But the concerns about meeting debt obligations extend to Spain, Portugal and, yet again, Greece. Fortunately, Greece, Ireland and Portugal account for only 6% of the euro-zone's economy.

One interesting development was the comment made by Axel Weber, the head of Germany's Bundesbank. He's a member of the European Central Bank (ECB) Governing Council, and rumored to be the next president of the ECB after Jean-Claude Trichet's term is complete.

Weber mentioned that the EU's bailout fund could be increased if necessary to restore confidence in the euro. In fact, there's a growing camp that believes the ECB may eventually unleash its own new round of quantitative easing by purchasing a big chunk of European sovereign debt. (Our Federal Reserve recently announced QE2—a policy injecting cash into the economy and pushing interest rates lower by purchasing Treasury securities.)

Also, the Council of the EU set up a European Stabilization Mechanism slated to go into effect mid-2013 to replace the bailout fund it established in May. The key to this plan is for future debt crises to be handled on a case-by-case basis, rather than abiding by automatic mechanisms.

There's a rub here, though: Following the announcement of an Irish rescue plan, investors simply turned their attention to which country is next in line, with Spain being the elephant in the room.

Where exposure lies

The overarching concern is not related to the impact on the global economy, considering Ireland is a small economy, but is about the prospect of a sovereign debt default and consequent damage to the European banking system.

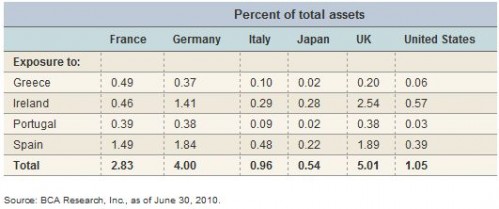

In terms of where exposure is greatest, BCA recently crunched the numbers and found that European banks are the largest holders of the debt of the four troubled borrowers (Ireland, Spain, Portugal and Greece).

Specifically, German banks have the largest exposure to Ireland. The good news is that US banks actually have very limited exposure. You can see the details in the table below.

Consolidated Foreign Claims of Banks

Source: BCA Research, Inc., as of June 30, 2010.

Were problems to significantly accelerate in Spain, the implications would be more severe and the future of the euro currency would be called into question. But BCA believes the situation is not spinning out of control.

Spain's debt-to-GDP ratio will be about 63% in 2010, lower than even Germany's. Spain's budget deficit is shrinking and its authorities have taken serious measures to please the financial markets. Given Spain's problem being about private borrowing and not public-sector debt, the key will be to prevent a US-like crisis in real estate.

Trade impact

I've gotten many questions lately about the mechanism of trade and whether problems in the euro-zone will significantly damage US exports to the region. As noted by High Frequency Economics (HFE), absent a fundamental meltdown in the euro-zone, trade is the key mechanism to transmit economic activity from one country or currency zone to another.

The trade linkages between the United States and the euro-zone are limited. The euro-zone accounts for about 14% of exported US goods. With total exports representing only 12.6% of US GDP, HFE calculates that even if exports to the euro-zone were to fall by 50% (highly unlikely), US GDP would be hit by a mere 0.9%.

Dollar strength = market weakness?

All of the issues above have kept significant pressure on the euro, while elevating the dollar during the past couple of weeks. This is in stark contrast to investor expectations after the Fed initiated its second round of quantitative easing.