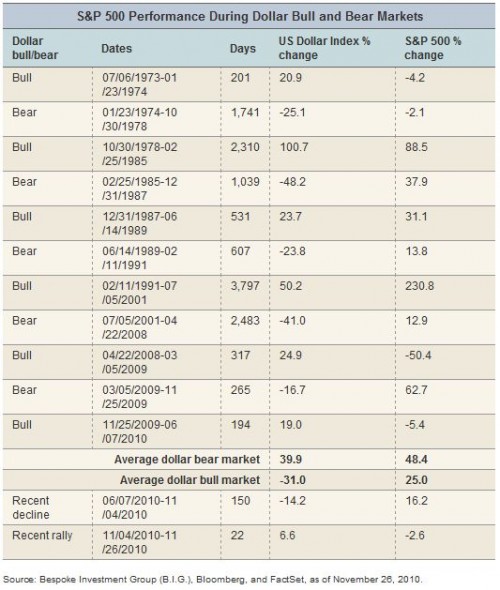

The stronger dollar has also contributed to the weakness in stocks and commodities given the inverse correlations between the dollar and both. We don't believe the inverse correlation between the dollar and stocks is a permanent fixture, but it's with us for now. Historically, more often than not, the two are positively correlated, as you can see in the table below.

Source: Bespoke Investment Group (B.I.G.), Bloomberg, and FactSet, as of November 26, 2010.

US economy gaining traction

It's our view that part of the reason for recent strength in the dollar is the improved outlook for the economy. The latest revision to GDP for the third quarter of 2010 was a better-than-expected 2.5%, while economists' estimates for the fourth quarter of 2010 are heading higher.

Initial unemployment claims—the best leading indicator for payroll growth—recently (and substantially) broke out on the downside. More broadly, the leading economic indicators are rebounding after a summer lull and improving job growth should give a boost to the coincident indicators, as well.

Even consumer spending has been ahead of expectations for five straight months and the holiday shopping season is shaping up nicely. The initial read on the Thanksgiving weekend's sales tally was a jump of more than 6% from last year, without the recent bias toward the discounters. In fact, real (inflation-adjusted) consumer spending is now officially in "expansion" mode given that it has surpassed the 2007 peak. You can see this in the chart below.

Consumer Spending in Expansion Mode

Click to enlarge

Source: Bureau of Economic Analysis and FactSet, as of October 31, 2010.

Many point out that a lot of the lift has come courtesy of stimulus-related transfer payments from the government, but do note that, more recently, both hours worked and real wages/salaries have been accelerating.

Business confidence is recovering and should lead to increased capital spending and job creation. As to the former, recent Fed data showed an increase in commercial and industrial lending for the eighth week in 11. Even consumer loan fundamentals are shaping up as lending standards across the spectrum of loan type have eased significantly. Loan demand, though, will remain shy of supply as long as the private sector continues deleveraging (paying down debt).

Debt woes will linger for a long, long time

Deleveraging cycles take a very long time, whether they're of the private or public-sector variety. We're still in the early stages. I would have a less sanguine view of the problems in Europe if we weren't seeing some renewed economic strength in the United States. Ultimately, we believe it's those fundamentals that will hold sway over Europe's sovereign debt crisis, but the period of digestion for the market may not yet be past.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative (or "informational") purposes only and not intended to be reflective of results you can expect to achieve.

Copyright (c) Charles Schwab & Co., Inc