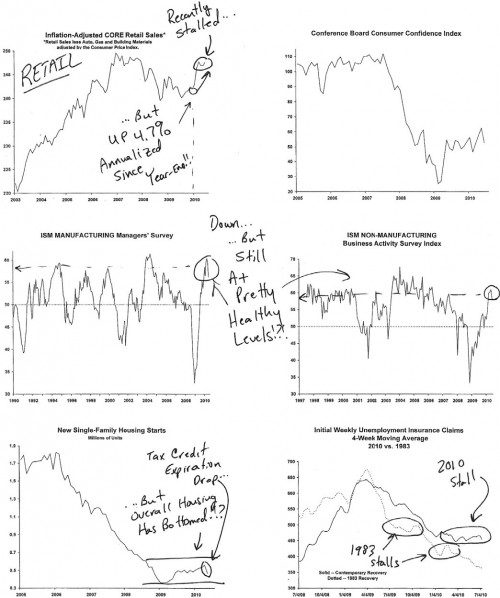

What about the job market? The lack of improvement in weekly unemployment claims has certainly been disappointing in recent months and does suggest a loss of momentum in the economy and in the job market. However, as the chart in Exhibit 1 illustrates, “claim stalls” are not at all uncommon, nor do they necessarily suggest the recovery is ending. Similar to the stall in claims this year, during the early part of the 1983 recovery the pace of improvement in weekly unemployment claims stalled twice for about three to four months. We expect initial jobless claims to soon resume a pattern of steady improvement. Many other indicators suggest job market conditions are still improving including a continued rise in the Employment Trends Index, strength in Monster.com index, a much lowered level of Challenger layoff announcements, a persistent advance in temporary job hirings, and finally and most importantly, continued evidence of strong corporate profit momentum.

Exhibit 1

New-Normal or Just Normal?

Partly, there has been such a sharp reaction to this soft patch in the economy because so many have become convinced the contemporary recovery is “different this time.” That is, many believe we are in a “new-normal” recovery, one which will be characterized by sub-par growth for many years and a recovery which therefore will remain highly vulnerable to a potential double-dip recession.

Exhibit 2 brings some perspective on this concept. The top chart shows the growth rate of real GDP during the first year of every recovery since 1970. Assuming real GDP growth in the second quarter of 2010 at the current expected Wall Street consensus growth rate of 3.25 percent, real GDP growth during the first year of the contemporary recovery will be 3.4 percent. While much slower than the 1982 or 1975 recoveries and also about 1 percentage point slower than the 1970 and 1980 recoveries, it is not, as it is frequently described, the all-time weakest recovery. Indeed, it represents the strongest first year recovery in the United States in more than a quarter century outpacing the 1991 recovery by about 1 percent and besting the first year of the 2001 recovery by about 1.5 percent!