by David Andrews, CFA, Director of Research, Richardson GMP Ltd.

If asked for a few words to describe the beginning of third quarter Earnings Season, we would probably offer “Has it started yet?” Earnings Season has indeed begun but investors and markets continue to take their cues from the macro driven events and the ever increasing prospect of further monetary stimulus from the Federal Reserve. Stock markets ended higher with the Dow firmly above 11,000 and the S&P500 up 0.98% in the past week. Canada’s S&P/TSX also moved higher led by rising Materials stocks seeing big moves by Agrium and Sino-Forest. Gold touched yet another record high topping out at US$1383.90 before a modest recovery by the U.S. dollar. The greenback remains under siege ahead of the Fed’s likely Quantitative Easing (QE) which was reaffirmed by Chairman Ben Bernanke, during a recent speech in Boston. Bernanke signaled further stimulus was on the way as inflation remains too low and unemployment too high, both of which violate the two mandates of the U.S. central bank.

If asked for a few words to describe the beginning of third quarter Earnings Season, we would probably offer “Has it started yet?” Earnings Season has indeed begun but investors and markets continue to take their cues from the macro driven events and the ever increasing prospect of further monetary stimulus from the Federal Reserve. Stock markets ended higher with the Dow firmly above 11,000 and the S&P500 up 0.98% in the past week. Canada’s S&P/TSX also moved higher led by rising Materials stocks seeing big moves by Agrium and Sino-Forest. Gold touched yet another record high topping out at US$1383.90 before a modest recovery by the U.S. dollar. The greenback remains under siege ahead of the Fed’s likely Quantitative Easing (QE) which was reaffirmed by Chairman Ben Bernanke, during a recent speech in Boston. Bernanke signaled further stimulus was on the way as inflation remains too low and unemployment too high, both of which violate the two mandates of the U.S. central bank.

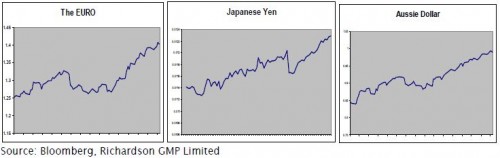

Singapore fired the latest salvo in the increasingly volatile currency markets by widening the band within which they will allow the Singapore dollar to trade. The U.S. dollar sank on the news and the pressure is on policymakers ahead of the next G20 meeting (November). Global currency imbalances are expected to dominate the agenda. Developing markets are concerned their export industries will suffer if increased demands for their currencies continue. The demand is coming from investors moving capital into these markets and away from near zero yielding developed nation currencies.

Despite investors’ apparent lack of interest in the earnings results, the results themselves have gotten off to a good start. This week, we saw how several key bellwether names are dealing with the slow growth economy. Intel beat top and bottom line estimates as corporate and emerging market demand for chips continues to grow. JP Morgan maintained its number one ranking in global investment banking fees and showed a continuing decline in credit losses. The shares later fell following allegations the banking industry was using improper foreclosure procedures further setting back the recovery in housing. So far, 47 of 500 companies have reported third quarter results. 71% have exceeded consensus which sounds good, but is lower than the beat rate in the third quarter one year ago (79.5%).

Currency Wars

The past three months has seen a massive realignment of currency values which in turn has significant implication for portfolios. The S&P500 is up almost 7% this year in local currency terms. When translated into Canadian dollars, U.S. stocks have returned a paltry 1.79% year to date.

Looking Forward

Just in time for Halloween, Canadian investors will get their own version of the CBOE Volatility or ‘Fear Index’ on Monday. The TMX Group is launching a Canadian version of the famous ‘VIX index’ based on the TSX60 and should be widely used as a gauge of investor anxiety. Earnings Season will really kick into high gear next week with 12 Dow and 112 S&P500 companies due to report third quarter results. Our Earnings Calendar, on the right hand side, highlights the notables.

The Bank of Canada is likely to leave overnight interest rates unchanged at the next policy meeting on Tuesday. Having lifted rates three times since June 1st, Governor Carney is likely to pause given pending QE from the U.S. which would likely put more upward pressure on the Canadian dollar. The bank will use low interest rates to stimulate growth, but not too much growth from borrowing by over-indebted households. Carney is also expected to present a revised outlook for slower growth for the second half of 2010 on Wednesday.

Canadian CPI is expected to show a rebound for September as higher energy prices due to a weakening U.S. dollar are factored in. Canadian retail sales for August are expected to again show a

slight decline as they did in July indicative of an economy losing momentum, and hence no change to rates is expected next week.

U.S. data should once again confirm the economy remains adrift and in need of a shot of stimulus. Housing starts and building permits will show the housing market continues to struggle to stabilize. Investors will want to see if last week’s higher than expected weekly claims were an anomaly or the beginning of a trend.

Copyright (c) Richardson GMP Ltd.