This article is a guest contribution by David Andrews, CFA, Director, Investment Management and Research, Richardson GMP Ltd.

The seemingly endless stream of increasingly negative economic news and market pessimism was rudely interrupted last week with a series of market friendly merger and acquisition announcements. Intel finally consummated its year and a half courtship of McAfee Inc. in an $8 billion dollar deal for the security software maker. Korean National Oil Corp (KNOC) upped its ongoing hostile takeover bid for Scotland-based Dana Petroleum plc to £1.9 billion. By far, the biggest of the big announcements came earlier last week when Australian mining giant, BHP Billiton, made a splash with an unsolicited bid of $39 billion for Canada’s Potash Corp. The bid was immediately rejected by the Potash board and the stock soared 25% in anticipation of a deal being done at a much higher price.

The key takeaways for investors are that companies, now sitting on almost $3 trillion in cash, are seeing compelling value in the marketplace and are increasingly willing to spend their cash. Low interest rates are also helping fuel what is typically the slowest month for mergers and acquisitions into one of the busiest. The other key take away is that perhaps the flurry of M&A activity will inject a much needed boost to investor confidence. Increasingly bad news on the economic front has been zapping both consumer and investor confidence which has aided in keeping markets range bound. John Maynard Keynes used the phrase ‘animal spirits’ to refer to the psychological motivations that drive both the economy and the stock market. Right now, investors have preferred to keep their animal spirits either on a short leash or in a cage.

The outlook for the U.S. economy continued to deteriorate last week with a report indicating the number of Americans filing for unemployment benefits climbed to 500,000, the highest level since last November. Unemployment seems stuck at 9.5% as companies are frozen in a sea of uncertainty regarding both the economic outlook and the regulatory environment. Another blow to confidence came in a report, known as the ‘Philly Fed’. It showed manufacturing in the mid-Atlantic area shrank in August, possibly suggesting the ISM manufacturing index may drop below 50 – a sign the economy is contracting. The market will turn its focus to July housing data due out this week. We will be looking to see if the rebound in June activity can be maintained. In June, U.S. housing made a strong recovery after the month of May proved to be a disaster. As with most other data points on the U.S. economy this year, housing data has also been inconsistent. Investors will get to reflect on U.S. second quarter GDP due out Friday. It is expected that a growing U.S. trade gap and weaker consumer spending will have shaved roughly one percentage point of growth off the world’s largest economy. The slowdown, initially thought to occur in the second half of 2010 appears to have hit in the second quarter of the year instead. Not to add salt to the U.S. economy’s wounds, it is worth noting China surpassed Japan as the world’s second largest economy capping the Sino nation’s rise from communist isolation to emerging superpower.

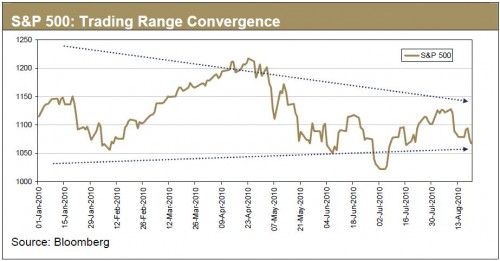

Turning to the investment markets, investors continue to be fascinated with both safety and liquidity as concerns about the economic recovery continue to persist. 10-year government bonds posted a fourth consecutive weekly advance as investors anticipate increased quantitative easing by the Fed in an effort to stimulate the economy. Bond bulls shoved the U.S. 2-year note to record low yields in what may be an overreaction to the negative data streaming in on the economy. Over reaction or not, this is the difficult environment investors face today. Indicative of the challenge is the fact North American market indices are seeing convergence of both the shorter and longer term moving averages. This normally indicates an impending change in trend. Think of the coiling of a spring before it is unleashed. The big question is in which direction will it move when it unleashes? More M&A announcements like we saw last week would favour a significant move higher. We know companies are sitting on piles of cash, which are earning next to no return. On the other hand, the bond market is telling us the economy is getting worse and could, for lack of a better term, get worser.

Of course the equity market could choose to follow a third path. We may see the stock market continue to grind for the next number of weeks until a direction changing catalyst emerges. In that environment, we continue to recommend investors stay focused on large-cap, liquid, dividend paying stocks that: a) will offer some form of downside protection in the form of yield support and liquidity b) will also participate should the market decide to break higher from here.

Copyright (c) David Andrews, CFA, Director, Investment Management and Research, Richardson GMP Ltd.