“When you combine those, you’re talking about 18% of investor capital that’s been lost by all this trading,” said Bogle.

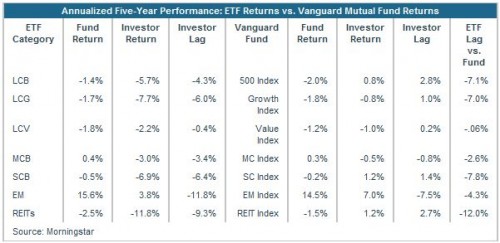

To hammer his point home, Bogle compared the returns of investors in Vanguard ETFs with the returns of investors in comparable Vanguard mutual funds. The study, looking over the same five years, confirmed that investors trading in and out of Vanguard ETFs did worse, on average, than investors in Vanguard mutual funds.

“Investor lag in the ETF category is large and significant,” said Bogle. “The … mutual funds have a lag here and there, but in general, come very close to the markets they are in.

“So we have evidence—strong evidence—that exchange-traded funds, because of the timing that goes on in them, are not acting in the best interest of investors. Or, that investors are not acting in their own best interests, which may be a better way to put it.”

Data for the study were compiled by Morningstar. The study looked at monthly cash flows and monthly fund returns. Bogle noted that this is not a precise format, as daily cash flows into and out of the funds could skew the results.

“Is that way of aggregating data (on a monthly basis) precise? No it is not,” said Bogle. “But I’m persuaded in the absence of compelling data on the other side that these data are telling us something that is worth knowing … that mutual fund trading is about as valuable as trading individual stocks, which is to say, not valuable at all, and harmful to your returns.”

A complete replay and transcript of the webinar will be available on IndexUniverse.com on Thursday.

Copyright (c) IndexUniverse.com