Whoosh!

by David Andrews, Director of Research, Richardson GMP Ltd.

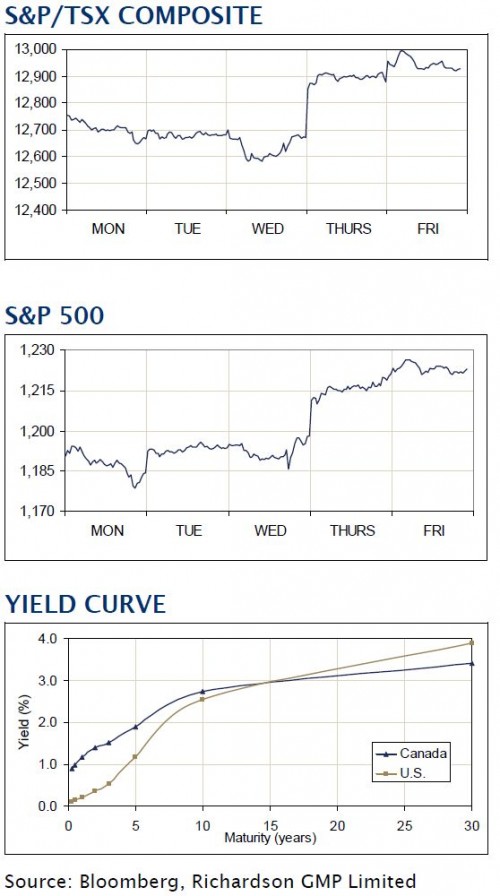

That is the sound of North American equity markets moving higher on the release of Ben Bernanke’s sequel, Quantitative Easing Part 2. Key benchmarks in Toronto and New York rushed higher, trading at levels not seen since Lehman Brothers filed for bankruptcy in September 2008. Oh yeah, there was also the U.S. mid-term elections this week but all investors could seem to do was yawn as all eyes were squarely on the Fed. For the record, quite a few Democrats were ‘whooshed’ out of office as the Republicans stormed back to take the House of Representatives. The outcome is a clear signal that Americans are angry about how the current administration is handling the economy.

That is the sound of North American equity markets moving higher on the release of Ben Bernanke’s sequel, Quantitative Easing Part 2. Key benchmarks in Toronto and New York rushed higher, trading at levels not seen since Lehman Brothers filed for bankruptcy in September 2008. Oh yeah, there was also the U.S. mid-term elections this week but all investors could seem to do was yawn as all eyes were squarely on the Fed. For the record, quite a few Democrats were ‘whooshed’ out of office as the Republicans stormed back to take the House of Representatives. The outcome is a clear signal that Americans are angry about how the current administration is handling the economy.

The Fed basically met ambitious expectations with details of their new large scale asset purchase program. They plan to buy $600 billion of assets over the next 8 months - $75 billion per month – and left the door open for more should they need to add further stimulus. We think the announcement helps stocks in two important ways. Firstly, it immediately sinks the value of the U.S. dollar which should be supportive of earnings going forward, especially for export oriented U.S. companies. Secondly, QE2 should help stocks through multiple expansions. The Fed has basically ensured lower interest rates for an extended period of time. The stock market uses interest rates to discount future earnings, hence the share price lift we witnessed in stock values this past week. Whoosh indeed!

In other news this past week, Investment Canada flushed the idea of a BHP Billiton’s takeover of Saskatchewan’s crown jewel: Potash Corp. Citing no ‘net benefit’ to Canada, the federal government protected its federal electoral votes in Saskatchewan by siding with the provincial government and effectively nixing the deal. That ‘whooshing’ sound may also be the career aspirations of Billiton’s CEO Marius Kloppers who now has three M&A strikeouts on his resume. Canadian corporate earnings have been strong with Suncor reporting a $1billion profit and Manulife Financial getting out from under a $1 billion loss one year ago. The king result this week belongs to Magna which blew past expectations, hiked its dividend and announced a stock split as the company continues to reap the benefit of the recovery in the automotive sector.

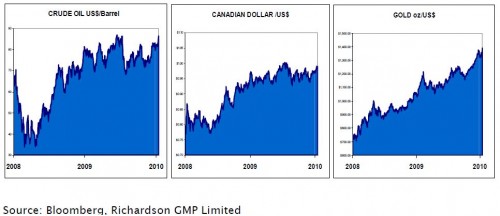

Commodities on a Roll

Commodity markets have exploded to the upside, boosted again this week by the Fed’s QE announcement. Investors have lost faith in the ability of governments to resist debasing their paper currencies. The Fed is banking that higher stock market wealth will spark consumer spending. The CRB Index is up 13.8% in September and October.