This post is a guest contribution by Asha Bangalore* of The Northern Trust Company.

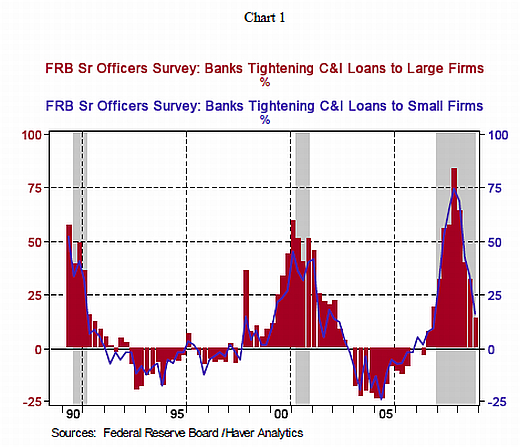

The main aspect that stands out in the October 2009 Senior Loan Officer Opinion Survey is that lending conditions were less tight than survey results of July 2009 indicated and there was a substantial improvement from the October 2008 survey when credit markets had frozen. The net fraction of banks that reported tightening standards on commercial and industrial (C&I) loans for large firms dropped to 14% during October from 31.5% in July and was noticeably below the peak of 83.6% reported in January 2009 (see chart 1). A similar reduction in the number of banks reporting tightening lending standards was reported for C&I loans to small firms (see chart 1).

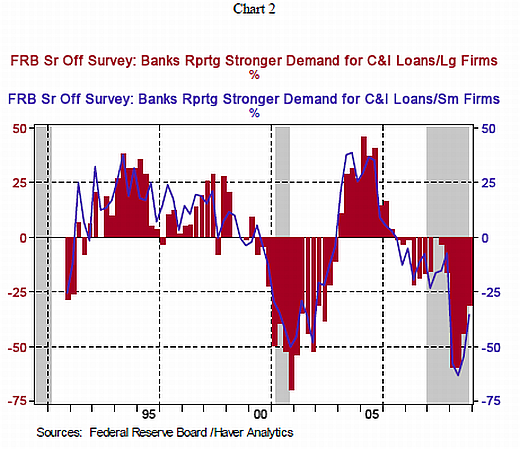

However, demand for C&I loans continued to be weak according to the survey results of October but less weak compared with the July survey (see chart 2). It was noted that a decline in the need to finance inventories, purchases of plant and equipment, accounts receivables, and M&A activity were the reasons for soft demand for loans. The enormous excess capacity in place and soft consumer demand conditions are factors holding down the demand for C&I loans.

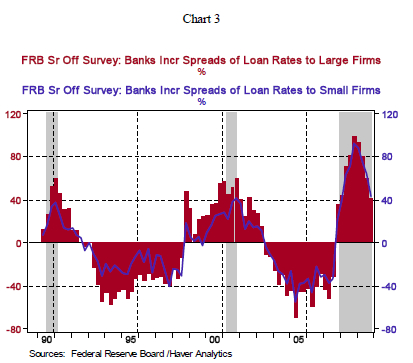

About 40% of banks reported increasing spreads of loan rates over their cost of funds, which is significant decline from the situation reported in October 2008 and January 2009 surveys (see chart 3). In sum, cost of funds is easing and underwriting standards of loans have been eased but demand for loans has to gather steam in the business sector.

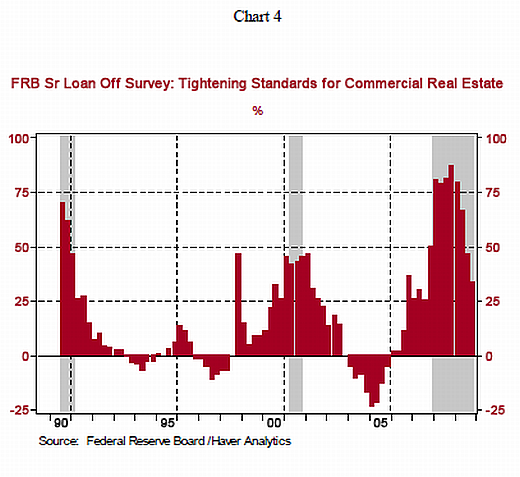

Given the problems of the commercial real estate sector, the fact that there were fewer banks reporting a tightening of underwriting standards in October (33.9%) compared with the earlier quarters (see chart 4), suggests that the commercial real estate market may be in marginally less trouble than anticipated.

