold at the highest yield since April last year.

It wasn’t all good news on the economy as weekly jobless claims (+35K to 445K) increased more than expected (the highest level since October). The soft U.S. employment data weighed on the Canadian dollar and was enough to give equity investors some pause until more earnings data is released.

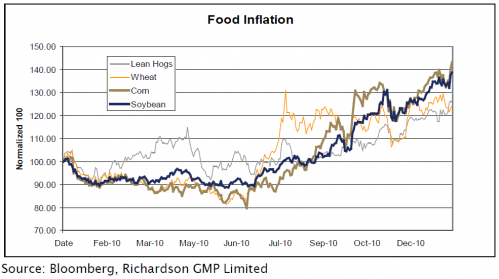

Verge of a Food Crisis

Food riots have occurred in both Algeria and Mozambique sparking a recent United Nations’ warning about a possible 2011 food price shock if output continues to dwindle. The global food supply demand balance is being skewed by pinched crop yields due to hot weather in Latin America and the floods in Australia.

How can investors benefit? PowerShares Agricultural ETF (DBA) has a direct interest in agricultural futures. (Be mindful of the wide contangos on rolling contracts and the U.S. dollar exposure.) Another approach is the Claymore Global Agricultural ETF. This one has big equity positions in companies like Monsanto, Potash Corp., and Agrium.

Download [PDF]

Copyright (c) Richardson GMP