As already indicated, Solvency II will regulate the insurance industry but not the pension industry. European life insurers, who often compete with the pension industry for business, are obviously keen for pension funds to be part of the new rules. Pension funds, on the other hand, are desperate to stay outside. By one estimate1, should UK pension funds be forced into the Solvency II regime, liabilities will rise by a whopping 30%, caused by the lower discount rate which will be forced upon them under Solvency II. Not exactly good news for an industry that is already seriously underfunded. It is estimated that, should regulators decide to subject UK pension funds to Solvency II, UK companies (the plan sponsors) would have to cough up about £500 billion in order to meet the raised capital standards.

The Dutch are in trouble

In the Netherlands the situation is arguably even worse. Dutch pension funds are quite seriously underfunded (about 40% according to an article in the FT earlier this week2). Even the political leaders in the Netherlands have now woken up to this fact. Jan Pieter Donner, the Minister of Social Affairs, stated the other day that a pension reform can wait no longer. The retirement age must be increased and pensions must be adjustable, reflecting the economic cycle (i.e. you receive more in good times than in bad). There is even talk of allowing Dutch pension funds to bend the rules somewhat in order to carry them through the current crisis.

The Dutch problems appear to be somewhat self-inflicted, though. Pension funds can, and often do, hedge their interest rate exposure. In Denmark, for example, this ability has been the saving grace for many pension funds which would otherwise be in the same sort of trouble as the Dutch pension funds now find themselves in (more about how interest rates affect pension funds later).

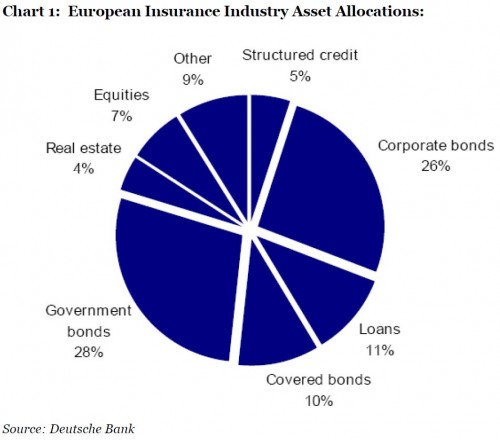

Now, across Europe, insurers have been busy preparing for when the new rules come into effect. As you can see from chart 1 below, the average exposure to equities is already very low – around 7% according to Deutsche Bank. As Solvency II (unlike Solvency I) penalises the insurer if there is a duration mis-match between assets and liabilities, forced buying of bonds from the insurance sector may have been a major feature in the bond market rally of the past six months.

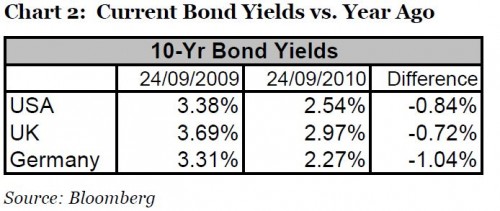

Yield compression is rife Obviously, interest rates have been impacted not only by Solvency II but by a host of other factors as well. It is noteworthy, though, that in Germany, where the impact of Solvency II has been more profound than in most other markets, the yield compression has been greatest (see chart2).

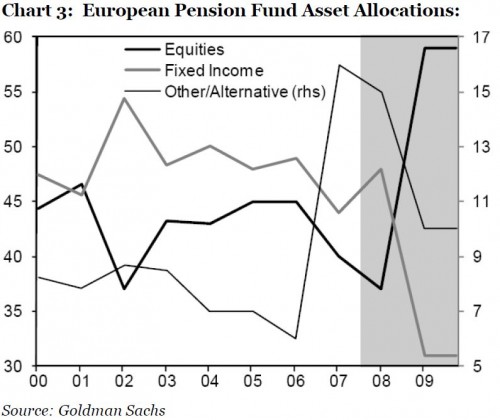

Insurance companies’ low allocation to equities is in stark contrast to the average allocation to equities amongst European pension funds which stands at about 45% according to Goldman Sachs (see chart 3). This has several implications. For starters, you can understand why European insurers are desperate to have the pension fund industry brought into the Solvency II regime because, if they stay outside the new directive, pension funds may have a significant competitive advantage, assuming equities outperform bonds over the long term.