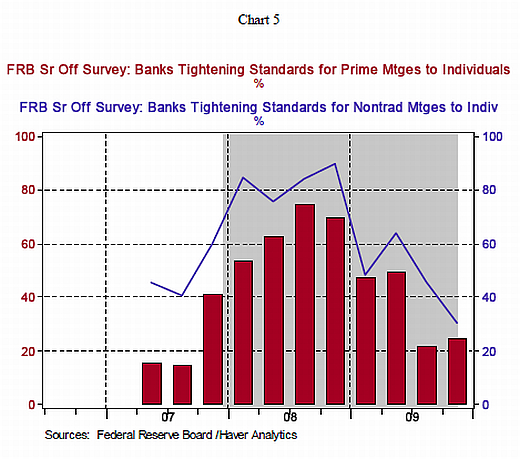

In the household sector, mortgage underwriting standards for prime loans were tightened by (slightly) more banks compared with the situation in July. However, bankers were less stringent with non-traditional mortgage loans (see chart 5).

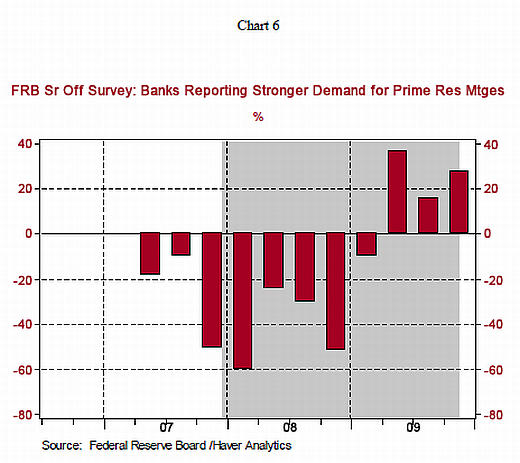

There was a small improvement in the demand for prime mortgage loans reported in October survey compared with July, which is consistent with the increase in home sales.

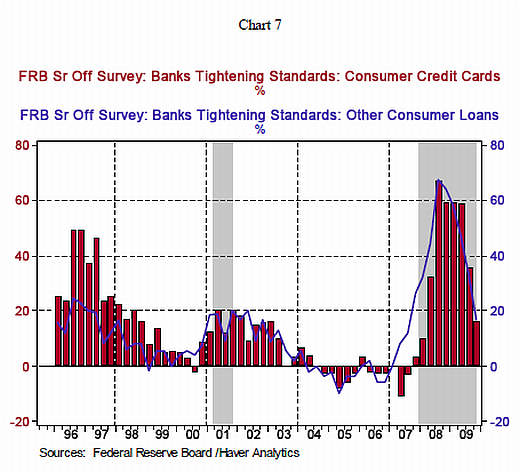

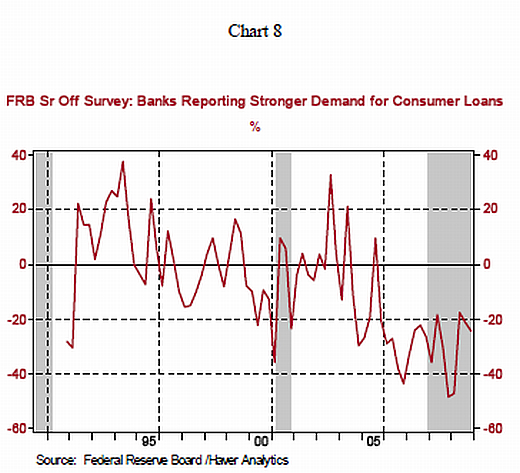

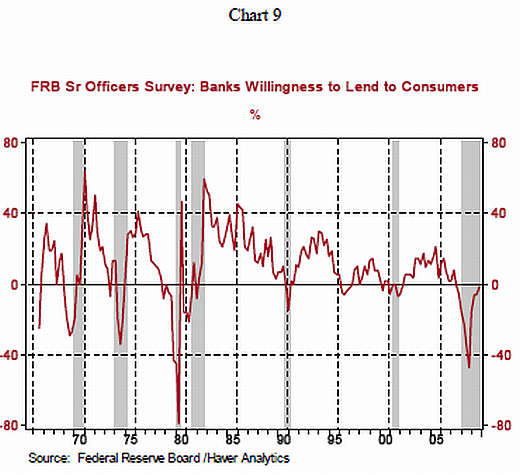

The number of banks tightening standards for credit cards and other consumer loans fell in October, particularly in comparison with the situation in the second-half of 2008 (see chart 7). Are consumers willing to borrow? Chart 8 indicates that fewer bankers see a willingness among consumers to borrow in October vs. the situation in July. The Senior Loan Officer Survey indicates that bankers are more willing to lend (see chart 9) to consumers compared with the situation a year ago. Employment has to post a significant increase for households to be enthusiastic about borrowing.

* Asha Bangalore is vice president and economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Source: Northern Trust - Daily Global Commentary, November 8, 2008.